It’s a giant week of earnings, headlined by Alphabet and Tesla. The Each day Breakdown dives into this week’s huge occasions.

Earlier than we dive in, let’s be sure you’re set to obtain The Each day Breakdown every morning. To maintain getting our each day insights, all it’s essential to do is log in to your eToro account.

Monday’s TLDR

The alts carry on working

GOOGL, TSLA report earnings

Solana appears to be like for extra momentum

What’s Taking place?

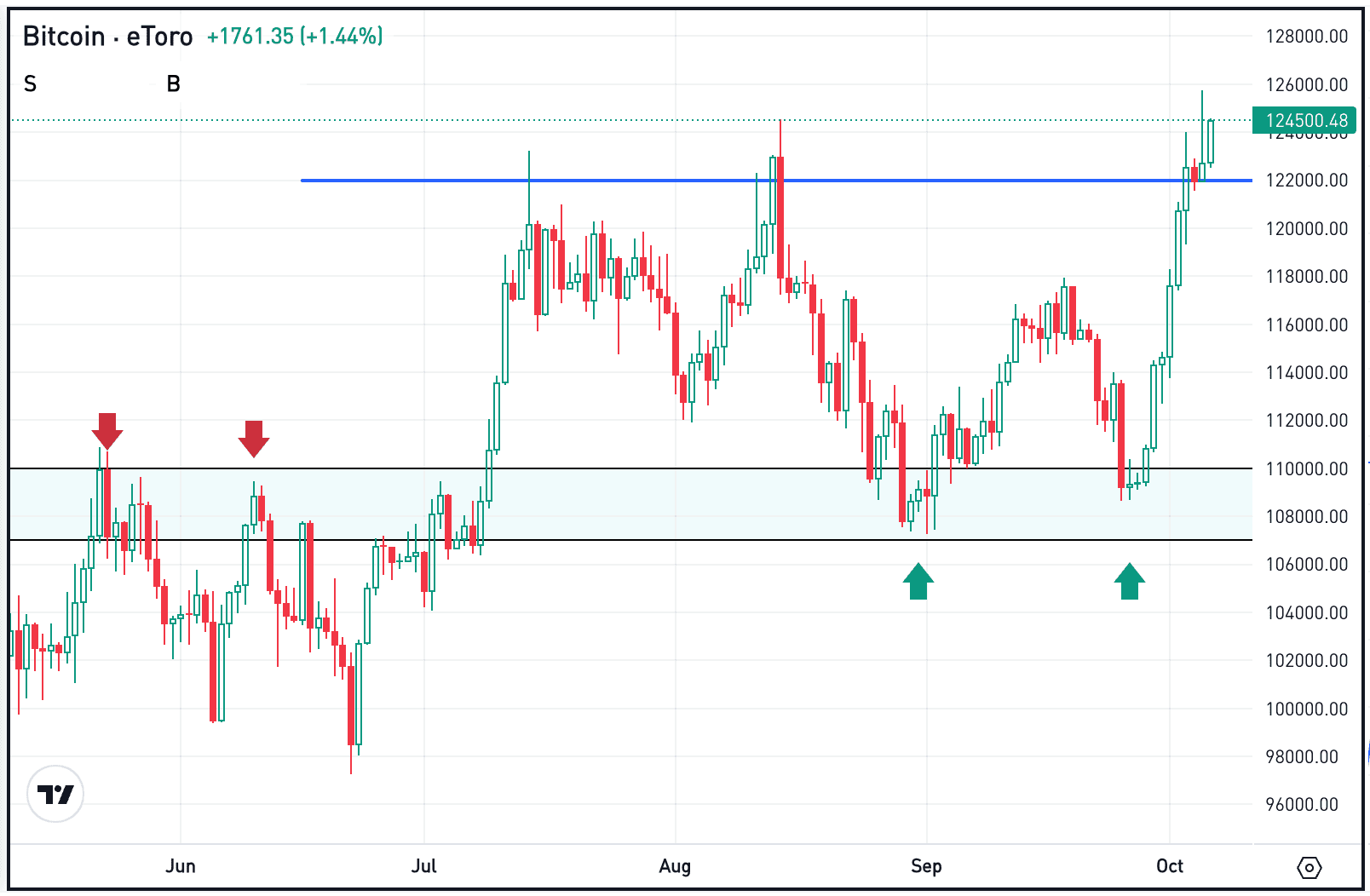

Bitcoin cooled off final week, slipping 1.5%, however continues to be holding above the breakout zone round $110K–$112K. Nevertheless, Ethereum and the alts are stealing the highlight.

ETH has risen in 12 of the final 13 classes, gaining almost 50%. Ripple hit file highs after clearing $3.40 and is now consolidating round that stage. Whereas Stellar hasn’t hit a brand new excessive — and dipped barely final week — it’s nonetheless up over 100% in July and is consolidating its positive aspects.

Solana, Shiba, Dogecoin, Bonk, Cardano and others are additionally transferring greater.

Earnings season is heating up. Massive names reporting this week embrace Coca-Cola, AT&T, Chipotle, IBM, Honeywell, American Airways, and Intel. Notably, Tesla and Alphabet report Wednesday after the shut.

Tesla is the worst-performing Magnificent 7 inventory this 12 months, and bulls hope Elon Musk & Co. can spark a turnaround. However with the weakest 2025 earnings progress outlook within the group, which will clarify the inventory’s stoop.

Alphabet is down about 2% in 2025 however stays the most affordable Magazine 7 inventory by ahead P/E. Buyers are eyeing this quarter to reignite momentum.

Need to obtain these insights straight to your inbox?

Join right here

The Setup — Solana

Solana is beginning to acquire some steam, not too long ago breaking out over the important thing $180 stage that has served as each help and resistance over the previous few quarters. As you’ll be able to see on the weekly chart beneath, this stage has been important for technical merchants.

From right here, bulls wish to see SOL maintain up above this stage. If it may well accomplish that, the momentum might assist gas an extra push to the upside. Nevertheless, if Solana breaks again beneath the $180 stage, the current bullish momentum might wane and extra short-term draw back could also be within the playing cards.

What Wall Road Is Watching

VZ

Verizon is rallying this morning, up nearly 5% in pre-market buying and selling after the agency delivered a top- and bottom-line earnings beat as gross sales rose 5.2% 12 months over 12 months. Verizon bulls are hoping to snap the inventory’s eight-day shedding streak, whereas Verizon’s dividend yield was roughly 6.6% as of Friday’s shut. Try Verizon’s fundamentals.

NVDA

Nvidia continued its highly effective run on Friday, once more hitting one other file excessive. It did so alongside Microsoft, because the latter tries to turn into the second firm after Nvidia to hit a $4 trillion market cap — it’s at the moment sitting at $3.8 trillion. Nvidia is now up 28.4% up to now this 12 months and is up greater than 46% over the previous 12 months. Try Nvidia’s charts.

Disclaimer:

Please be aware that as a consequence of market volatility, a few of the costs could have already been reached and eventualities performed out.