The Each day Breakdown seems on the rally in Ripple, Stellar, and different cryptocurrencies. Plus, PepsiCo and Taiwan Semi earnings are out.

Earlier than we dive in, let’s ensure you’re set to obtain The Each day Breakdown every morning. To maintain getting our each day insights, all it’s essential do is log in to your eToro account.

Thursday’s TLDR

XRP continues crypto rally

TSM earnings increase AI shares

Charting NFLX into earnings

What’s Occurring?

There’s rather a lot to concentrate on this morning, from crypto to earnings.

Beginning with earnings, shares like PepsiCo and Taiwan Semiconductor are in focus, with each shares buying and selling larger. Regardless of seeing decrease demand for its merchandise, PepsiCo beat on earnings and income estimates and maintained its full-year outlook.

As for Taiwan Semi, gross sales surged virtually 40% and income climbed greater than 60%, with each metrics beating analysts’ expectations. Administration additionally raised its 2025 income outlook, boosting investor confidence that the AI spending spree stays intact — giving a carry to different chip shares, like Superior Micro Gadgets, Nvidia, and Broadcom.

Main in crypto this morning, Ripple is making one other run to multi-month highs, tagging $3.30 this morning. It’s up 15% up to now this week, after climbing 24.9% final week. Stellar can also be in focus in the present day, whereas Ethereum, Cardano, Hedera, and Solana are pushing larger too.

Crypto has began off Q3 with a bang. There’s a query of how lengthy these names can run earlier than they should consolidate, however there’s no query which route has the momentum proper now.

Lastly, retail gross sales are in focus. At 8:30 ET, we’ll get the newest retail gross sales figures. Buyers need to see a powerful outcome, giving confidence to the concept that customers stay resilient regardless of a seemingly unending stream of adverse headlines.

Need to obtain these insights straight to your inbox?

Join right here

The Setup — Netflix

Netflix is about to report earnings tonight, an occasion that might set off a big transfer within the inventory. Shares just lately hit document highs close to $1,341 however have since pulled again over the previous few weeks. Some traders would possibly argue that the decline units the fill up for a rally, whereas others would possibly imagine that extra consolidation is required with shares nonetheless up 40% up to now this 12 months.

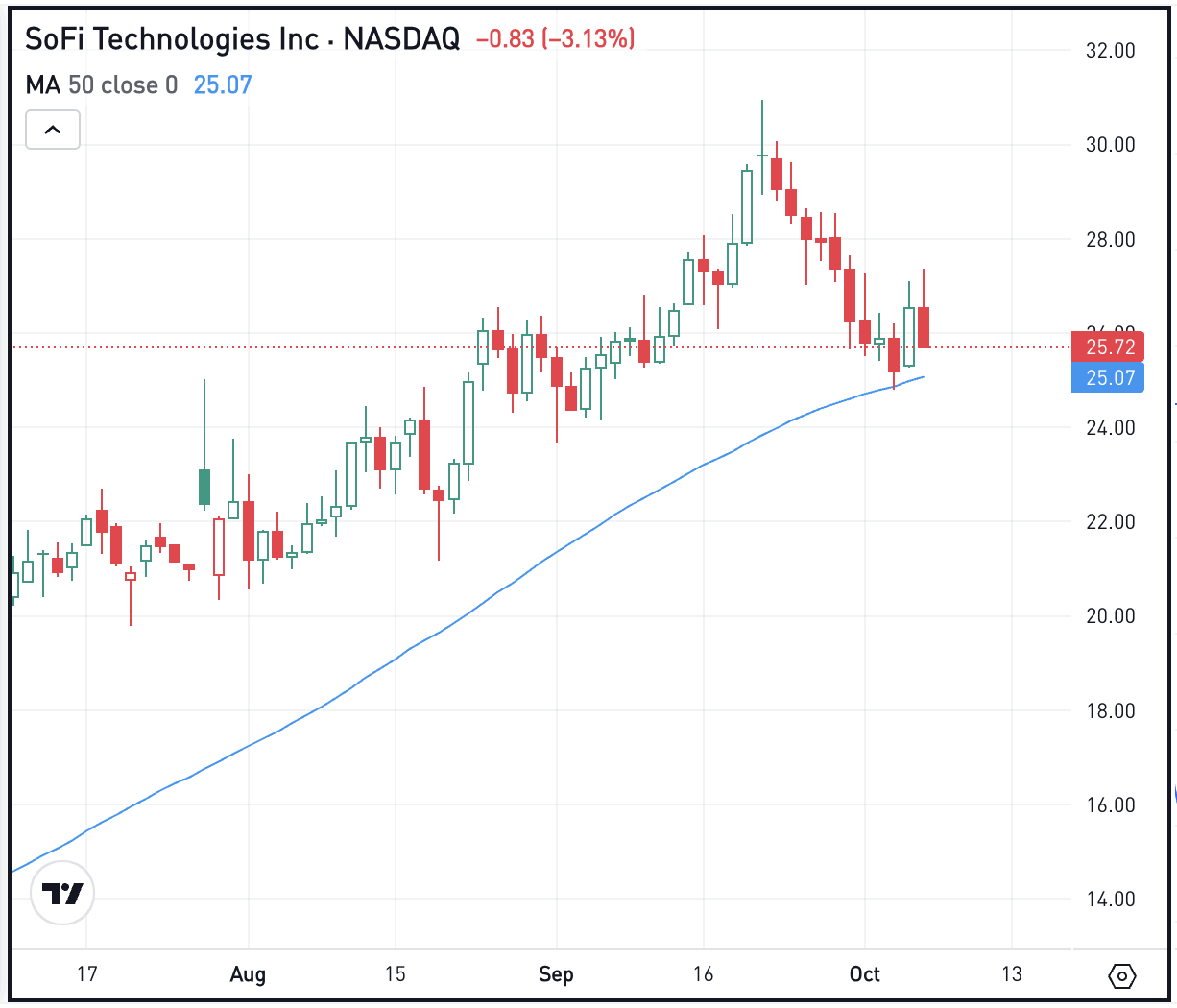

If NFLX dips on earnings, bulls will probably need to see assist come into play close to two areas. First is the 50-day transferring common, at present close to $1,220. The second is round $1,175, which was resistance in early Could, however assist later within the month and in June. And if the inventory rallies on earnings? Bulls will need to see an eventual return again towards the highs, adopted by a possible rally above $1,340.

Choices

One draw back to NFLX is its share value. As a result of the inventory value is so excessive, the choices costs are extremely excessive, too. This could make it troublesome for traders to strategy these firms with choices.

In that case, many merchants could choose to simply commerce just a few shares of the widespread inventory — and that’s high-quality. Nevertheless, one various is spreads.

Name spreads and put spreads enable merchants to take choices trades with a a lot decrease premium than shopping for the calls outright. In these instances, the utmost threat is the premium paid.

Choices aren’t for everybody — particularly in these eventualities — however spreads make them extra accessible. For these trying to study extra about choices, think about visiting the eToro Academy.

What Wall Avenue Is Watching

LCID

Shares of Lucid are surging this morning on reviews that Uber will make investments $300 million within the firm as a part of its robotaxi partnership. The 2 shares have had very totally different paths, with LCID just lately making an attempt to remain above $2, whereas Uber just lately hit document excessive.

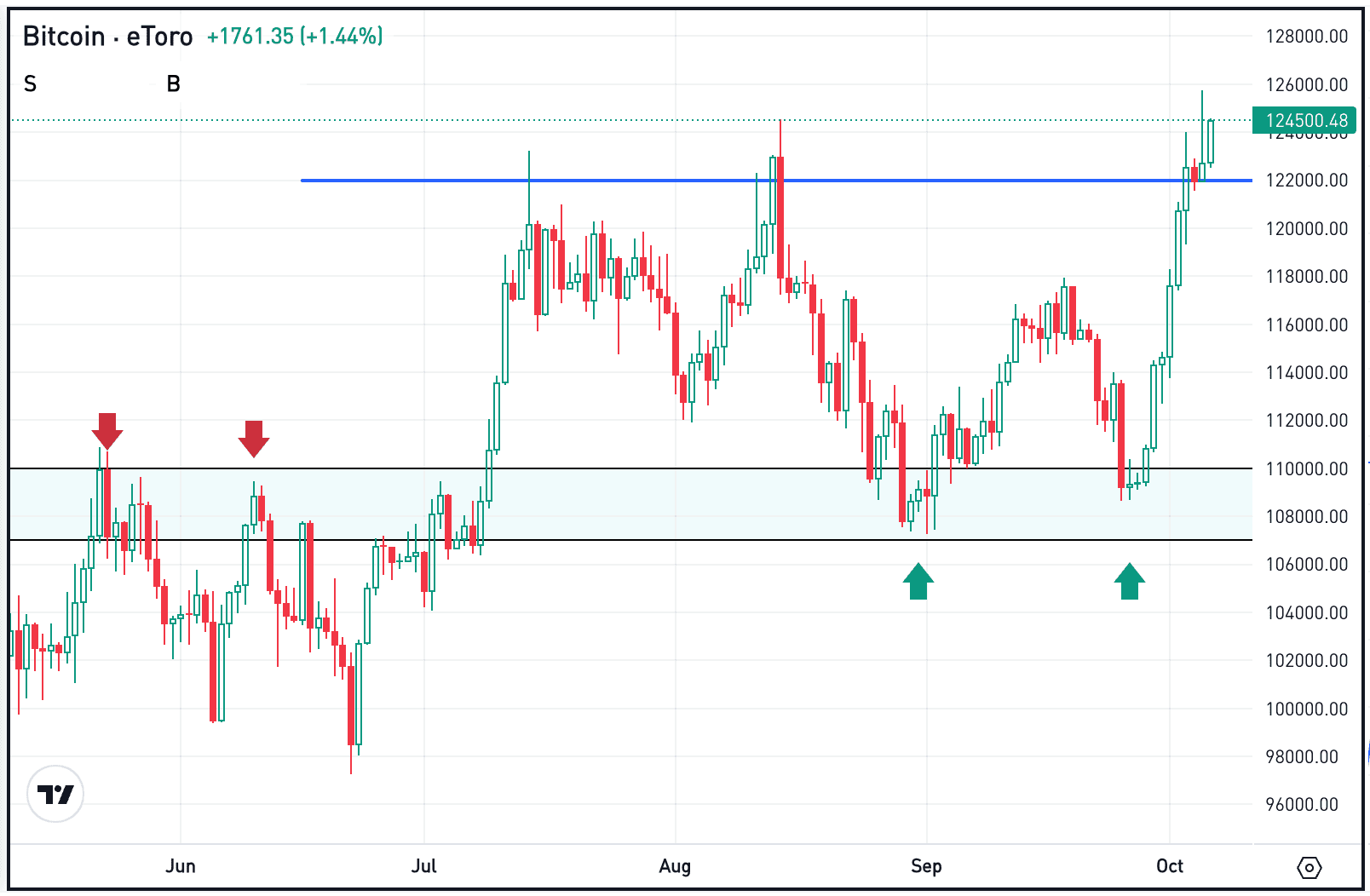

BTC

Regardless of a continued rally in lots of fashionable cryptos this morning, Bitcoin’s value motion stays subdued. BTC is down about 1% this morning and down the same quantity for the week. Bulls nonetheless have the momentum following final week’s breakout, however traders are questioning if it will possibly proceed to push larger. Take a look at the charts for BTC.

Disclaimer:

Please notice that on account of market volatility, a number of the costs could have already been reached and eventualities performed out.