Briefly

Coinbase (COIN) inventory hit a file value Wednesday, together with a file closing value and market cap.

Bitcoin large Technique (MSTR) completed the day with a file closing market cap, as properly.

Ethereum and Solana treasury corporations noticed every day inventory surges as crypto costs pop.

Two of the most important crypto-linked shares set data on Wednesday, with Coinbase hitting a an all-time excessive value and each Coinbase and Technique setting new highs for closing market cap.

The inventory milestones got here amid a surge in crypto costs, with Bitcoin setting a number of all-time highs in latest days, whereas different main cash like Ethereum and XRP are up greater than 20% every over the previous week.

Coinbase, the distinguished American crypto alternate, hit a file of $405.88 on Wednesday afternoon, per Yahoo Finance, together with a file peak closing value of $398.20—up 2.6% on the day and 6.5% during the last week.

The market cap of $101.42 billion can also be a file shut for COIN, which trades on the Nasdaq and is a part of the S&P 500.

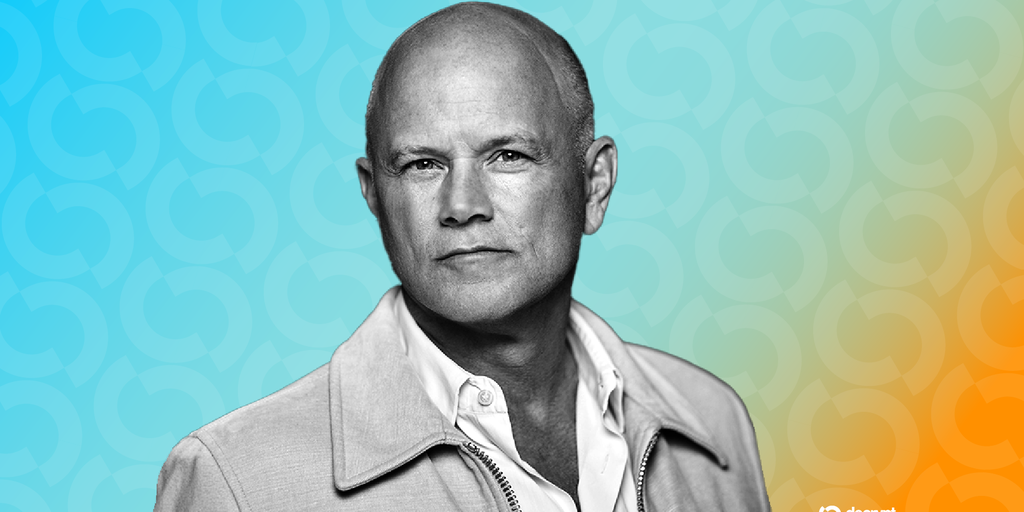

In the meantime, Technique—the most important company holder of Bitcoin with a stash of practically $72 billion value of BTC—completed the day with a file market cap, co-founder and Govt Chairman Michael Saylor introduced on X.

Technique completed the day at a value of $455.90, per information from Yahoo Finance, up 3% on the day and virtually 10% on the week. It closed the day at a market cap above $128 billion—however fascinating, it did not end at an all-time excessive inventory value.

The value of MSTR surged even increased again in November 2024, topping out at $542.99—although it solely received as excessive as $457.22 on Wednesday. The distinction is that MicroStrategy has launched tens of thousands and thousands extra shares into the market over the previous a number of months, enabling its climb into file market cap territory.

“The rally in Coinbase and MicroStrategy is a mirrored image of the market’s rising confidence in institutional crypto infrastructure,” Douro Labs CEO Mike Cahill instructed Decrypt. “This yr particularly, Coinbase is more and more being acknowledged because the on-ramp for regulated publicity—particularly with its ties to USDC, ETH ETFs, and custodial roles. In the meantime, MicroStrategy has advanced right into a publicly traded Bitcoin proxy. At the moment’s all-time highs sign that institutional urge for food for digital property is accelerating like by no means earlier than.”

Broadly, the key inventory market indices have been up barely on Wednesday, with the S&P 500 rising 0.32% and the Nasdaq up $0.25%.

Ethereum treasury corporations spiked on Wednesday, with SharpLink Gaming (SBET) leaping 29% to a closing value of $37.38 and BitMine Immersion Applied sciences (BMNR) rising 12% to $44.80.

Equally, a few distinguished Solana treasury corporations climbed, with DeFi Improvement Corp. (DFDV) rising 23% to $30.36 and Upexi (UPXI) spiking virtually 40% to $7.26.

Bitcoin miners like MARA Holdings (MARA) and CleanSpark (CLSK) gained modestly on the day, rising greater than 3% every.

“MicroStrategy’s valuation has turn into a leveraged guess on Bitcoin, whereas Coinbase has positioned itself because the infrastructure layer for the following wave of crypto adoption,” Fogo preliminary contributor Doug Colkitt instructed Decrypt. “As crypto enters the mainstream, the market is rewarding corporations with clear narratives, regulatory moats, and publicity to Bitcoin upside. This momentum displays a repricing of crypto-native equities as strategic gateways—not simply speculative performs.”

Editor’s be aware: This story was up to date after publication so as to add feedback.

Each day Debrief E-newsletter

Begin daily with the highest information tales proper now, plus authentic options, a podcast, movies and extra.