Introduction: Two Doorways, Two Tales

Image your self standing on the threshold of two rooms.

In a single, you discover a risky, thrilling experiment in digital cash — Bitcoin. It’s uncooked, unpredictable, and uncensored. It guarantees freedom, however not security.

Within the different room, there’s one thing extra acquainted. A refined funding product beckons with phrases like “month-to-month earnings” and “excessive yield.” Its objective? To package deal Bitcoin’s power into one thing you may maintain in your brokerage account.

That is the realm of MSTY, the YieldMax MSTR Choice Revenue Technique ETF.

In case you have ever puzzled how Bitcoin’s fierce independence will get reshaped right into a monetary product — and what you acquire or lose within the course of — this story is for you.

1. Bitcoin: Shortage Meets Volatility

Let’s begin with the asset on the coronary heart of this labyrinth.

Bitcoin emerged in 2009, born of an thought so easy it feels radical:

Cash mustn’t require permission.

Solely 21 million Bitcoin will ever exist, enforced by unalterable code. No central banker or politician can dilute this provide.

Shortage is Bitcoin’s biggest power — and its most provocative function. It transforms what could possibly be a uninteresting retailer of worth into one thing extra like a residing organism. Its value reacts to regulation, investor sentiment, and generally a single tweet.

Volatility isn’t an accident; it’s the worth of freedom. On some days, Bitcoin’s worth can swing 10% or extra. Over time, as adoption has grown, these wild strikes have tempered. However they haven’t disappeared.

2. MicroStrategy: A Company Gamble on Digital Gold

Think about a midsize tech firm all of a sudden deciding to rework its steadiness sheet right into a Bitcoin vault.

This isn’t fiction — it’s MicroStrategy, now rebranded as Technique.

Below CEO Michael Saylor, Technique purchased huge portions of Bitcoin, funded by issuing debt. As of July 1, 2025, Technique owns roughly 597,325 BTC, price tens of billions of {dollars}.

This huge guess has turned Technique’s inventory into one thing distinctive: a extremely leveraged Bitcoin proxy. When Bitcoin rises, Technique’s shares typically rise quicker. When Bitcoin falls, they tumble even more durable.

This leverage has made Technique’s volatility legendary.

3. MSTY’s Ingenious Construction: A Artificial Lengthy with No Inventory in Sight

Many traders suppose MSTY holds Technique’s inventory.

The truth is, it doesn’t personal a single share.

As an alternative, MSTY engineers an artificial lengthy place. Right here’s how this works, in plain phrases:

The fund buys name choices on Technique, giving it the best to take part in positive factors.It sells put choices on the similar strike, obliging it to take losses if the inventory falls.The mix — a protracted name plus a brief put — mimics proudly owning the inventory’s upside and draw back with out ever shopping for the shares.

This setup comes with benefits:

No want to carry bodily inventory (which may complicate taxes and diversification guidelines).A lighter “basket” of holdings — simply choices and money collateral, sometimes U.S. Treasury payments.

Consider it like a hologram of Technique’s inventory: all of the motion, not one of the substance.

4. The Lined Name Overlay: Harvesting Time Decay

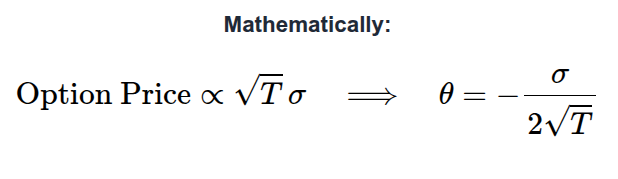

Proudly owning an artificial lengthy isn’t sufficient to generate MSTY’s fabled yields. The actual engine of earnings is theta decay, the regular erosion of an possibility’s time worth.

Right here’s the idea simplified:

Each possibility’s value has two elements: intrinsic worth (how “within the cash” it’s) and extrinsic worth, which is principally the worth of uncertainty in regards to the future.As every day passes, the uncertainty shrinks. This decline is named theta decay.

MSTY exploits this decay by promoting near-dated, near-the-money name choices on its artificial lengthy. In plain language:

Close to-dated: Choices expiring quickly — sometimes in 4–5 weeks.Close to-the-money: Strike costs near the place the inventory is buying and selling.

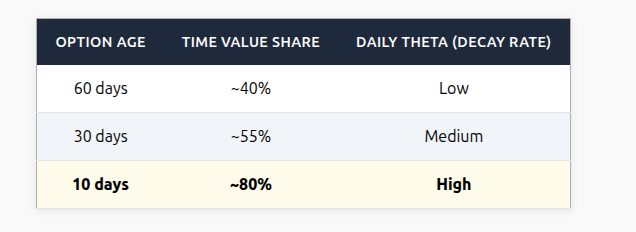

This mixture will not be unintended. The nearer an possibility is to expiration, the quicker it decays:

The shorter the clock, the steeper the soften. MSTY positions itself the place the time worth melts quickest. Each night, a few of that extrinsic worth merely disappears, captured as a acquire within the fund’s internet asset worth (NAV).

It’s, in a way, a machine powered by the passage of time.

5. Why Technique’s Volatility Makes the Machine Work

All choices are extra useful when the underlying inventory is risky.

Technique’s leverage to Bitcoin means it swings 2–3 occasions more durable than the typical S&P 500 inventory.

Increased volatility does two issues:

It fattens the choice premiums MSTY can acquire.It will increase the day by day theta decay — the very course of the fund harvests for earnings.

In easy phrases: Huge volatility + brief time horizon = quicker time decay.

That is the candy spot MSTY exploits.

6. The Month-to-month Theta Harvest Cycle

MSTY’s enterprise mannequin follows a rhythm as regular as a lunar cycle:

Put up-Expiry Friday:

Roll the artificial lengthy ahead (substitute expiring choices).Promote a recent batch of near-dated calls.Acquire possibility premiums in money.

Days 1–25:

Theta decay accrues day by day.If Technique’s inventory soars, MSTY hedges by shopping for extra calls, so losses don’t spiral.

Expiry Week:

Choices are closed or allowed to expire.Web earnings (possibility premium minus hedging prices) turns into distributable money.

That is the second you see these eye-catching distributions — just like the 97.45% return of capital payout reported in June 2025.

7. The Phantasm of Yield: The place Your Cash Comes From

On paper, MSTY’s distributions look astonishing — typically exceeding 100% annualized yields.

However right here’s the nuance:

Most of this money stream isn’t “earnings.” It’s your personal cash coming again.Every distribution erodes the NAV slightly extra.Over time, if positive factors don’t replenish the principal, your funding shrinks.

It’s not in contrast to proudly owning an orchard the place you harvest the branches in addition to the fruit. The yields look spectacular… till you discover the timber rising smaller.

8. When Bitcoin Rallies: The Ceiling of Capped Upside

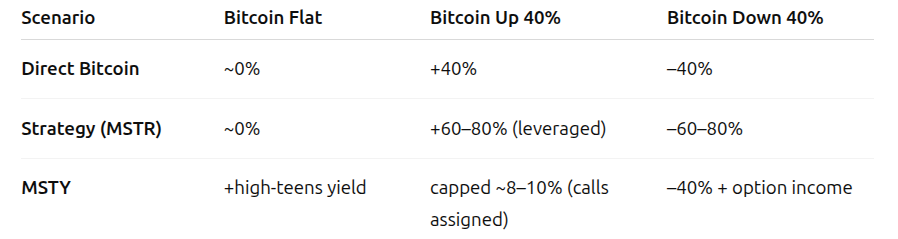

What occurs if Bitcoin surges 40%?

Technique’s inventory will probably rally even more durable, as a result of leverage.The calls MSTY bought will climb in worth, remodeling time decay into intrinsic worth owed to somebody else.The fund will cap its positive factors — typically round 8–10% — whereas the underlying inventory (and Bitcoin) soars far greater.Subsequent month’s theta harvest will shrink as a result of volatility tends to compress after massive strikes.

In impact, the technique works finest when markets are quiet to reasonably risky, not after they rocket upward.

9. Why Does This Technique Exist at All?

Regardless of the trade-offs, MSTY meets particular investor appetites:

Yield Starvation: In a world the place T-bills yield 4%, traders crave one thing richer.Regulatory Flexibility: The Funding Firm Act of 1940 limits ETFs from concentrating >25% in a single issuer — except they use derivatives. The artificial construction squares that circle.Tax Advantages: As a result of possibility premiums are handled as return of capital, they are often extra tax-deferred in comparison with dividends.

10. A Easy Determination Tree for Buyers

Right here’s a desk summarizing how totally different eventualities may play out:

11. The Philosophical Query: Possession or Comfort?

This brings us to the ultimate, maybe most essential consideration.

Bitcoin in its purest kind is about self-sovereignty:

Proudly owning an asset that no establishment can debase, censor, or reclaim.

Merchandise like MSTY dilute this ethos. They’re handy however layered with constructions, charges, and limits.

Right here’s the pressure:

Direct Bitcoin: Full publicity to danger and reward, no intermediaries.MSTY: Engineered publicity with predictable money stream however capped upside and hidden complexity.

It’s neither good nor dangerous. It merely displays totally different priorities.

Conclusion: Selecting Intentionally

Should you’ve made it this far, you perceive greater than most traders about how theta decay, artificial longs, and coated calls intertwine to create MSTY’s payouts.

You additionally perceive the price of that yield:

Eroding NAV.Missed rallies.Full draw back danger if Bitcoin tumbles.

In the end, the best door to stroll by means of is determined by your objectives.

Would you like unfiltered participation within the Bitcoin experiment? Or would you moderately acquire earnings, even when it means watching another person journey the subsequent wave greater?

No reply is inherently appropriate. What issues is that it’s deliberate.

Thanks for exploring this panorama with me. Could your curiosity keep sharp, your selections keep grounded, and your investments replicate not solely your objectives however your rules.

🌿 Bitcoin, Derivatives, and the Curious Case of MSTY: An Invitation to Look Nearer was initially printed in The Capital on Medium, the place individuals are persevering with the dialog by highlighting and responding to this story.