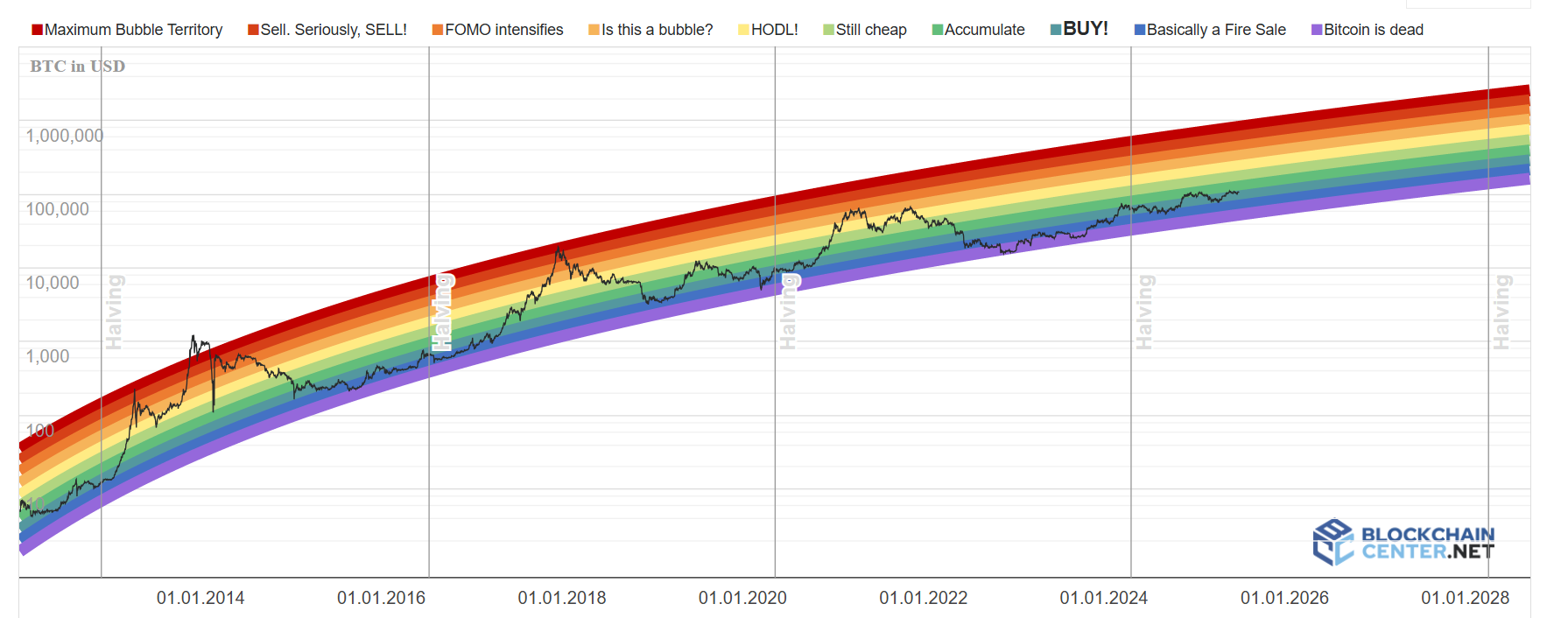

The Bitcoin rainbow chart reveals BTC ▼-0.12% cruising effectively above $100K and even on a budget.

But, 99Bitcoin’s evaluation reveals that USDT’s provide is peaking, and leveraged shorts are swelling, that are indicators we may oscillate both means.

In the meantime, critiques of well-liked predictive fashions like economist Raoul Pal’s M2-Bitcoin correlation make us marvel, is that this cycle completely different? Is the alt-season cancelled?

Bitcoin Rainbow Chart: The Battle Between Bulls and Bears

Bitcoin rebounded from a multi-month low of $98k, wiping out bearish positions priced on geopolitical fears. Presently buying and selling close to $108,952, BTC is consolidating inside the $106k–$108k vary as bulls eye a retest of the psychological $110k degree.

One factor to notice: well-known dealer James Wynn has a 40x quick place, price $1.49 million, that hinges on $108,630 as a key liquidation degree. Wynn and different bearish merchants may face a brief squeeze if Bitcoin breaks above this zone.

All of this might set off a brand new BTC ATH and subsequent alt-season later in the summertime.

Altseason loading… pic.twitter.com/sYgCmHNEv7

— Julien Bittel, CFA (@BittelJulien) June 28, 2025

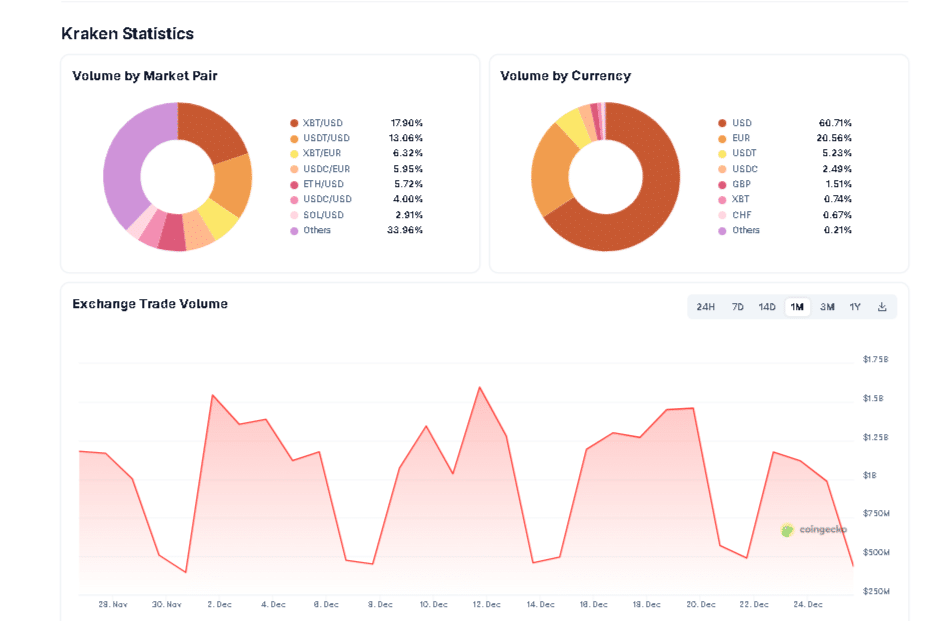

Moreover, Tether’s circulating provide hit a document $158 billion late final week. Pair this with BlackRock’s regular $1.15B weekly Bitcoin buys, which clearly indicators that establishments are positioning with intent.

Critiquing the M2-Bitcoin Correlation

Bitcoin’s run previous six figures has reawakened an previous debate: Is any of this truly predictable? Raoul Pal says sure, pointing to M2 cash provide tendencies as a crystal ball for BTC. Nevertheless, twenty first Capital Co-Founder Sina says that’s nonsense.

Epic assortment of Raul Pal’s disastrous suggestions

Folks truly pay to take heed to him

pic.twitter.com/edqUhEaVsz

— Sina

twenty first Capital (@Sina_21st) January 15, 2025

In a takedown posted June 24, he argued the mannequin’s predictive energy dissolves on contact with actuality. The extra you tweak it, the more serious it will get. “It’s not forecasting however forcing a narrative onto the chart,” he mentioned.

Regardless, the following 4 months will present if we’re in a “conventional cycle” the place Bitcoin goes bananas off of cash printing, price cuts, and geopolitical cooldown, or if Sina is correct.

What’s Subsequent for Bitcoin?

Blind religion in legacy Bitcoin fashions is fading. Analysts like Sina are urging a return to fundamentals: liquidity flows, pockets exercise, and real-time community indicators.

Pack your baggage, boys (and women), the following few weeks might determine whether or not BTC breaks orbit or will get dragged again into chop.

EXPLORE: Tether CEO Paolo Ardoino Hopes For Internet Optimistic From US Elections, Says Bitcoin Strategic Reserve Is A Nice Concept: 99Bitcoins Unique

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

Critiques of well-liked predictive fashions like economist Raoul Pal’s M2-Bitcoin correlation are spreading

All eyes are on Powell subsequent month as inflation lingers and labor metrics soften.

The submit Bitcoin Rainbow Chart: The Subsequent 4 Months For BTC May Change Every thing: Is Historical past Repeating? appeared first on 99Bitcoins.

_id_acc4b566-fde8-476c-9461-d10580c9d344_size900.jpg)