Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

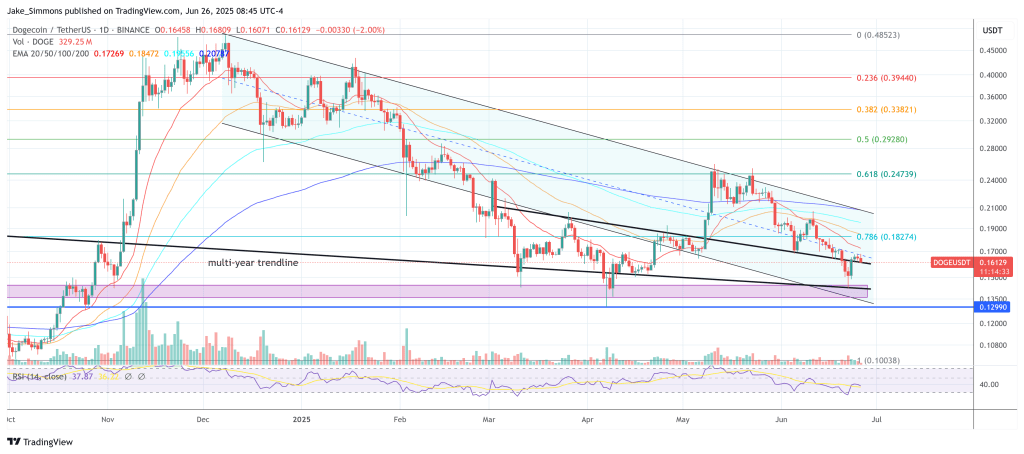

Dogecoin modified palms close to $0.162 in late-European buying and selling on June 26, little modified on the day however nonetheless greater than 13% above final Sunday’s swing low. But beneath that placid value motion, the market is balancing on what YouTube analyst Extra Crypto On-line calls “a wait-and-see state of affairs” that might ignite both a decisive upside impulse or a slide again towards $0.14.

Dogecoin Teeters On The Edge

In a video revealed yesterday beneath the headline “Is DOGE About to CRASH or SOAR? Value Evaluation & Situations,” the Elliott-wave commentator argues that the advance from the June 22 backside stays incomplete.

“The Doge chart is presently nonetheless, yeah, making an attempt to reverse right here to the upside from the swing low that shaped on the twenty second of June,” he says on the outset, stressing that the rise thus far is “solely a three-wave transfer.” As a result of the construction has not but printed the complete five-wave sequence that usually inaugurates a brand new bullish pattern, he cautions merchants in opposition to assuming the worst is over.

Associated Studying

The technician locates that June 22 low inside a requirement band between $0.15 and $0.14, a zone that additionally contains the 78.6 p.c Fibonacci retracement of the Might–June rally and sits simply above April’s cycle by way of—his onerous “invalidation level.” From there, Dogecoin bounced in what he labels an a-b-c restoration, with the third wave peaking at $0.169, precisely the 1.618 Fibonacci extension he seems for in a “wholesome third wave.” If value can now carve a fourth-wave larger low and prolong to a fifth-wave excessive close to $0.174–$0.177, the analyst says, “we really get 5 waves up after which we are able to add assist … and now we have a setup.”

Till that affirmation, the transfer stays a “chameleon-like” B-wave—susceptible to deeper pullbacks than the extra bullish wave-two various. The road within the sand is $0.158. “Any break now under $0.158 cents would point out the upside-reversal try is failed and we fall again into the assist area, perhaps we’ll even take a look at the $0.14 degree,” he warns. Conversely, holding that micro-support and punching by way of the $0.17 deal with would offer the primary “proof” {that a} sturdy backside has shaped.

Associated Studying

The stakes are excessive as a result of, because the analyst factors out, affirmation of a five-wave impulse would power subsequent corrections to respect a higher-low framework, permitting merchants to reposition with clearer danger parameters. Failure would probably drag Dogecoin again into the vast consolidation vary that has dominated June and danger flipping sentiment towards a protracted draw back grind.

For now, the memecoin’s near-term destiny rests on whether or not consumers can engineer that remaining fifth-wave pop with out first violating $0.158. “For the time being,” he concludes, “we’re in a wait-and-see state of affairs to see if we really get 5 waves up.” Till the chart resolves, Dogecoin stays suspended between a technical breakout and one other leg down—increase or bust hinging on a single intraday sign.

At press time, DOGE traded at $0.161.

Featured picture created with DALL.E, chart from TradingView.com