Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Trump Media and Expertise Group Corp (TMTG) has formally filed for its second crypto exchange-traded fund (ETF), specializing in Bitcoin (BTC) and Ethereum (ETH), as detailed in a current submitting to the Securities and Alternate Fee (SEC).

Trump Media Information For Second Crypto ETF

If the SEC approves this new funding product, it would commerce on NYSE Arca, the digital division of the New York Inventory Alternate identified for dealing with exchange-traded fund transactions.

This newest submitting comes simply eight days after TMTG submitted a prospectus with the Connecticut Lawyer Normal via its Particular Function Acquisition Firm (SPAC) companion, Yorkville America.

Majority-owned by President Donald Trump, Trump Media is intensifying its efforts to advertise monetary merchandise linked to blockchain applied sciences. The corporate goals to supply the general public with regulated funding autos that supply publicity to the cryptocurrency market.

Associated Studying

Just lately, Trump Media introduced its ambition to boost $2.4 billion, with the objective of changing into one of many largest company holders of Bitcoin. This transfer seems to be a part of a broader technique to diversify its enterprise and entice a wider array of buyers.

By launching a number of crypto-focused ETFs, Trump Media hopes to generate vital curiosity in its inventory, probably positioning itself as an interesting possibility for cryptocurrency lovers.

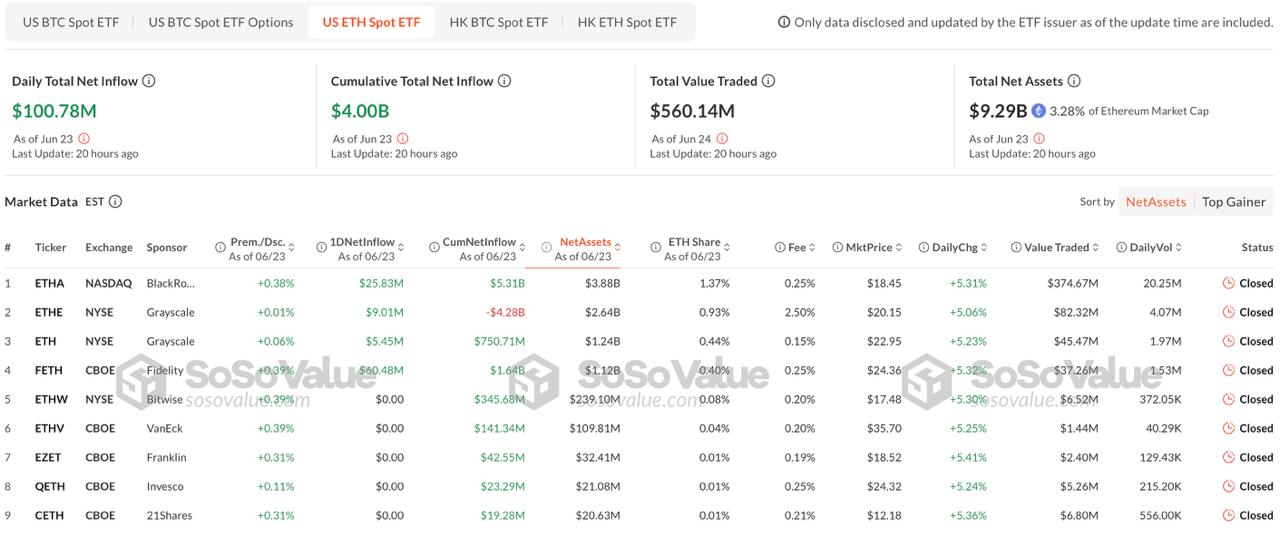

Nevertheless, with a number of crypto ETFs already obtainable available in the market, there are questions on how a lot investor curiosity these funds will garner. The success of the ETFs will seemingly hinge on their payment buildings and the way aggressive they’re in comparison with present choices.

Bitcoin To Hit $180,000-$250,000

As of now, Bitcoin is buying and selling at $106,000, recovering 3% from a current drop to $98,000. This volatility is basically attributed to the continued battle between Israel and Iran, which has intensified over the previous 12 days, impacting monetary markets considerably.

Market analyst generally known as Mr. Wall Avenue not too long ago shared his insights on social media platform X (previously Twitter), reiterating his bullish targets for Bitcoin, which he believes will attain between $180,000 and $250,000 this yr regardless of any exterior battle.

Curiously, Mr. Wall Avenue famous a big shift in capital flows, with over $20 billion transferring from gold to Bitcoin within the final two weeks alone.

Associated Studying

This development means that institutional buyers and hedge funds are more and more viewing Bitcoin as a extra dependable retailer of worth in comparison with gold, given Bitcoin’s mounted provide.

Moreover, Mr. Wall Avenue identified that the over-the-counter (OTC) desks have gotten much less liquid, indicating that vital upward motion in Bitcoin’s value might be imminent.

A key indicator, the hash ribbon, not too long ago flashed, signaling that Bitcoin usually experiences a ten% correction earlier than rallying by 50-125%. Mr. Wall Avenue believes that the current dip to $98,000 constituted this correction, and he anticipates a considerable return on funding from present ranges.

Transferring ahead, the analyst expects “continued noise” from the geopolitical panorama, however he believes that additional escalation is unlikely. The current market dip created a way of peak worry, which traditionally precedes vital value breakouts, Mr. Wall Avenue stated.

Featured picture from DALL-E, chart from TradingView.com