US Senate handed the “GENIUS Act” (68-30) to create a regulatory framework for stablecoins.

The invoice requires stablecoins to be backed by liquid belongings and issuers to reveal reserves month-to-month.

This can be a main milestone for the crypto business, which has lengthy pushed for regulatory readability.

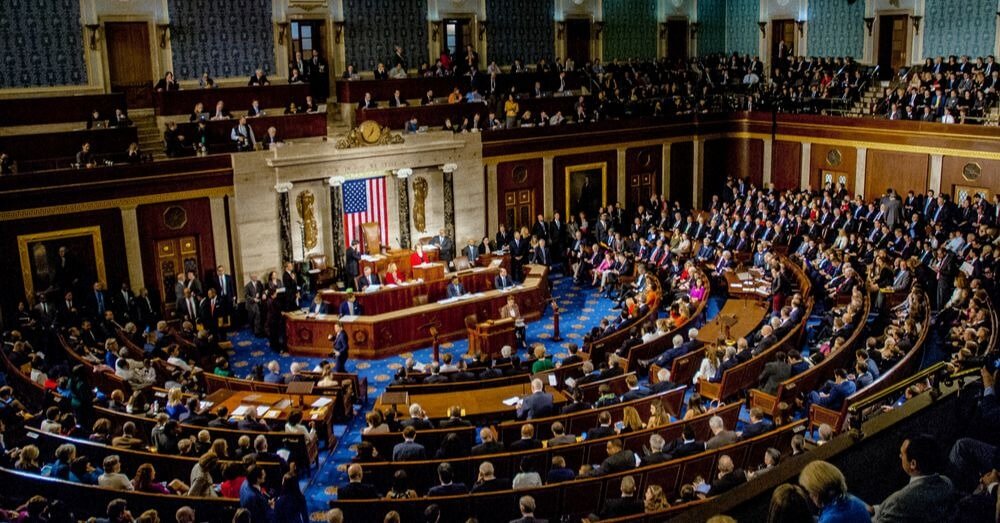

In a major improvement for the digital asset business, the US Senate on Tuesday handed a invoice aimed toward making a complete regulatory framework for US dollar-pegged cryptocurrency tokens, generally generally known as stablecoins.

This bipartisan achievement marks a possible watershed second, bringing much-sought-after readability to a quickly evolving sector of the monetary world.

The laws, formally titled the “Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act,” garnered appreciable bipartisan assist, with a number of Democrats becoming a member of nearly all of Republicans to again the proposed federal guidelines.

The invoice finally handed by a decisive vote of 68-30. For the invoice to grow to be regulation, the Home of Representatives, which is at the moment managed by Republicans, might want to go its personal model.

If profitable there, the harmonized laws will then proceed to President Donald Trump’s desk for ultimate approval.

The passage within the Senate is being hailed as a pivotal step.

“It’s a main milestone,” commented Andrew Olmem, a managing companion on the regulation agency Mayer Brown and the previous deputy director of the Nationwide Financial Council throughout President Trump’s first time period.

“It establishes, for the primary time, a regulatory regime for stablecoins, a quickly creating monetary product and business.”

Stablecoins, a selected kind of cryptocurrency designed to keep up a relentless worth, usually by pegging 1:1 to the US greenback, are broadly utilized by crypto merchants to facilitate the motion of funds between totally different digital tokens.

Their utilization has seen exponential development in recent times, and proponents argue they maintain the potential to revolutionize cost methods by enabling instantaneous transactions.

If enacted, the stablecoin invoice would mandate that these tokens be backed by liquid belongings, comparable to US {dollars} and short-term Treasury payments.

Moreover, issuers could be required to publicly disclose the composition of their reserves on a month-to-month foundation, enhancing transparency.

Trade advocacy and a push for readability

The cryptocurrency business has lengthy advocated for lawmakers to go laws creating clear guidelines for digital belongings.

The prevailing argument is {that a} well-defined regulatory framework may unlock the potential for stablecoins to grow to be extra broadly adopted and built-in into the mainstream monetary system.

Reflecting this push, the sector reportedly spent over $119 million backing pro-crypto congressional candidates in final 12 months’s elections and has constantly sought to painting the problem as a bipartisan concern.

An earlier try and go stablecoin laws within the Home of Representatives final 12 months was profitable, however that invoice finally died within the Senate, the place Democrats held the bulk on the time and didn’t deliver it up for a vote.

The present momentum displays a shifting panorama, partly influenced by President Trump, who has sought to broadly overhaul US cryptocurrency insurance policies after actively courting monetary assist from the business throughout his presidential marketing campaign.

Bo Hines, who leads Trump’s Council of Advisers on Digital Property, has indicated that the White Home is eager to see a stablecoin invoice handed earlier than August.

Navigating political tensions and lingering considerations

The trail to this Senate vote has not been with out its challenges. Tensions on Capitol Hill over President Trump’s varied private crypto ventures at one level threatened to derail the digital asset sector’s hopes for laws this 12 months.

Some Democrats have grown more and more annoyed with Trump and his relations selling their private crypto tasks, together with a meme coin referred to as $TRUMP launched in January and a crypto firm named World Liberty Monetary, partly owned by the president.

The White Home has maintained that there are not any conflicts of curiosity for Trump, stating his belongings are held in a belief managed by his youngsters.

Critics, nevertheless, stay vocal. “In advancing these payments, lawmakers forfeited their alternative to confront Trump’s crypto grift – the biggest, most flagrant corruption in presidential historical past,” asserted Bartlett Naylor, monetary coverage advocate for Public Citizen, a shopper rights advocacy group.

Different Democratic lawmakers have expressed considerations that the present invoice doesn’t adequately forestall massive tech corporations from issuing their very own personal stablecoins.

They’ve additionally argued for stronger anti-money laundering (AML) protections and extra stringent prohibitions on overseas stablecoin issuers.

Senator Elizabeth Warren, a Democrat, voiced these considerations on the Senate flooring in Could, stating, “A invoice that turbocharges the stablecoin market, whereas facilitating the president’s corruption and undermining nationwide safety, monetary stability, and shopper safety is worse than no invoice in any respect.”

The highway forward: home deliberations and state regulator enter

Regardless of its passage within the Senate, the stablecoin invoice may face additional modifications within the Home of Representatives.

The Convention of State Financial institution Supervisors (CSBS) has already referred to as for “essential adjustments” to the laws to mitigate potential monetary stability dangers.

“CSBS stays involved with the dramatic and unsupported enlargement of the authority of uninsured banks to conduct cash transmission or custody actions nationwide with out the approval or oversight of host state supervisors,” mentioned Brandon Milhorn, president and CEO of the CSBS, in an announcement, highlighting ongoing debates in regards to the acceptable steadiness between federal and state oversight within the burgeoning stablecoin market.