On-chain information reveals the Bitcoin Market Worth to Realized Worth (MVRV) Ratio is at present nonetheless under historic market peaks.

Bitcoin MVRV Ratio Might Not Be That Overheated But

In a brand new submit on X, the institutional DeFi options supplier Sentora (beforehand IntoTheBlock) has mentioned concerning the newest pattern within the MVRV Ratio of Bitcoin. The “MVRV Ratio” refers to a preferred on-chain indicator that compares the BTC Market cap and Realized cap.

The Realized Cap is an on-chain capitalization mannequin for the asset that calculates its whole valuation by assuming the worth of every particular person token in circulation is the same as the value at which it was final moved on the community. That is completely different from the standard Market Cap, which simply takes the present spot value as the worth for all cash.

The earlier transaction of any token is prone to signify the final time that it modified arms, so the value at its time might be thought-about as its present price foundation. Thus, the Realized Cap is actually the sum of the acquisition values of all cash.

One method to interpret the mannequin is as a measure of the quantity of capital that buyers as an entire initially put into the cryptocurrency. In distinction, the Market Cap represents the worth that they’re holding proper now.

Because the MVRV Ratio takes the ratio of the 2 fashions, its worth mainly tells us whether or not the buyers are holding greater than they put in. In different phrases, the indicator accommodates details about the profit-loss stability of the complete community.

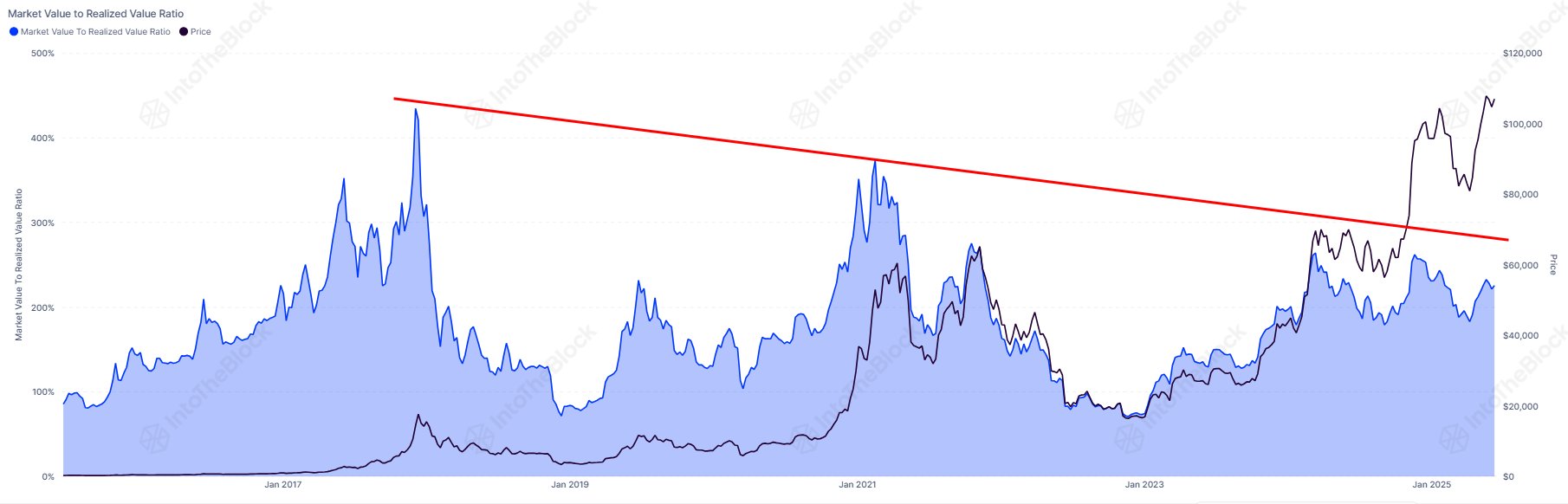

Now, right here is the chart shared by Sentora that reveals a long-term view of the Bitcoin MVRV Ratio:

The pattern within the BTC MVRV Ratio over the previous ten years | Supply: Sentora on X

As is seen within the above graph, an excessive peak within the Bitcoin MVRV Ratio has traditionally coincided with tops within the asset’s value. The reason behind the sample lies in the truth that buyers grow to be extra tempted to take their beneficial properties the bigger that they develop.

At a excessive worth of the MVRV Ratio, the Market Cap considerably exceeds the Realized Cap, so the common investor may be assumed to be holding onto a notable revenue. This typically results in holders taking part in mass selloffs to understand their beneficial properties, however the bull run retains going so long as sufficient demand continues to circulate in to soak up the promoting strain.

From the chart, it’s obvious that this stability appears to have been reaching a turning level earlier with every cycle, showcasing that as Bitcoin matures as an asset, its returns have gotten smaller. At current, the MVRV Ratio is sitting at a price of two.25, which suggests the Market Cap is greater than double the Realized Cap. Nevertheless, even after making an allowance for for shrinking beneficial properties, this worth is notably decrease than earlier cyclical tops.

“This means the market nonetheless isn’t as overheated because it was throughout earlier peaks,” notes the analytics agency. It now stays to be seen how the remainder of the cycle will play out, and whether or not BTC will make use of this potential room or not.

BTC Value

Bitcoin has erased its latest restoration as its value has come again right down to the $104,200 mark.

Appears to be like like the value of the coin has plunged over the past couple of days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

_id_c73f2182-5fb5-453a-bce5-5871be9e42e1_size900.jpg)