The value of Bitcoin has proven indicators of indecision and exhaustion over the previous few days, with largely sideways motion and a few unsustained breaks above $105,000. This lack of momentum comes because the crypto market continues to grapple with the impression of the continued unrest within the Center East.

Whereas the present choppiness of the Bitcoin worth motion means that the cryptocurrency’s bullish momentum is, on the time, inadequate for a break, current on-chain knowledge not solely corroborates this inference but additionally presents insights into the potential subsequent cease for the flagship cryptocurrency.

Superior Sentiment Index Slips Beneath 50%

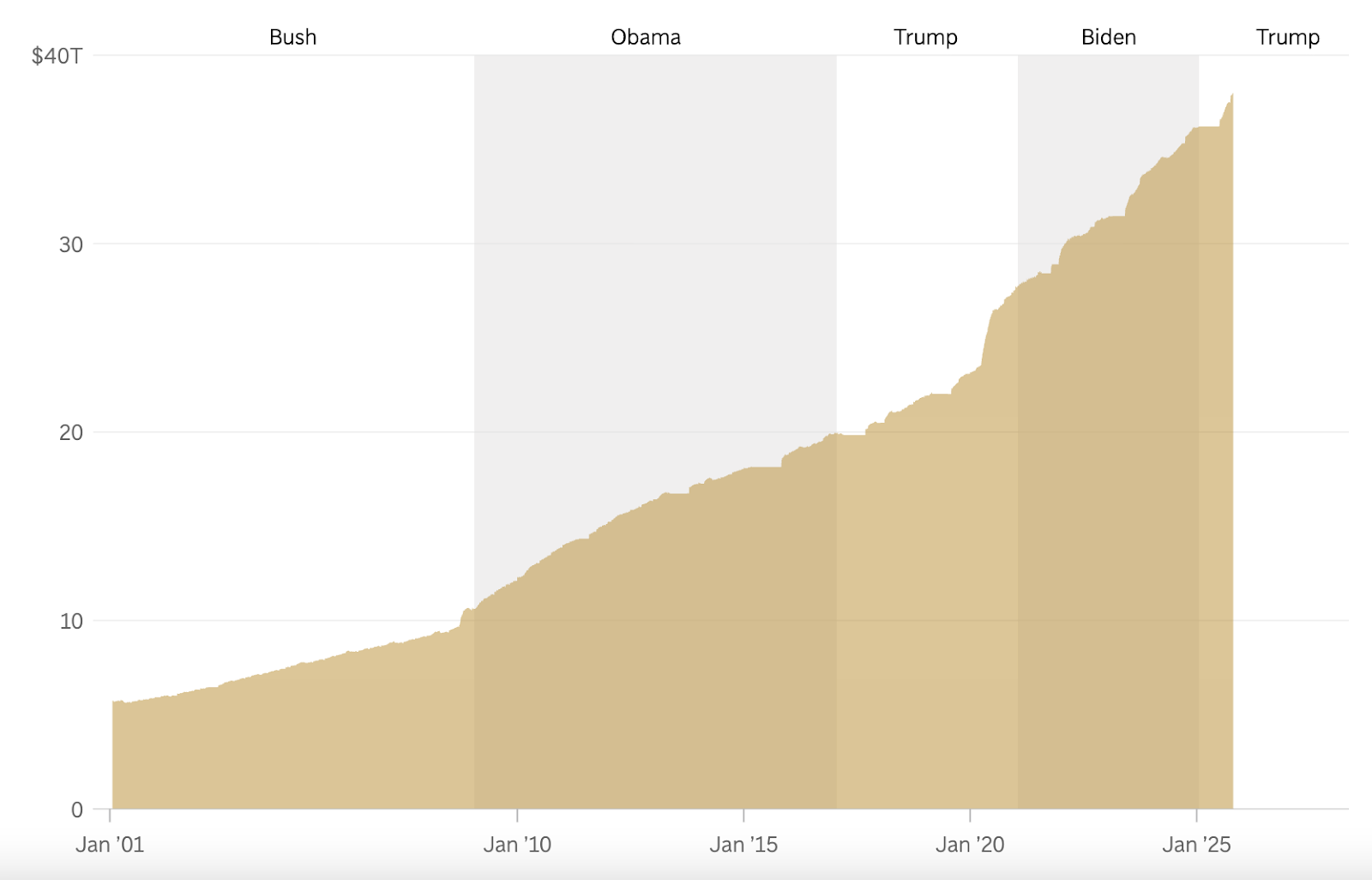

In a June 14 put up on the X platform, on-chain analyst Axel Adler Jr. reported that Bitcoin’s bullish sentiment amongst traders could also be beginning to lose depth. This on-chain commentary relies on the Bitcoin Superior Sentiment Index metric, which measures the steadiness between bullish and bearish positioning available in the market to gauge general dealer sentiment.

As its identify suggests, this on-chain indicator presents perception into the overall sentiment in a specific cryptocurrency market. As an illustration, a studying above 60-70% usually alerts sturdy bullish sentiment available in the market and is often seen earlier than or throughout worth rallies.

In the meantime, when the metric’s worth is round 50%, it often signifies impartial market sentiment, which means there’s a degree of indecision or steadiness between bears and bulls. That is often recorded in a consolidation part, which precedes definitive directional motion available in the market.

On the opposite finish of the spectrum, when the Bitcoin Superior Sentiment Index reads under 40-50%, it implies rising worry or warning available in the market, which may precede additional loss in BTC’s worth. Nevertheless, it may additionally probably point out a backside if the sentiment have been to be overly pessimistic.

Supply: @AxelAdlerJr on X

Within the put up on X, Adler Jr. reported a drop within the Sentiment Index under the impartial 50% threshold to about 46%, which falls throughout the bearish territory. In accordance with the analyst, Bitcoin’s Sentiment Index peaked above 80% early within the month of June however slowly began to say no after hitting the excessive.

As BTC not too long ago rallied to $105,000 from $103,000, different necessary metrics such because the open curiosity additionally indicated little or no investor assist, additional demonstrating weak bullish presence.

What’s Subsequent For Bitcoin Worth?

Adler Jr. opined that the indecisiveness presently being noticed available in the market may proceed till one thing necessary — just like the Sentiment Index — adjustments. For the uptrend to renew, the analyst defined that the Index has to rebound above 60-65%, which might solely happen if there are simultaneous will increase in web taker quantity and open curiosity.

If this doesn’t occur, the Bitcoin worth dangers testing the following assist degree, round $102,000 — $103,000. For that reason, warning when dealing available in the market is important, as the following assist’s power continues to be extremely probabilistic.

As of this writing, Bitcoin is valued at $105,419, reflecting no important worth motion up to now 24 hours.

The value of Bitcoin on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.