World Macro Investor’s head of analysis Julien Bittel used a marathon X thread on 9 June to sew collectively what he calls “The All the things Code”―a demographic-debt-liquidity suggestions loop that he believes will catapult the digital-asset advanced from in the present day’s roughly $3.5 trillion capitalization to $100 trillion inside a decade.

Talking towards the backdrop of a crypto market that has already doubled because the begin of 2024, Bittel lays the groundwork with a blunt analysis of the developed world’s labour market. “The labor power participation charge isn’t going to rise anytime quickly – it’s set to maintain declining over time. This can be a structural drawback,” he writes, including that “people are already being changed by AI and robots at a staggering tempo, and that shift is simply simply starting. That is deflationary.” In his view, shrinking workforces meet unyielding entitlement guarantees in a cocktail that “reinforces the necessity for ongoing stimulus to maintain the system afloat. Fewer employees. Extra tech. Similar money owed.”

Bittel’s subsequent step is the fiscal arithmetic. With private and non-private liabilities already hovering close to 120% of worldwide GDP, “the one reply is extra debt… That’s how the system survives,” he warns. Ought to development sputter, “Debt-to-GDP goes to maintain rising over time,” a development he expects policymakers to soak up by means of financial debasement quite than austerity.

Debasement, he reminds readers, is the hidden eight-percent annual lack of buying energy that piles on prime of headline inflation. “Money has quietly turn into one of many riskiest belongings on the market,” Bittel argues, forcing savers to hunt double-digit nominal returns merely to face nonetheless.

The $100 Trillion Crypto Supercycle

From there the thread pivots to liquidity, the variable Bittel and GMI founder Raoul Pal have elevated to first-principles standing. When GMI combines central-bank balance-sheet enlargement with commercial-bank credit score creation throughout main economies, the ensuing “Complete Liquidity” gauge explains about 90% of Bitcoin’s strikes and 95% of the Nasdaq-100’s, he writes. “Fewer employees. Extra tech. Similar money owed,” means liquidity should preserve rising to stop a credit score contraction, and that liquidity, in Bittel’s fashions, “is the tide that lifts scarce, risk-sensitive belongings.”

Shortage is the bridge to Bitcoin. “Bitcoin has been compounding buying energy sooner than any asset in human historical past—annualizing practically 150 % in extra of the debasement charge since 2010,” Bittel notes, whereas even the Nasdaq’s stellar 13 % actual return “is down 99.94 % versus Bitcoin because the begin of 2012. Surprising…” The superlatives serve a objective: they body Bitcoin as the one macro-scale antidote to the coverage cocktail of demographic drag, rising leverage and compelled liquidity.

All of that funnels into his headline projection. “We’re nonetheless within the early phases of a worldwide race—a scramble by establishments, sovereigns, and people—to build up as a lot Bitcoin as potential,” Bittel writes. That scramble, he believes, will propel the crypto universe “from a $3 trillion asset class in the present day to $100 trillion over the subsequent seven to 10 years.”

Doing the mathematics, a leap from the present $3.55 trillion market capitalisation implies a 40% compound annual development charge over a decade, or roughly 61% if the window compresses to seven years—each aggressive, however neither with out precedent in earlier crypto cycles.

Bittel concedes the trail will likely be “each extremely difficult and unimaginably rewarding—the worst of occasions and one of the best of occasions,” however he insists Bitcoin is “a part of the answer.” He and Pal have referred to as the approaching chase for scarce belongings “the one best wealth-creation alternative of our lifetimes,” and Bittel closes the thread by declaring that if GMI’s name performs out, it is going to be “remembered as the best macro commerce of all time. That is The All the things Code.”

Pal, whose personal presentation at Actual Imaginative and prescient’s Sui Basecamp in Might framed crypto as “a supermassive black gap that outperforms and sucks in each different asset,” reaches comparable conclusions. He locations Bitcoin in what he calls the “banana zone,” a reflexive section during which increasing liquidity and herd behaviour work together to drive parabolic good points, with a cycle goal of roughly $450,000 per coin. Pal’s estimates implies a Bitcoin capitalization solely effectively above $40 trillion even with out altcoins—complementing Bittel’s upper-bound situation.

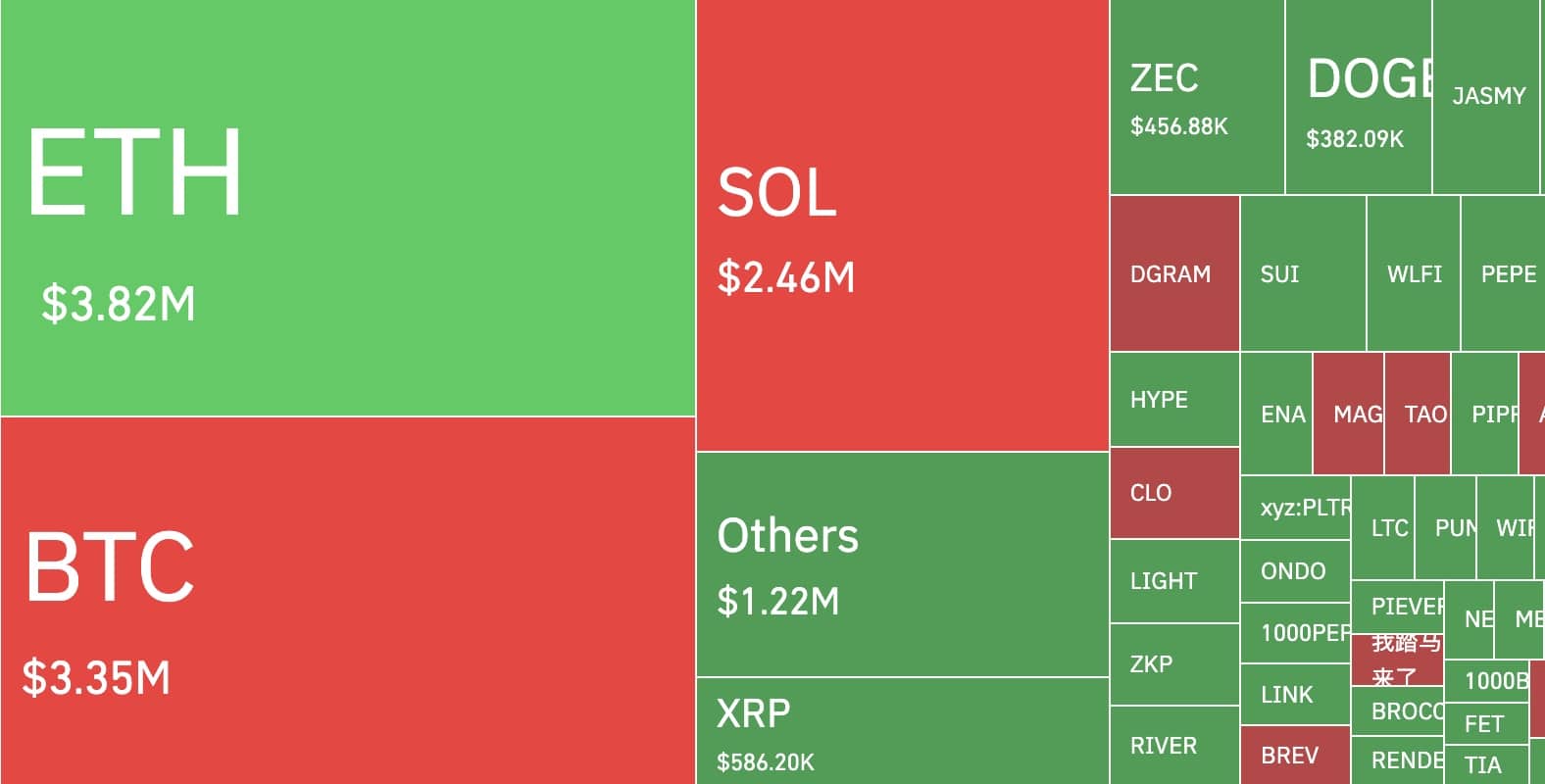

At press time, the full crypto market cap stood at $3.37 trillion.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.