Information reveals the cryptocurrency sector has seen a considerable amount of liquidations following the volatility that Bitcoin and others have gone by previously day.

Bitcoin Has Seen A Rollercoaster Over The Final 24 Hours

The previous day has been a wild time for Bitcoin and the cryptocurrency market as a complete as costs have displayed some notable volatility. BTC, particularly, has gone by fairly the rollercoaster, with its worth seeing swings in each the up and down path.

Under is a chart that reveals how the latest worth motion has regarded for the primary digital asset.

As is seen within the graph, the Bitcoin worth first went right down to a low of $100,400 from a excessive round $105,800 after which witnessed a restoration run again to $104,100.

The coin continues to be total down throughout the previous day, however its loss stands at lower than 2%. The opposite cryptocurrencies haven’t been so fortunate, as their costs haven’t fairly retraced to the identical diploma. Ethereum continues to be down nearly 6% and Dogecoin about 7%.

The unstable storm within the sector has come following a public feud between US President Donald Trump and Tesla founder Elon Musk. The spat started when the previous stated in an Oval Workplace assembly that he was ‘dissatisfied’ within the latter over his criticism of the One Massive Stunning Invoice Act. Musk had beforehand known as the invoice a ‘disgusting abomination.’

The 2 let sparks fly on social media, with the SpaceX founder even accusing the President of being within the Epstein recordsdata. “That’s the actual purpose they haven’t been made public,” stated Musk in an X put up.

Crypto Liquidations Have Neared A Billion

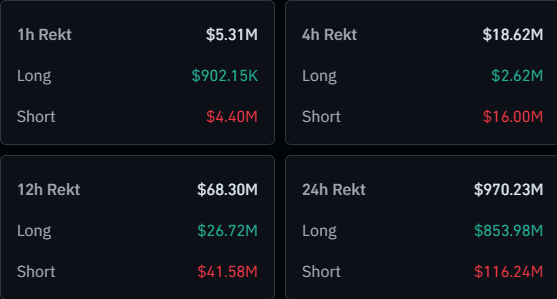

With all of the volatility that has gripped Bitcoin and firm throughout the previous day, it’s solely to be anticipated that the derivatives market would really feel the affect. Based on knowledge from CoinGlass, a mass quantity of liquidations have piled up on the assorted centralized exchanges.

“Liquidation” right here naturally refers back to the forceful closure that any open contract has to undergo if it amasses losses of a sure share.

As displayed within the desk, the cryptocurrency market has seen liquidations amounting to a whopping $970 million over the past 24 hours. Out of those, a staggering $854 million, representing 88% of the overall, got here from the lengthy buyers alone. That is naturally right down to the truth that costs as a complete have gone down throughout this window.

Like typical, Bitcoin and Ethereum have led the sector in liquidations, contributing $346 million and $286 million, respectively.

A mass liquidation occasion is popularly generally known as a ‘squeeze.’ Contemplating that the longs have made up for an awesome majority of the newest occasion, it could possibly be termed an extended squeeze.