Bitcoin is as soon as once more underneath stress after falling greater than 7% from its all-time excessive of $112,000. The sharp retracement has introduced BTC right down to a vital help zone, and what occurs subsequent might decide the path for the remainder of the quarter. World tensions between the US and China are intensifying, with tariff disputes resurfacing and including stress to an already fragile market setting. This backdrop is fueling volatility and forcing traders to rethink their publicity to danger belongings.

High analyst Darkfost shared key insights revealing that funding charges stay unusually low throughout main exchanges. This means a transparent lack of conviction amongst merchants to open new lengthy positions, particularly within the derivatives market. Usually, a breakout above earlier all-time highs would set off euphoric habits and rising leverage, however the present setting is marked by hesitation and warning.

Whereas some interpret this as weak point, others see it as a wholesome signal, suggesting the market isn’t overheated and could also be constructing a stronger basis for the following leg up. As BTC holds close to key ranges, all eyes at the moment are on whether or not bulls can regain management or if a deeper correction is on the horizon.

Bitcoin Derivatives Market Indicators Wholesome Warning

Bitcoin is now dealing with notable promoting stress after consolidating just under its all-time excessive of $112,000. After weeks of energy, the present pullback suggests the market could enter a interval of sideways consolidation as merchants anticipate recent catalysts. Macroeconomic uncertainty continues to weigh on sentiment, particularly as rising US Treasury yields elevate issues over systemic danger. These situations are affecting not solely Bitcoin but in addition the broader crypto market, together with altcoins.

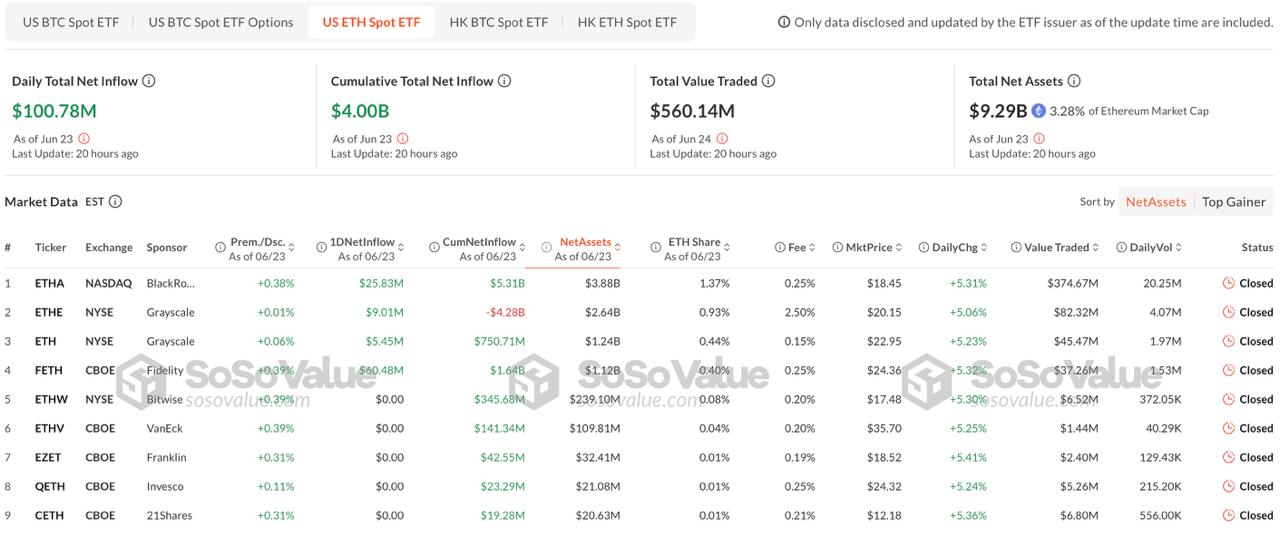

In line with evaluation by Darkfost, funding charges stay unusually low throughout most exchanges. This metric, which displays the price of holding leveraged positions in perpetual futures contracts, usually spikes throughout euphoric rallies. Nevertheless, regardless of BTC hovering close to its highs, investor urge for food for lengthy publicity stays subdued. This cautious stance is partly fueled by political uncertainty, as ongoing Trump-related developments add additional unpredictability to world markets.

Apparently, Darkfost notes that this low-risk setting in derivatives is definitely a bullish sign in disguise. With brief positions nonetheless vital, any sudden upside momentum might set off a cascade of liquidations, accelerating a possible breakout. Moreover, the absence of extreme leverage implies that the market is just not overheating—a key consider establishing a sustainable basis for additional beneficial properties.

In brief, Bitcoin could also be cooling off quickly, however the construction beneath the floor stays robust. So long as funding charges keep balanced and systemic danger doesn’t escalate additional, the present pause might function a launchpad for the following impulsive transfer.

BTC Holds Assist As Bulls Defend $103K–$104K Zone

Bitcoin is at present testing a vital help zone between $103,600 and $104,000 after failing to keep up momentum above its all-time excessive close to $112,000. The chart reveals a powerful rejection from the $109,300 resistance stage, which beforehand acted as a key breakout level in Might. The pullback has been accompanied by declining quantity, suggesting that promoting stress could also be slowing as value nears demand.

The 34-day exponential transferring common (EMA), at present sitting at $102,710, can be converging with this help space, including additional confluence and technical significance to this zone. If bulls handle to carry above the $103,600 line, Bitcoin might kind a better low—a bullish construction which may set the stage for a rebound within the coming periods.

Nevertheless, a clear break beneath this stage with robust quantity would probably invalidate the short-term bullish thesis and open the door for a deeper correction towards the $98,000–$100,000 vary. As world tensions and financial uncertainty stay elevated, this stage will function a litmus take a look at for market energy. For now, Bitcoin continues to be technically in an uptrend, however this help should maintain to keep up bullish momentum heading into June.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.