Crypto agency Matrixport has delivered insights into why this bull market is totally different from the 2021 bull run. Their evaluation sheds extra gentle on why altcoins are lagging regardless of the Bitcoin worth rally to a new all-time excessive (ATH) at $111,900.

Why This Bull Market Is Completely different As Altcoins Lag Behind Bitcoin Value

In an X submit, Matrixport acknowledged that many merchants are lacking out on the present Bitcoin worth rally as conventional retail engagement indicators stay low regardless of the rally to a brand new ATH. The agency defined that this rally is occurring because of institutional buyers, with retail buyers on the sidelines in this bull market.

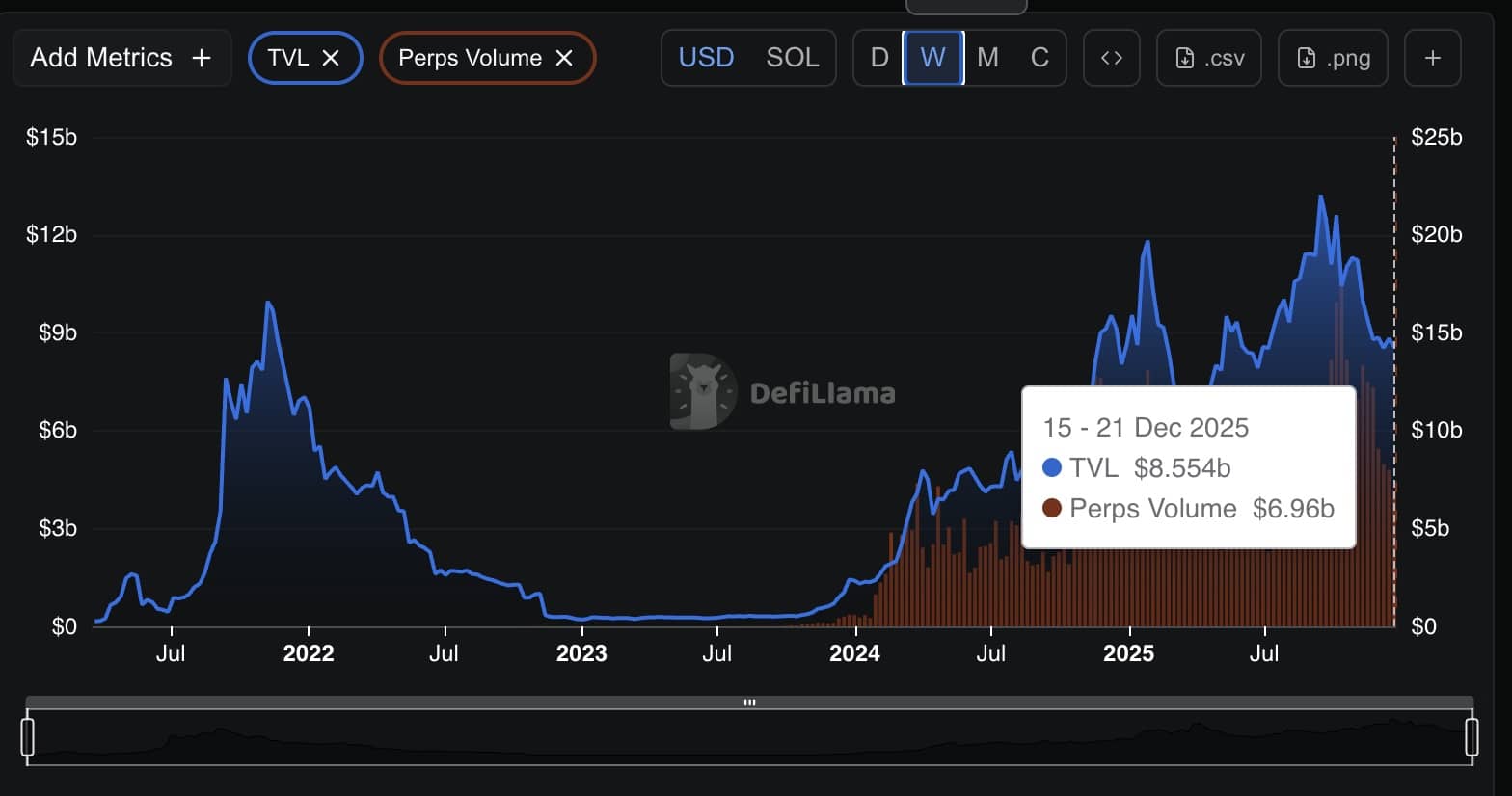

Matrixport famous that this explains why funding charges stay subdued, retail exercise is low, and lots of altcoins proceed to lag as the Bitcoin worth rallies on this bull market. The agency additionally revealed that retail merchants make the elemental mistake of not anticipating market corrections, resulting in them sometimes closing their positions throughout sharp drawdowns.

This bull market additionally differs from 2021 in that retail’s share of Bitcoin possession is now not increasing. Crypto whales have stepped in and are absorbing a lot of the flagship crypto’s provide, kicking retail buyers to the curb. Bloomberg analyst Eric Balchunas as soon as famous that this might clarify why the Bitcoin worth has held up effectively throughout main corrections.

Based on Matrixport, understanding how company demand influences the Bitcoin worth habits and the way lengthy this pattern is prone to final is important because the shift on this bull market progresses. In the meantime, the absence of retail merchants on this cycle explains why funding charges and buying and selling volumes are comparatively low, with altcoins lagging.

The agency famous that market individuals are witnessing a quiet switch of Bitcoin from early adopters and buyers, miners, and exchanges to companies like Technique and institutional buyers like BlackRock. Matrixport once more asserted that the present Bitcoin worth rally is pushed by spot market accumulation and never derivatives exercise, which may clarify why altcoins are lagging behind BTC.

What Subsequent For BTC And Altcoins

In an X submit, crypto analyst Kevin Capital acknowledged that the subsequent vital step is for the Bitcoin worth to file a weekly shut above $106,800 after which observe by way of or consolidate subsequent week. He remarked that BTC is basically the one factor that issues and urged market individuals to take their eyes off altcoins.

If the Bitcoin worth fails to perform that aim, the analyst acknowledged that market individuals can then flip their consideration to the reverse psychology 2021 fractals. It’s value mentioning that the analyst as soon as predicted that altcoins led by Dogecoin will nonetheless have their run as soon as BTC’s dominance cools off in the summertime.

On the time of writing, the Bitcoin worth is buying and selling at round $108,258, down virtually 2% within the final 24 hours, in accordance with information from CoinMarketCap.

Featured picture from Pixabay, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.