Earlier than leaping head-first into crypto like so many individuals do, it’s important to perceive the important thing variations between a crypto alternate and a pockets. They’re each essential instruments—however do very various things. Crypto exchanges provide help to purchase, promote, and commerce digital property. Crypto wallets are the place you retain these valuable property secure.

Realizing how every works may also help you keep away from rookie errors and make smarter strikes.

Why Understanding the Distinction Issues

Once you’re selecting between a crypto alternate and a pockets, you aren’t simply choosing no matter seems prettiest. It’s about strolling the effective steadiness between management and threat. Exchanges are constructed for getting, promoting and buying and selling digital property, and wallets are constructed for securely storing your crypto. Complicated the 2 can result in misplaced funds or missed alternatives.

Go away your property on an alternate, and there’s an opportunity (even when it’s a small one) that it may get hacked, leaving you with nothing. However retailer your crypto on a chilly pockets that doesn’t help swaps, and also you’ll miss out on huge performs and main worth actions.

How Is a Cryptocurrency Alternate Totally different from a Cryptocurrency Pockets?

Folks use cryptocurrency exchanges to purchase, promote and commerce digital property, however a crypto pockets is the place they shelf these property for long-term storage—that is the important thing distinction.

Exchanges deal with transactions, set pricing, and match market orders between customers. However wallets don’t often allow you to commerce immediately. As an alternative, they simply retailer your non-public keys and assist you to ship or obtain crypto securely, with out having to depend on a 3rd get together.

Exchanges are for motion, wallets are for stability. You commerce on exchanges, however you defend your crypto in a pockets.

What Is a Cryptocurrency Alternate?

Merely put, a cryptocurrency alternate is a platform that allows you to purchase, promote and commerce crypto. You’ll additionally be capable to convert fiat currencies like USD into crypto, or crypto again into fiat.

Typically, you’ll hear two fundamental sorts of crypto alternate talked about in any crypto areas: they’re centralized exchanges (CEX) and decentralized exchanges (DEX). CEXs are often run by basic, real-world corporations, require ID verification, and provide buyer help. In the meantime, DEXs allow you to commerce immediately with others utilizing good contracts—no middlemen concerned.

Numerous crypto exchanges will even have helpful additional instruments like worth charts, staking, and margin buying and selling. However take into account that storing crypto on an alternate for lengthy durations of time comes with some dangers.

What Is a Crypto Pockets?

A crypto pockets is an tackle which may securely retailer, ship, and obtain crypto. This allows customers to handle their digital property, private and non-private keys in an easy-to-use method, multi functional place with out risking safety. There are a number of sorts of crypto wallets:

Software program wallets could be cellular apps, browser extensions and even desktop wallets which you can set up immediately in your laptop. In the meantime {hardware} wallets provide stronger safety, since they retailer property totally offline. There are additionally paper wallets, that are mainly simply keys printed out on paper, just like the title suggests. They’re undoubtedly secure from on-line assaults, however you wouldn’t need your cat enjoying with one.

There’s additionally the choice of selecting custodial or non-custodial wallets. One permits an organization to carry your keys for you, and the opposite provides management totally to you.

Simply bear in mind: for long-term holding, use a {hardware} pockets. For energetic use, go along with a software program pockets like MetaMask or Belief Pockets.

Key Variations Between Exchanges and Wallets

Exchanges vs wallets serve totally different roles on the planet of crypto. Exchanges are used to purchase, promote and commerce cryptocurrencies, and wallets are used to retailer them.

Possession and Management of Funds

A centralized crypto alternate finally has management of each consumer funds and personal keys. However on a decentralized alternate, you possibly can commerce immediately from your personal pockets.

A crypto pockets provides you full possession and management of all of your property. That is very true of non-custodial wallets. You’re in a position to handle all of your non-public keys your self, and no third events can entry them with out your data and consent.

Safety Options and Dangers

Crypto exchanges are sometimes focused by hackers as a result of they retailer a variety of consumer funds. Be careful, as a result of if an alternate is breached, your crypto might be in critical hazard.

It is a far cry from crypto wallets, which give extra enhanced safety and management when in comparison with even essentially the most safe exchanges. With a pockets, you handle your non-public keys your self, and there’s a a lot decrease likelihood you’ll be hacked or grow to be a sufferer of mismanagement.

{Hardware} wallets, for example, retailer keys offline, safeguarding property from on-line threats. Because of this, despite the fact that exchanges undoubtedly provide extra comfort for buying and selling, wallets are nonetheless preferable for long-term storage and safety.

Entry to Non-public Keys

When you’re planning to make use of an alternate to retailer your digital forex, you ought to be conscious that you simply received’t have entry to the non-public keys that management your funds. The platform holds them in your behalf. This implies it’s important to depend on its safety techniques and insurance policies.

However when you’ve got a chilly, non-custodial crypto pockets, you possibly can hold your non-public keys offline. This provides you full management of your digital property and eliminates additional threat. Preserving your non-public keys offline is a particularly efficient technique to defend your property from theft or loss.

Use Instances

Crypto exchanges are finest for energetic buying and selling. They allow you to purchase, promote, or swap crypto property rapidly. They’ll additionally verify costs, and entry real-time markets. When you want buying and selling pairs, liquidity, or fiat conversion, an alternate is the way in which to go.

Crypto wallets are for safe storage and holding digital property long-term. They offer you full management of your crypto, particularly with a chilly pockets that retains keys offline. Wallets are additionally essential for utilizing dApps, staking, or just retaining your crypto secure.

Learn extra: The Prime 10 dApps You Ought to Know About

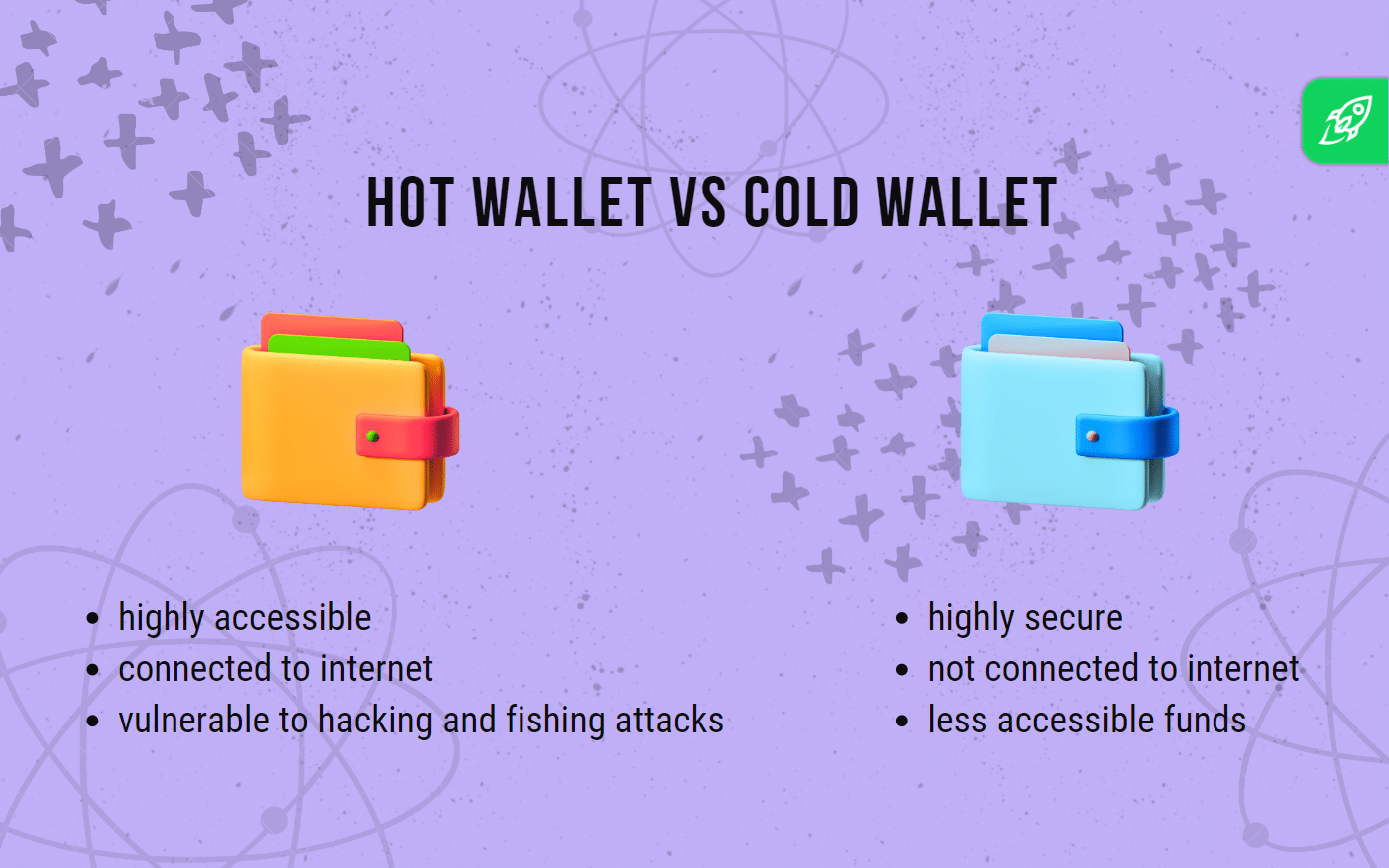

Connectivity

Crypto exchanges are all the time on-line, providing you with instantaneous entry to purchase, promote, and react to market adjustments. That’s nice for energetic buying and selling—nevertheless it additionally means they’re extra uncovered to hacks and scams, since they’re all the time on-line.

For instance, the alternate Bybit misplaced over $1.5 billion in ETH after hackers exploited a pockets switch. They compromised a developer’s machine and quietly rerouted the funds. Even main platforms face dangers like this. Because of this many customers commerce on exchanges, however nonetheless select to retailer their crypto elsewhere.The most secure crypto wallets are chilly wallets, which keep offline for higher safety. Scorching wallets, nonetheless, are on-line and due to this fact simpler to entry. You must select between all these choices primarily based on how usually it’s essential use your crypto and the way dangerous you need your strikes to be.

Person Expertise

Crypto exchanges really feel acquainted—like utilizing a checking account or a buying and selling app. You may also deposit fiat forex to purchase crypto immediately, making exchanges the primary entry level for many novices.

Crypto wallets fluctuate in consumer expertise. Utilizing paper wallets is as simple as printing out a bit of paper along with your keys. Cellular and on-line wallets take some getting used to. {Hardware} wallets provide extra safety however require additional steps.

Although wallets want extra setup, they offer you full management and direct entry to your crypto.

Charges

Crypto exchanges cost charges for buying and selling, withdrawing, and deposits. Prices fluctuate by platform, commerce measurement, and cost methodology. Some provide tiered pricing, with decrease charges for high-volume customers.

Crypto wallets don’t often cost platform charges, however community charges nonetheless apply. These fluctuate by blockchain and are required to course of transactions.

Regulation & KYC

In relation to crypto exchanges, they often require you to cross Know Your Buyer (KYC) checks earlier than you may make any crypto transactions. You’ll must confirm your identification with a photograph ID or different private information to cross one among these checks. This helps the corporate forestall fraud and adjust to anti money-laundering legal guidelines.

Crypto wallets don’t usually require KYC, although. You possibly can create a pockets for storing digital property with out revealing your identification. This undoubtedly presents you extra privateness, however comes at the price of fewer authorized protections if one thing goes incorrect.

Backup & Restoration

Crypto exchanges deal with backups for you. When you neglect your password, you possibly can reset it utilizing your e mail and ID. However the platform controls your entry.

Crypto wallets go away restoration as much as you. You get a restoration phrase that restores your pockets. Lose it, and also you lose all of your digital cash. There’s no technique to reset.

Integration with Providers

Crypto exchanges join simply with banks, cost apps, and buying and selling instruments, enabling customers to purchase crypto with a card, transfer consumer funds quick, and use built-in options like charts and order books.

Crypto wallets hyperlink with dApps, NFT platforms, and DeFi protocols. Many allow you to swap tokens, stake property, or play blockchain video games with out leaving the app.

Anonymity

Crypto exchanges require you to submit paperwork to confirm your identification. That is referred to as KYC. This manner, you’ll be capable to commerce, withdraw, or entry your digital property. This course of helps meet authorized requirements however limits your privateness.

Crypto wallets don’t ask to your identification. You possibly can ship, obtain, and handle crypto with out linking it to your private info. This makes wallets extra non-public—but additionally locations extra accountability on you to remain safe.

Crypto Alternate vs. Pockets: Comparability Desk

Ought to You Use an Alternate, a Pockets, or Each?

When you’re new to crypto, a crypto alternate is the best place to start out. You should buy, promote, and swap digital property rapidly by a user-friendly platform. However exchanges aren’t constructed for long-term storage. Centralized exchanges maintain your non-public keys—so if the platform is hacked or goes offline, your funds might be misplaced.

Cryptocurrency wallets offer you full management over your property. They’re higher for long-term storage and provide extra safety. Non-custodial wallets additionally allow you to work together immediately with decentralized functions (dApps), resembling DeFi platforms and NFT marketplaces.

For many customers, the good transfer is to make use of each crypto exchanges and wallets. Use the alternate for buying and selling and conversions, and your pockets to securely retailer property and entry dApps. It’s the easiest way to steadiness comfort with management.

Frequent Newbie Errors to Keep away from

Leaving Funds on an Alternate

Positive, retaining your crypto on a centralized alternate is certainly handy, nevertheless it really exposes you to some vital dangers. Quite a bit can go incorrect with centralized techniques. Exchanges can go offline, get hacked, or freeze withdrawals, leaving your funds misplaced someplace on the blockchain. Storing your property on a {hardware} pockets is your finest wager by way of safety.

Forgetting Seed Phrases or Passwords

That is essential: When you lose your seed phrase or password after organising your crypto pockets, you possibly can lose your entry to it completely. On prime of that, forgetting even one phrase of your seed phrase could make it utterly ineffective.

Falling for Phishing Scams

When you’ve heard of phishing scams you already know that they use pretend web sites or emails to imitate legit crypto companies and attempt to steal your property. You may even assume you’ll be capable to acknowledge one among these scams for those who’re the one being scammed. However don’t be so certain. Crypto is commonly focused by phishing scams, and attackers will go to very nice lengths simply to get you to offer them your pockets tackle and all the pieces on it.

The way to Transfer Crypto Off an Alternate and Retailer Cash on a Pockets

1. Setting Up Your First Pockets

Begin by selecting a pockets—software program wallets are simple to make use of, whereas {hardware} wallets provide extra safety. Observe the setup directions and save your pockets tackle for future transfers.

2. Fundamental Safety Suggestions

Be sure you’ve acquired two-factor authentication (2FA) enabled to guard your funds. Write down your restoration phrase and retailer it someplace secure, offline. When you lose this phrase, you lose your crypto.

3. Storing Cash on Your Pockets with Changelly

As soon as your crypto pockets is prepared, you should purchase or swap crypto on Changelly and ship it on to your pockets tackle. It really works lots like transferring cash to a checking account—easy, secure, and acquainted. Changelly helps tons of of buying and selling pairs and makes managing property simple, even for novices.

Remaining phrases

There are essential variations it’s essential know to make the selection between crypto alternate vs crypto pockets. Crypto exchanges are for buying and selling, crypto wallets for storing. To remain secure, keep away from widespread errors and safe your digital property. Whether or not you’re beginning out or constructing a portfolio, all the time know the place your crypto is and who controls it.

FAQ

Can I retailer my crypto on an alternate endlessly?

Sure, nevertheless it’s not very secure. Whereas each crypto exchanges and wallets are each susceptible to hacking, exchanges (particularly centralized exchanges) are more likely to be hacked, and may go offline totally. For long-term storage, cryptocurrency wallets are the safer technique to retailer crypto.

Do I want a pockets to purchase cryptocurrency?

No, you should purchase crypto immediately on an alternate. However you’ll undoubtedly want a crypto pockets if you would like full management of your property, or for those who plan to maneuver them wherever off the platform.

What occurs if I lose entry to my pockets or alternate account?

When you lose your entry to the pockets the place you retailer your funds, and don’t have (or don’t bear in mind) your restoration phrase, all of your crypto is mainly gone. However for those who’re dealing with the identical drawback with an alternate, you possibly can often get better your entry with ID verification.

Are crypto wallets free to make use of?

Sure, most crypto wallets are free—nevertheless it is determined by the kind. Software program, cellular and net wallets are often free to obtain and use. {Hardware} wallets, like Ledger or Trezor, have to be bought. Regardless of the kind, you’ll nonetheless pay community charges when sending or swapping crypto.

Is a cellular pockets secure for novices?

Sure! However it’s important to hold it safe. Ensure to make use of a pockets that’s trusted by the group, set a robust password, use 2FA, and again up your restoration phrase.

What’s higher for a newbie—utilizing an alternate or a pockets?

Each are helpful, however for various causes. Exchanges are higher for getting began, shopping for, promoting, and buying and selling. Wallets offer you extra management and safety. In the long term, it’s finest to make use of each—an alternate for transactions, and a pockets as a safe storage resolution.

Disclaimer: Please notice that the contents of this text are usually not monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native rules earlier than committing to an funding.