Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Dogecoin has entered a crucial section because it consolidates beneath the $0.26 resistance degree, dealing with rising stress after a pointy rejection final week. Since tagging a neighborhood excessive on Might tenth, DOGE has dropped over 18%, retracing among the positive factors from its spectacular rally that started in early April. Bulls had constructed robust momentum following the breakout above $0.13, which marked a 100% worth surge inside a month. Nevertheless, latest worth motion suggests the transfer could also be stalling.

Associated Studying

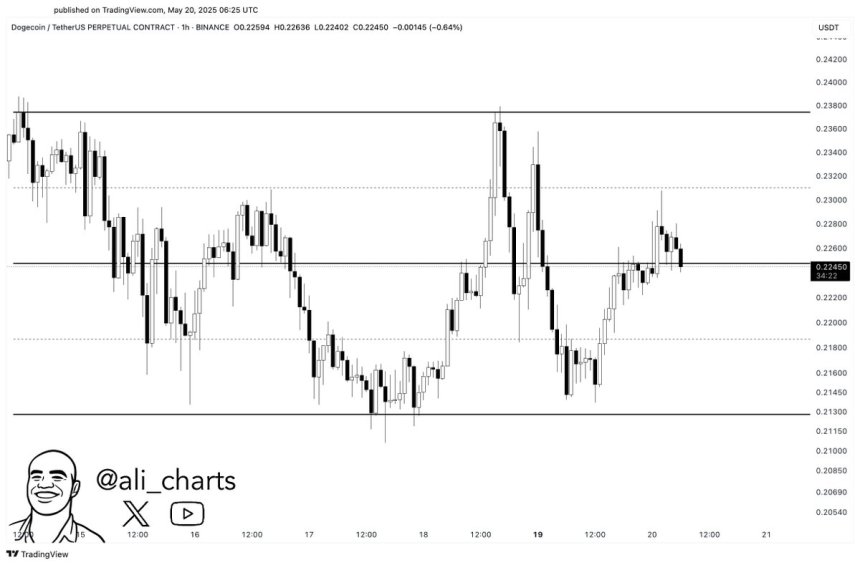

The market now watches intently to see if Dogecoin can defend present ranges or if additional draw back is on the horizon. In response to prime analyst Ali Martinez, the most recent rejection has opened the door for a doable revisit to the $0.213 degree — a key zone that beforehand served as each resistance and help. This degree might now act as a magnet for worth if bullish management continues to fade.

Whereas sentiment stays cautiously optimistic, the following transfer will rely on whether or not bulls can reclaim momentum or if DOGE breaks beneath its native vary. The approaching days might outline the trajectory of Dogecoin’s midterm pattern, with volatility more likely to decide up.

Hypothesis Rises However DOGE Faces Essential Check

Through the latest correction that despatched shockwaves throughout the crypto market, meme cash like Dogecoin have been among the many most closely affected belongings. As Bitcoin and main altcoins confronted steep retracements, DOGE skilled an aggressive pullback, shedding over 18% since Might tenth and erasing a good portion of its earlier positive factors. This correction disrupted the bullish construction that had shaped after DOGE surged over 100% from early April, following a breakout above the $0.13 mark.

Regardless of the drop, hypothesis continues to mount round Dogecoin’s potential to steer if the market regains momentum. Traditionally, DOGE has acted as a high-beta asset, usually outperforming in euphoric phases of the cycle. With the broader market trying to stabilize, some analysts view DOGE as a probable beneficiary if sentiment shifts bullish as soon as once more.

Nonetheless, dangers stay. Value is now hovering simply above key help ranges, and a failure to carry this zone might set off a deeper retracement. Martinez shared a technical view suggesting that if present ranges fail to carry, Dogecoin might wish to revisit the $0.213 degree — a crucial space that beforehand acted as a launchpad through the April breakout.

The approaching periods are more likely to be decisive. The meme coin narrative might regain power if bulls reclaim management and push DOGE again towards the $0.26 resistance. Nevertheless, if bearish momentum builds and DOGE breaks decrease, it will sign a continuation of the present downtrend. For now, all eyes stay on this pivotal help zone as Dogecoin navigates a high-stakes second inside the broader market’s unsure situations.

Associated Studying

Technical Particulars: Dogecoin Going through Essential Demand

Dogecoin (DOGE) is displaying indicators of weak spot after failing to carry above key resistance close to $0.26 earlier this month. The each day chart signifies that DOGE is at the moment buying and selling at $0.221, consolidating simply above the 200-day EMA ($0.219) and beneath the 200-day SMA ($0.269). This vary has acted as a battleground between bulls and bears, with the latest candles forming tight-bodied constructions, signaling indecision.

Quantity has declined notably for the reason that early Might breakout, suggesting a lack of momentum and dealer curiosity. If DOGE loses the $0.219–$0.220 help zone, the following logical help degree sits close to $0.213, aligning with analyst considerations of a possible retest of that degree. A breakdown beneath this space might set off additional draw back stress towards the $0.19 zone.

Associated Studying

On the upside, reclaiming the 200-day SMA at $0.269 can be a big bullish sign, as it will place DOGE again above long-term resistance. Nevertheless, the present pattern favors a cautious stance, particularly amid broader market uncertainty and weakened sentiment throughout altcoins. General, the chart displays a pause in bullish momentum and rising threat of a deeper retrace except DOGE regains power above key shifting averages. The following few days might decide whether or not consolidation holds or turns right into a full correction.

Featured picture from Dall-E, chart from TradingView