On-chain information exhibits the Ethereum Alternate Netflow has remained unfavorable throughout the previous week, an indication that could possibly be bullish for ETH.

Ethereum Alternate Netflow Suggests Pattern Of Withdrawals

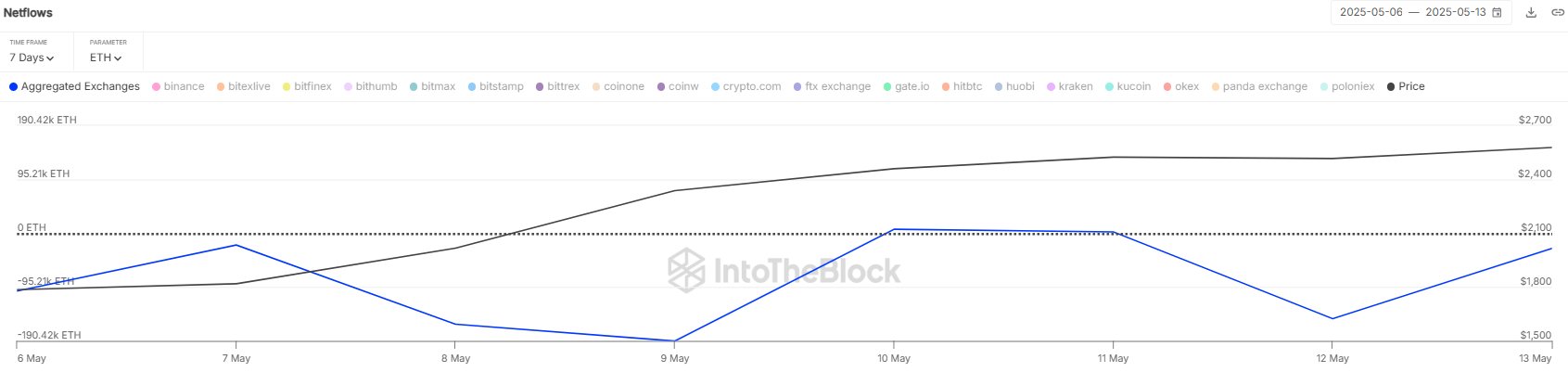

In a brand new put up on X, the institutional DeFi options supplier Sentora (previously IntoTheBlock) has talked in regards to the newest pattern within the Alternate Netflow of Ethereum. The “Alternate Netflow” right here refers to an on-chain metric that retains monitor of the web quantity of the cryptocurrency shifting into or out of the wallets related to centralized platforms.

When the worth of this metric is constructive, it means the traders are depositing a internet variety of tokens to those platforms. As one of many important the explanation why holders switch to exchanges is for selling-related functions, this sort of pattern can have a bearish affect on the ETH value.

Then again, the indicator being below zero suggests the outflows are outweighing the inflows. Usually, traders take their cash away from the custody of exchanges for holding into the long run, so this sort of pattern can show to be bullish for the asset.

Now, right here is the chart shared by the analytics agency that exhibits the pattern within the Ethereum Alternate Netflow over the previous week:

The worth of the metric seems to have been unfavorable in latest days | Supply: Sentora on X

As displayed within the above graph, the Ethereum Alternate Netflow has largely been unfavorable inside this window, which means the holders have been pulling provide out of the centralized exchanges.

In complete, the traders have made withdrawals value $1.2 billion with this outflow spree. “This sustained pattern of internet outflows, intensifying since early Could, indicators continued accumulation and decreased sell-side stress,” notes Sentora.

Whereas ETH has seen this bullish growth just lately, the cryptocurrency will not be providing that good an entry alternative proper now, because the analytics agency Santiment has defined in an Perception put up.

The information for the 30-day and 365-day MVRV Ratios of ETH | Supply: Santiment

The indicator shared by the analytics agency is the “Market Worth to Realized Worth (MVRV) Ratio,” which principally gives a measure of the profit-loss state of affairs of the Bitcoin traders.

Within the chart, Santiment has included two variations of the indicator: 30-day and 365-day. The previous tells us in regards to the profitability of the traders who bought throughout the previous 30 days and the latter that of the previous 12 months consumers.

As is seen within the graph, the 30-day MVRV Ratio for Ethereum has a notable constructive worth proper now, implying the latest consumers are in important revenue. Extra particularly, the metric is sitting at 32.5%, which is properly above the 15% hazard zone for altcoins that the analytics agency recommends as a rule-of-thumb.

“It might not imply that costs are about to drop, nevertheless it does recommend that the rally will possible sluggish or halt till the 30-day MVRV dips again right down to one thing extra affordable,” explains Santiment.

ETH Value

On the time of writing, Ethereum is buying and selling round $2,600, up over 43% within the final week.

The pattern within the ETH value during the last 5 days | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Santiment.internet, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.