Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum is gaining momentum once more after tagging the $2,739 degree and setting a brand new native excessive, reaching costs not seen since late February. The rally marks a robust comeback for ETH, which has been underneath vital stress earlier this 12 months. Now, bulls seem firmly in management because the broader crypto market wakes up and capital flows return to altcoins.

Associated Studying

Analysts are calling for a possible altseason, fueled by Ethereum’s relative power towards Bitcoin and rising investor confidence. As Bitcoin consolidates close to all-time highs, Ethereum has taken the chance to outperform, pushing up by way of key resistance ranges with conviction.

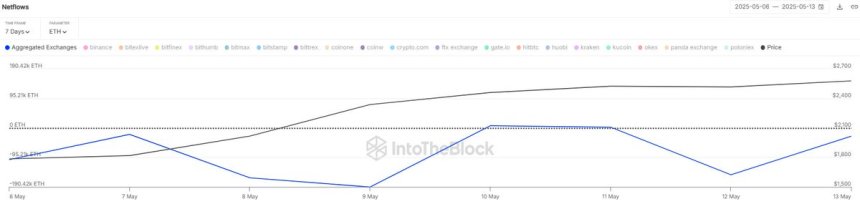

Supporting this narrative, information from Sentora (previously IntoTheBlock) reveals that $1.2 billion value of ETH has been withdrawn from centralized exchanges over the previous seven days. This sustained development of web outflows suggests continued accumulation and lowered sell-side stress, each robust alerts for long-term bullish momentum.

With worth motion heating up and investor sentiment shifting, Ethereum may very well be making ready for a serious breakout. If bulls preserve management, the $3,000–$3,100 area could also be examined within the coming days as the subsequent main resistance zone. All eyes are actually on ETH because the altcoin market reveals indicators of life.

Ethereum Builds Momentum As Trade Outflows Sign Accumulation

Ethereum is buying and selling above vital ranges as hypothesis of a sustained rally continues to develop. After weeks of sluggish motion, ETH has roared again to life, gaining over 50% in worth since final week. This sharp transfer to the upside has reignited hopes for an altseason, with many analysts viewing Ethereum’s breakout because the potential set off for broader altcoin market power.

Ethereum is now holding firmly above the $2,600 mark, a degree that had acted as robust resistance for months. This breakout, coupled with growing momentum towards Bitcoin, suggests bulls are regaining management. Merchants are carefully watching the subsequent main resistance zone between $2,900 and $3,100, which might function a key take a look at for Ethereum’s uptrend.

Including to the bullish case, information from Sentora reveals that $1.2 billion value of ETH has been withdrawn from centralized exchanges over the previous 7 days. This development has intensified since early Could, pointing to elevated investor accumulation and lowered sell-side stress. Massive change outflows are sometimes seen as an indication that holders intend to retailer ETH off-exchange, reducing fast provide and supporting upward worth motion.

With market sentiment turning bullish and Ethereum main the cost, all eyes are actually on whether or not ETH can preserve its momentum and drive the altcoin market into a brand new development section. If accumulation tendencies persist and bulls maintain key ranges, Ethereum’s path towards $3,100 might open the door to a broader market rally.

Associated Studying

Worth Motion Particulars: ETH Testing Key Ranges

Ethereum’s weekly chart reveals a strong breakout after weeks of bearish stress, with ETH now buying and selling round $2,599.14. The current surge pushed the value above each the 200-week EMA ($2,259.65) and the 200-week SMA ($2,451.55), two vital long-term development indicators. Reclaiming these ranges alerts renewed bullish momentum and a robust shift in sentiment.

The breakout candle itself is among the largest weekly inexperienced candles in over a 12 months, reflecting a pointy inflow of purchaser curiosity and doubtlessly marking a key reversal level after months of draw back. Notably, this transfer brings ETH to ranges not seen since February, with the native excessive for the week reaching $2,739.05.

Quantity has elevated considerably throughout this transfer, confirming the power behind the rally. Nonetheless, Ethereum now faces overhead resistance close to $2,800–$2,900, a zone that beforehand acted as assist throughout early 2024 earlier than the breakdown. If bulls preserve momentum and shut this week above $2,600, it might open the door for a take a look at of the $3,100 resistance zone.

Associated Studying

On the draw back, the important thing assist to observe is round $2,450, aligned with the 200-week SMA. A failure to carry that degree might invite a retest of $2,250. For now, the development is bullish, however follow-through subsequent week can be essential.

Featured picture from Dall-E, chart from TradingView