Key Takeaways:

By becoming a member of the S&P 500, Coinbase turns into the primary cryptocurrency firm to take action, therefore signifying a major turning level in crypto’s incorporation into typical finance.The addition comes after Coinbase’s strong monetary outcomes and market worth exceeding $53 billion.This motion helps crypto’s validity on Wall Avenue by reflecting accelerating institutional adoption of digital belongings.

Greater than a symbolic win, Coinbase‘s inclusion within the S&P 500 marks a seismic change in the way in which the monetary sector sees cryptocurrency. This second confirms crypto’s entry within the financial mainstream as institutional barricades fall and acceptance rises.

Learn Extra: Coinbase Overview 2025: Is This Centralized Trade Legit and Secure for Rookies?

Coinbase Enters Wall Avenue’s Premier Membership

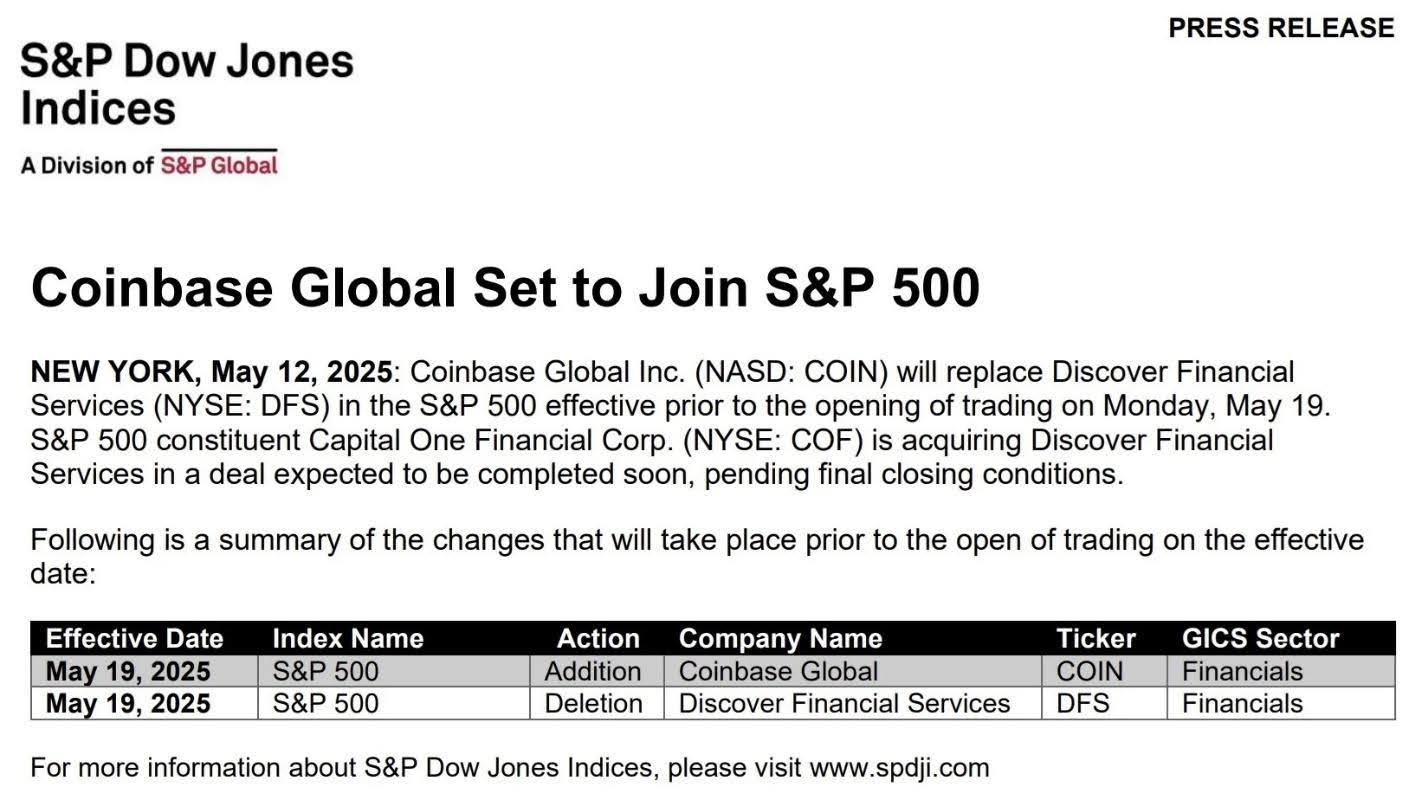

With Capital One’s acquisition of Uncover Monetary Companies (NYSE: DFS), Coinbase International Inc. (NASDAQ: COIN) will supplant it within the S&P 500 on Might 19, 2025. In terms of bitcoin corporations, Coinbase is the one one on the S&P 500 proper now. The S&P 500 is a rating of the five hundred greatest publicly traded corporations within the US.

S&P Dow Jones Indices assured the companies certified by verifying they fulfilled rigorous requirements. Firms needed to have a market worth of at the least $18 billion, be very liquid, make most of their shares accessible to the general public, and present that they had been worthwhile over the past 4 quarters. With a market worth of greater than $53 billion and a stable This fall 2024 efficiency with revenue over $6.6 billion, Coinbase qualifies for all these standards.

Coinbase’s CEO Brian Armstrong wrote on X:

“Coinbase simply grew to become the primary and solely crypto firm to affix the S&P 500. This milestone represents what the true believers knew all alongside. Crypto is right here to remain.”

Coinbase simply grew to become the primary and solely crypto firm to affix the S&P 500.

This milestone represents what the true believers, from retail traders to institutional traders to our staff and companions, knew all alongside.

Crypto is right here to remain. https://t.co/MnMRCX8pMg

— Brian Armstrong (@brian_armstrong) Might 12, 2025

Learn Extra: Trump’s Professional-Crypto Stance: Coinbase to Create 1,000 US Jobs

Institutional Sign: Crypto Goes Mainstream

Index Inclusion Triggers Large Funding Flows

Coinbase’s inclusion within the S&P 500 has important monetary results, not solely a badge of delight. Funds monitoring the S&P 500, together with pensions, mutual funds, and ETFs, handle about $15.6 trillion in belongings. These funds can be obligated to purchase COIN inventory as soon as Coinbase is formally included, therefore elevating demand and perhaps inflicting main value motion.

Furthermore, index inclusion enhances credibility. For years, crypto critics have ridiculed the sector as speculative or risky. With Coinbase now becoming a member of one of the well-known monetary indices on the planet, the message is clear: crypto has earned its place on the desk.

This might have ripple results past simply Coinbase inventory. Publicity to crypto infrastructure by way of S&P 500 portfolios means extra retail and institutional traders will not directly maintain crypto belongings. It’s a step towards normalizing digital belongings in conventional portfolios and retirement accounts.

Crypto Trade Sector in Fast Progress Mode

Coinbase’s development mirrors the extra normal motion within the crypto change sector. Projected to be $71.94 billion by 2029 and $213.15 billion by 2034, the worldwide crypto change business, valued at $24.75 billion in 2024, in accordance with market predictions. Being one of many greatest exchanges worldwide, Coinbase is completely positioned to grab a good portion of this enlargement.

With non-U.S. revenue making 19% of This fall income, Coinbase has additionally superior overseas, indicating robust enlargement and utilization past the American market.

In recent times, the corporate’s enterprise mannequin has modified. Whereas buying and selling nonetheless contributes considerably, subscription and providers income has grown quickly, making a extra steady revenue stream. With rising adoption of stablecoins and layer-2 networks, Coinbase is aligning itself with rising monetary infrastructure developments.

A Milestone for the Complete Crypto Trade

Coinbase’s inclusion isn’t nearly one firm—it’s in regards to the validation of a complete business. As the primary crypto-native agency to be acknowledged at this degree, the second holds weight just like what Tesla’s S&P 500 inclusion meant for electrical automobiles.

Michael Saylor, Government Chairman of MicroStrategy (NASDAQ: MSTR), congratulated Coinbase on X, calling the milestone a “main second for Coinbase and for Bitcoin.”

This recognition additionally follows a number of different main crypto milestones:

Approval of spot Bitcoin ETFs in early 2024USDC and Bitcoin reaching all-time highsA shift in U.S. federal coverage in favor of crypto innovation

All indicators level towards a broader institutional pivot. Coinbase’s itemizing now brings crypto one step nearer to full integration into the standard monetary system.

Crypto’s Subsequent Frontier: From Speculative to Systemic

Getting right here was not straightforward. For greater than ten years, crypto companies have battled public doubt, volatility, and regulatory ambiguity. Although dealing with regulatory points and market declines, Coinbase has managed to barter these difficulties and stay worthwhile.

Its rise to the S&P 500 displays a change from outsider to systematic participant. It’s an indication that crypto companies at the moment are a part of the financial infrastructure relatively than specialised tech enterprises.

This addition may additionally hasten the development of typical corporations together with blockchain into their operations or including cryptocurrency to their stability sheets. The change from “crypto as hype” to “crypto as core finance” is not speculative; it’s in movement.

Coinbase’s ascent into the S&P 500 is just not solely one other company information. One which opens the doorways for extra institutional involvement and future listings of different crypto-native corporations, it’s a turning level in crypto’s path towards mainstream consciousness. The subsequent chapter of digital finance is not forward—it’s already unfolding.

_id_76a436ed-c215-4675-98cf-9f73b721f795_size900.jpg)