Bitcoin has lastly damaged above the $96,000 mark, signaling a possible shift in market construction after weeks of consolidation and promoting stress. This breakout offers bulls the higher hand as momentum builds throughout the board, with renewed optimism that BTC may reclaim the $100K milestone within the close to time period. The market’s tone has shifted, and the breakout above $96K may mark the start of a brand new bullish section.

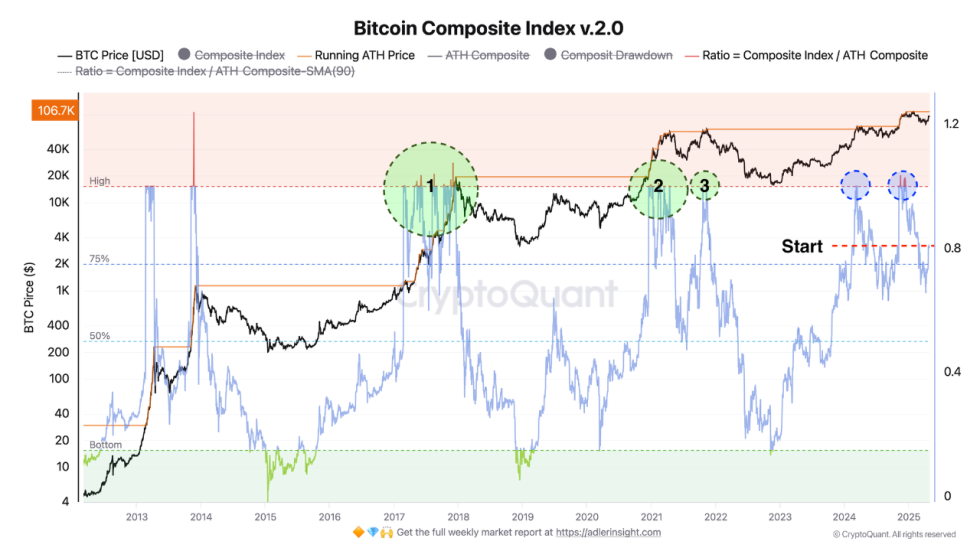

High crypto analyst Axel Adler shared a key on-chain metric suggesting that Bitcoin is coming into the early phases of a brand new rally. Based on Adler, the on-chain momentum ratio now sits round 0.8 (or 80%). Traditionally, this zone has preceded robust upward developments in earlier cycles.

Whereas international macroeconomic circumstances and geopolitical tensions proceed to solid uncertainty over monetary markets, Bitcoin’s on-chain power hints at a rising urge for food for danger amongst buyers. If bulls can maintain this breakout and push towards $100K, it will affirm a broader market shift and probably result in a robust Q2 rally throughout the crypto sector.

Bitcoin Eyes Bullish Continuation As Momentum Builds

Bitcoin is regaining power after months of promoting stress, with bulls now making an attempt to reclaim management. Because the breakout above the $90K degree, momentum has progressively shifted, and Axel Adler suggests the market is coming into what he calls the “begin” rally zone. That is primarily based on the on-chain Ratio indicator, which at the moment sits round 0.8—or 80%—a traditionally important degree that usually precedes main market strikes.

If this ratio breaks above 1.0 and holds, it will seemingly affirm a robust bullish impulse. On this optimistic state of affairs, key metrics like NUPL (Web Unrealized Revenue/Loss) and MVRV (Market Worth to Realized Worth) would sign an enlargement section, probably pushing Bitcoin to revisit its cycle sample seen in 2017 and 2021. A rally towards $150K to $175K wouldn’t be out of the query in such a case.

Nevertheless, if the ratio stays between 0.8 and 1.0, the market could enter a consolidation section. On this base-case state of affairs, Bitcoin would seemingly commerce between $90K and $110K, with individuals holding positions however not including important publicity. This range-bound habits would counsel warning stays, regardless of a constructive longer-term outlook.

A extra cautious outlook emerges if the ratio drops towards 0.75 or decrease. This could seemingly set off profit-taking from short-term holders, placing stress available on the market and probably driving Bitcoin right down to the $70K–$85K vary. Given {that a} correction has already taken place, Adler believes the primary two situations are at the moment extra possible. Nonetheless, macroeconomic dangers—equivalent to recession fears or geopolitical shocks—may tip the dimensions.

Total, Bitcoin seems to be warming up for a decisive transfer, and the following few weeks could affirm whether or not that is the start of a breakout or a continuation of broader consolidation.

Bitcoin Value Evaluation: Bulls Problem Key Resistance at $96K

Bitcoin is buying and selling at $96,130, persevering with its short-term uptrend after a pointy rally from the $81K degree in mid-April. The each day chart exhibits robust momentum, with BTC now consolidating slightly below the $96K resistance zone—a degree that beforehand acted as help in February and March earlier than the breakdown. A profitable breakout above this zone would open the door for a take a look at of the psychological $100K degree, adopted by the following main resistance at $103,600.

Notably, each the 200-day SMA ($89,843) and 200-day EMA ($85,926) have been cleanly reclaimed throughout this current transfer, signaling a transparent shift in pattern construction. Quantity has remained regular in the course of the rally, although a noticeable enhance in shopping for stress would assist affirm continuation.

The present construction resembles a bullish continuation sample, however BTC should break and shut above the $96K mark with conviction to substantiate upside momentum. Failure to take action could lead to a pullback to retest help zones round $92K and $89K.

Total, the pattern stays bullish within the quick time period, however warning is warranted because the $96K–$100K vary represents a vital provide zone the place many sellers could step in. A decisive transfer within the coming days may form Bitcoin’s path for Could.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

_id_39dd7283-c060-4267-adcd-c2c5fadbb5b1_size900.jpg)