Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

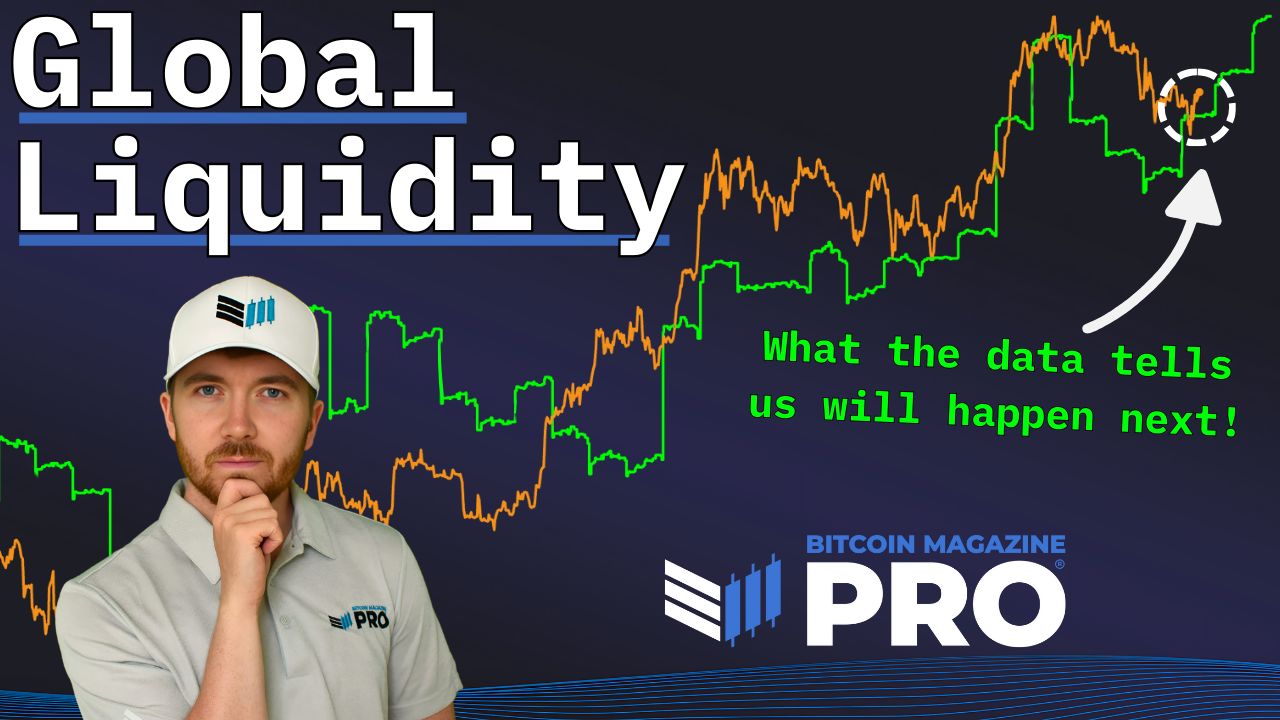

The Bitcoin value seems to be transferring in lockstep with a bullish prediction made by a crypto analyst earlier this month. In line with the analyst’s forecast, Bitcoin is about to get away to a brand new all-time excessive above $120,000 following the announcement of a brief tariff pause by United States (US) President Donald Trump.

$120,000 Bitcoin Value Forecast In Movement

Kaduna, a crypto analyst on X (previously Twitter), has launched a follow-up evaluation on his earlier bullish prediction of Bitcoin, highlighting that it’s enjoying out as anticipated. On April 11, the analyst predicted that Bitcoin was getting ready for a large push above $120,000.

Associated Studying

He outlined a thesis that the 90-day suspension of President Trump’s Tariffs would act as a robust macroeconomic catalyst for Bitcoin. Kaduna argued that the market might begin “frontrunning” a couple of month early, culminating in a mini bull market throughout a 55-day “exit window” between April 3 and June 3 2025.

Accompanying this bullish evaluation was an in depth chart evaluating Bitcoin’s value actions via candlesticks with a blue overlay, believed to characterize a macroeconomic indicator equivalent to international M2. The blue line within the chart tasks a gradual climb throughout this window, providing a transparent visible goal above $120,000. Kaduna had acknowledged that if his prediction performed out, he would exit most positions by the top of the window.

Simply days after his bullish forecast, Bitcoin has begun mirroring the projected path. Kaduna revealed in a follow-up candlestick chart that Bitcoin is breaking above the native resistance at $84,000 with sturdy quantity assist, aligning with the anticipated overlay. This early energy means that the frontrunning behaviour the crypto skilled projected earlier is now enjoying out in actual time.

The blue line suggests a possible transfer towards the $120,000 – $125,000 vary over the following month and a half, setting a transparent upside goal if momentum continues. Bitcoin’s value motion can be unfolding proper on cue throughout the 55-day window, validating the analyst’s bullish thesis.

Each the overlay and Bitcoin’s costs are trending upwards, signaling that the market is certainly reacting to the macroeconomic tariff catalyst. If this trajectory holds, it could mark a big validation of the analyst’s macro-technical evaluation strategy.

Replace On The Bitcoin Value Motion

Following its crash beneath $80,000, the Bitcoin value appears to be on a path to restoration. CoinMarketCap’s knowledge reveals that Bitcoin is presently buying and selling at $83,395, marking a big 7.16% improve over the previous week.

Associated Studying

The cryptocurrency had damaged the resistance degree at $84,000 earlier this week. Nonetheless, it retraced bought positive aspects and is now buying and selling at its current market worth. Given its fluctuating value and unstable market, crypto analysts like Tony Severino have revealed that he’s neither bullish nor bearish on Bitcoin. As a substitute, he appears to be taking a wait-and-see strategy, intently monitoring how the market responds to ongoing volatility pushed by the US Commerce struggle and tariff implementation.

Featured picture from Adobe Inventory, chart from Tradingview.com