Knowledge exhibits the Bitcoin Worry & Greed Index has registered a pointy bounce following the restoration within the asset’s value above $81,000.

Bitcoin Worry & Greed Index Is Now Pointing At ‘Worry’

The “Worry & Greed Index” is an indicator made by Different that tells us concerning the common sentiment current among the many traders within the Bitcoin and wider cryptocurrency markets.

The index makes use of a numeric scale working from zero to hundred for representing the investor mentality. All values above 53 correspond to a sentiment of greed, whereas these under 47 that to worry. Values mendacity between these two cutoffs recommend a web impartial sentiment.

Now, here’s what the present market sentiment is like, in response to the Worry & Greed Index:

The worth of the metric seems to be 39 in the meanwhile | Supply: Different

As displayed above, the Bitcoin Worry & Greed Index has a worth of 39 proper now, which implies the common dealer within the house holds a sentiment of worry. The fearful mentality isn’t too robust, nevertheless, because the indicator’s solely 8 models away from the impartial zone.

Yesterday was completely different, although, because the metric held a worth of 18. This degree of FUD was so robust that it was inside a particular area often known as excessive worry (25 and beneath). This low for the indicator got here as Bitcoin and others crashed amid uncertainty across the tariffs.

With US President Donald Trump placing a 90-day pause on the tariffs for many nations, costs have seen some restoration, which has naturally allowed for an uplift out there temper.

The pattern within the Worry & Greed Index over the previous twelve months | Supply: Different

Whereas the Worry & Greed Index has bounced again for now, it’s unknown how lengthy the restoration would stay. From the above chart, it’s seen that the metric has been up and down loads currently, implying the traders have been fickle.

Traditionally, Bitcoin and the altcoin market have tended to maneuver within the path that the group least expects. As such, excessive worry, the place FUD has been the strongest, has usually paved the best way for market bottoms. BTC was simply inside the intense worry territory so it’s potential that it could have shaped a backside. If that’s the case, then the most recent restoration might be one to final.

It must be famous, nevertheless, that in late February, the index hit a notably decrease worth of 10 and whereas it did coincide with a low, it was clearly not the principle backside. Thus, it solely stays to be seen how issues would play out this time.

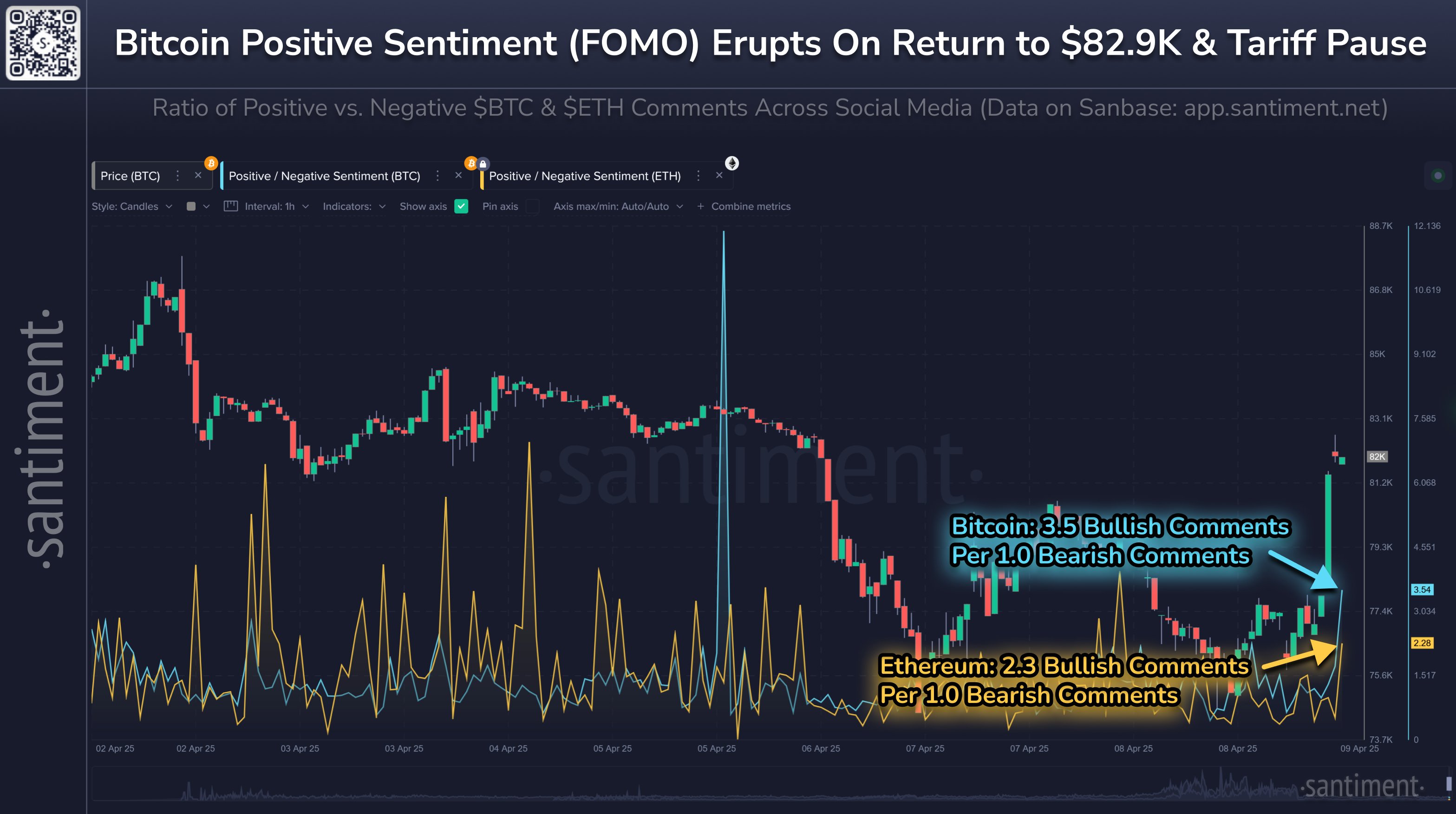

The Worry & Greed Index bases its worth off of many elements, one in all which is the sentiment on social media. In a put up on X, the analytics agency Santiment has talked about how this aspect of the market sentiment has modified following the tariff pause information for Bitcoin and Ethereum, the 2 largest digital belongings.

The information of the ratio between the optimistic and unfavourable sentiments on social media | Supply: Santiment on X

It will seem that bullish sentiment erupted on the social media platforms following the information, with 3.5 and a couple of.3 optimistic feedback coming for each unfavourable put up associated to Bitcoin and Ethereum, respectively.

BTC Value

On the time of writing, Bitcoin is buying and selling round $81,500, up nearly 6% up to now day.

Seems to be like the value of the coin has seen restoration within the final 24 hours | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Santiment.web, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.