The cryptocurrency trade has at all times been closely centered on crypto group constructing. From Bitcoin’s early days of grassroots adoption to the rise of meme cash and decentralized autonomous organizations (DAOs), “group” has been a driving drive behind many initiatives.

Nevertheless, this intense give attention to group generally comes on the expense of precise product improvement, resulting in a cycle of hype-driven investments quite than sustainable innovation.

On this article, we’ll discover why group engagement stays central to crypto, the dangers of overhyping initiatives with out actual substance, and whether or not Web3 can strike a stability between community-driven crypto development and tangible execution.

How Essential is “Neighborhood” in Crypto?

Not like conventional companies that depend on centralized decision-making, Web3 advertising and marketing thrives on community-driven governance. Crypto initiatives rely on collective participation quite than a single authority, which fosters belief and aligns with blockchain’s decentralization ethos.

For instance, Bitcoin’s protocol modifications, reminiscent of SegWit and Taproot, had been decided by means of group consensus, showcasing how decentralized governance enhances belief.

RELATED: What’s a Bitcoin Enchancment Proposal (BIP)? And How Does It Work?

Equally, Ethereum’s governance mannequin features a various set of stakeholders—builders, miners, and token holders—all contributing to its evolution.

Community Results and Adoption

A powerful group drives adoption, which is essential for the success of any cryptocurrency or blockchain challenge. The extra engaged a group is, the higher the community impact, resulting in elevated utilization and liquidity of the token.

Bitcoin and Ethereum are prime examples of how group involvement fuels long-term development. Bitcoin’s rise from an obscure cryptographic experiment to a globally acknowledged asset is essentially on account of its passionate early adopters. These people educated others, ran full nodes, and helped bootstrap a complete trade round Bitcoin.

Ethereum’s developer group has performed a key function within the community’s upgrades, together with the transition to Ethereum 2.0 and the implementation of good contract functionalities. The Ethereum Basis’s grants program, hackathons like ETHGlobal, and the continual growth of Layer 2 scaling options (reminiscent of Arbitrum and Optimism) spotlight how group engagement accelerates improvement.

Moreover, DeFi protocols reminiscent of Uniswap and Aave have thrived on account of sturdy group backing. Uniswap, for instance, went from an experimental challenge to one of many largest decentralized exchanges (DEXs) due to energetic consumer participation, liquidity suppliers, and governance token holders who repeatedly contribute to protocol enhancements.

Advertising and Natural Progress

Conventional companies make investments closely in paid advertising and marketing, however Web3 advertising and marketing depend on group advocacy. Social media platforms like Twitter, Discord, and Telegram act as main hubs for discussions, making word-of-mouth advertising and marketing extremely efficient.

As an example, the 2021 Dogecoin surge was largely pushed by Reddit and Twitter communities, with influencers like Elon Musk amplifying the motion. Regardless of having no inherent technological innovation, Dogecoin’s market capitalization skyrocketed previous $80 billion at its peak because of the sheer energy of group engagement.

Equally, initiatives like Shiba Inu (SHIB), which began as a joke, managed to construct a devoted fanbase that drove its widespread adoption. The introduction of ShibaSwap and an ecosystem growth plan solely grew to become viable due to the enthusiastic group that stored the challenge related.

Meme cash are usually not the one beneficiaries of community-driven advertising and marketing. Solana’s ecosystem development may also be attributed to its vibrant developer and consumer group. Solana’s low charges and high-speed transactions attracted NFT initiatives, gaming purposes, and DeFi protocols, all supported by an energetic on-line presence.

Moreover, influencer advertising and marketing and group engagement applications (reminiscent of token airdrops, staking rewards, and ambassador applications) create pleasure and encourage natural participation.

The Draw back of Hype: When Neighborhood Enthusiasm Overshadows Actual Growth

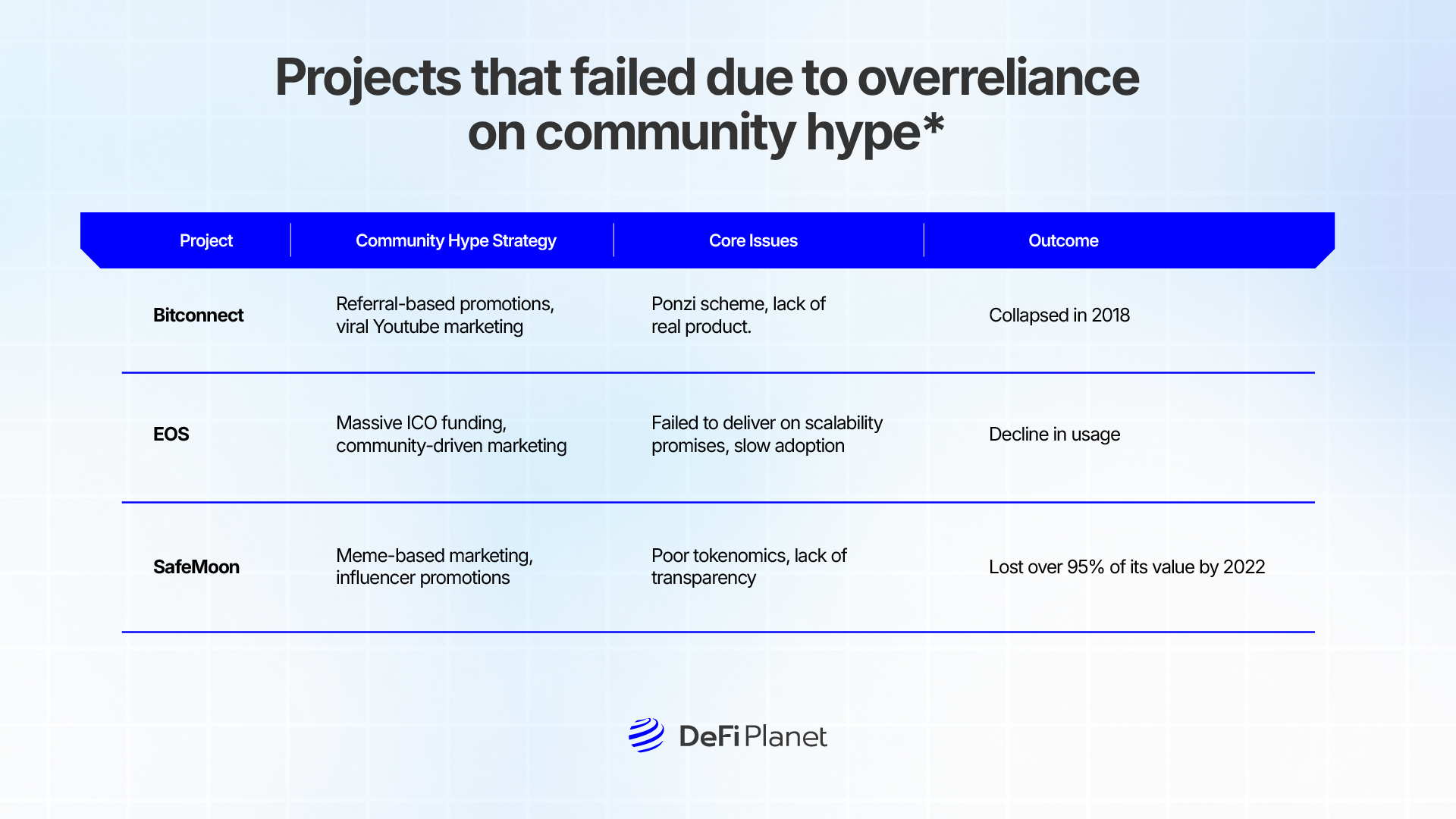

Whereas group engagement is essential to the success of crypto initiatives, extreme hype can typically be detrimental. Many initiatives capitalize on viral advertising and marketing methods and enthusiastic supporters to drive their token costs up, solely to fail in delivering any significant product. The initiatives’ groups prioritize sustaining a robust and engaged group over precise product improvement. This phenomenon ends in initiatives that stay perpetually caught within the “roadmap” part with out launching practical merchandise.

A main instance of that is SafeMoon, a token that gained large recognition in 2021 on account of its aggressive advertising and marketing campaigns and social media presence. Nevertheless, as its group expanded, critics raised severe considerations. Investigative YouTuber “Coffeezilla” accused the SafeMoon crew of misappropriating funds, and a class-action lawsuit alleged that the challenge used influencers and celebrities to advertise the token with deceptive info. By mid-2022, SafeMoon’s value had plummeted by over 95% from its all-time excessive, illustrating the dangers of prioritizing hype over actual technological innovation.

Whereas sturdy communities play a key function in a challenge’s success, historical past has proven that hype alone shouldn’t be sufficient to maintain long-term viability. And not using a stable basis of expertise, utility, and steady improvement, many overhyped initiatives ultimately collapse underneath their very own weight. For the crypto trade to mature, there should be a shift in the direction of balancing group engagement with real-world product execution.

Can Web3 Steadiness Neighborhood-Pushed Progress with Product Execution?

Whereas an engaged consumer base is important for adoption, real-world utility and technological innovation are vital for long-term sustainability.

Web3 goals to create a decentralized web the place customers have extra management over information and governance. Nevertheless, placing a stability between group engagement and tangible product improvement stays a major problem. One of many key elements in attaining this stability is having a long-term roadmap that aligns group enthusiasm with actual product milestones.

Profitable Web3 initiatives acknowledge the significance of structured improvement quite than short-term hype. An excellent instance of that is Ethereum’s transition to Proof-of-Stake (PoS).

This shift, which took years of analysis and implementation, was not pushed by mere hypothesis however by a transparent technical imaginative and prescient. Ethereum’s group performed a major function in supporting this transition, nevertheless it was the builders’ persistence and structured execution that made it a actuality.

One other essential side is incentivizing builders quite than simply promoters. Many crypto initiatives allocate vital sources to influencer advertising and marketing and community-building efforts, typically on the expense of precise product improvement. Nevertheless, initiatives that prioritize funding builders have a tendency to attain higher long-term success. Optimism, a Layer 2 scaling answer for Ethereum, launched grants particularly for builders contributing to the ecosystem. This initiative ensured that actual innovation passed off by rewarding those that actively improved the community quite than these merely hyping it on-line.

Moreover, regulatory strain is more and more shaping the crypto panorama. With higher scrutiny from governments and monetary authorities, initiatives should give attention to compliance and product utility quite than relying solely on speculative market dynamics. The SEC’s lawsuits in opposition to Ripple serve as reminders that token-driven advertising and marketing with out clear authorized frameworks can result in extreme penalties. Crypto initiatives that want to survive regulatory scrutiny should prioritize real-world purposes and be certain that their monetary fashions are sustainable.

In the end, for Web3 to thrive, initiatives should discover a approach to stability their community-driven ethos with sturdy technical execution. Whereas engagement is a robust software, it ought to complement—not overshadow—the precise improvement of blockchain-based options. This shift will assist be certain that the following wave of crypto initiatives is constructed on innovation and value, quite than hypothesis alone.

The Function of DAOs in Shaping Venture Path

Decentralized Autonomous Organizations (DAOs) have emerged as a robust mechanism for aligning group pursuits with challenge improvement. Not like conventional company buildings, DAOs function by means of decentralized governance, the place token holders have a direct say in key selections. This mannequin reduces the danger of centralized mismanagement and rug pulls, as seen with MakerDAO, which efficiently governs the DAI stablecoin by means of community-driven proposals and voting.

Nevertheless, whereas DAOs empower customers, they don’t seem to be with out challenges. One main concern is low voter turnout, which might result in decision-making being concentrated within the arms of a small, energetic minority quite than reflecting the broader group’s pursuits. Moreover, DAOs are susceptible to governance assaults. A notable instance is the 2022 Beanstalk hack, the place an attacker exploited the governance system to siphon $182 million, highlighting the safety dangers inherent in decentralized decision-making.

Regardless of these challenges, DAOs have the potential to drive significant improvement when carried out successfully. Tasks like Uniswap and Aave have efficiently leveraged DAOs to fund ecosystem initiatives whereas sustaining decentralization. If rigorously structured, DAOs can strike a stability between group engagement and product execution, guaranteeing that Web3 initiatives prioritize each innovation and long-term sustainability.

Last Ideas: Discovering the Candy Spot Between Hype and Substance

Neighborhood is crypto’s best power—but additionally its greatest weak point when taken too far. A passionate, engaged consumer base fuels adoption, innovation, and development. However when hype overshadows actual improvement, it creates speculative cycles that always result in crypto initiatives failing.

For the trade to mature, there must be a shift towards balancing Web3 advertising and marketing with precise execution. Builders ought to prioritize constructing earlier than advertising and marketing, buyers ought to demand substance over hype, and communities ought to maintain initiatives accountable for his or her guarantees.

The way forward for Web3 relies upon not simply on engagement however on actual innovation. Will the trade rise to the problem?

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. All the time conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”

The submit Why Are Crypto Tasks Nonetheless Obsessive about “Neighborhood” As an alternative of Product? appeared first on DeFi Planet.