With 37 totally different manufacturers and 4 divisions, Loreal ($OR.PA) has been on my radar since I began investing. However it has by no means been at a reduction. As we speak, buying and selling at 30x PE, it’s a kind of high-performing corporations that hardly ever disappoint. Is it price investing now, or ought to we look ahead to a greater alternative?

Supply: L’Oréal F2024 Annual Report.

Key Highlights

A Magnificence Big at 30x PE – L’Oréal has dominated for over a century, however is it nonetheless a purchase at this valuation?

AI-Pushed Edge – With 694 patents in 2024, tech innovation fuels development. Will it maintain premium pricing?

Progress vs. Stagnation – Growth slows, inflation bites. Is L’Oréal nearing its limits?

Enterprise overview

In 1909, a scientist in Paris developed one thing by no means seen earlier than: a safe-to-use hair dye, marking the start of L’oréal with Eugène Schueller. The enduring “As a result of I’m worthy” was the primary commercial of the model in 1970, however it’s nonetheless related right this moment.

The wonder business has proven resilience even within the worst disaster worldwide, and may discover the explanations behind this by in search of the “lipstick impact,” an actual financial principle explaining why customers proceed spending on inexpensive luxuries.

Supply: L’Oréal.com.

Supply: L’Oréal.com.

Magnificence markets are rising in the direction of the course of not solely feminine, however a extra inclusive sector, the place males, the aged, and even children are utilizing magnificence merchandise, which will increase the business’s attain.

L’Oréal has been one of many corporations that higher perceive the worth of AI of their processes, as they stated:

“We’ve got optimized the work of our workers, giving them extra time for increased value-added duties, reminiscent of creating methods by way of knowledge evaluation, threat administration, and anticipation.” – L’Oreal investor presentation.

Their CEO, Nicolas Hieronimus, is the instance of management we search for in firm administration, working within the firm since 1987, began as a product supervisor and climbed as much as turn into the CEO in 2021. We would like within the administration of our companies dedication, beliefs in the way forward for the corporate, and particularly deep data in how your organization works, processes, and generates revenues.

34.7% of the shares of the corporate are owned by the Betancourt household, and they’re a part of the board of administrators the board, making certain their robust private dedication to the corporate’s long-term imaginative and prescient.

Monetary evaluation

Once we discuss monetary well being, L’Oréal have to be one of many corporations with higher historic efficiency I’ve seen. Common income development of 6,99%, with an impressive historic capital effectivity with a Return on Capital Employed from 17% to 25%.

The worldwide magnificence market worth is about 290$ Bn, rising 4,5% yearly. By 2030, estimations are that 60% of the inhabitants will eat magnificence merchandise, which might imply 750 million extra individuals shopping for magnificence merchandise.

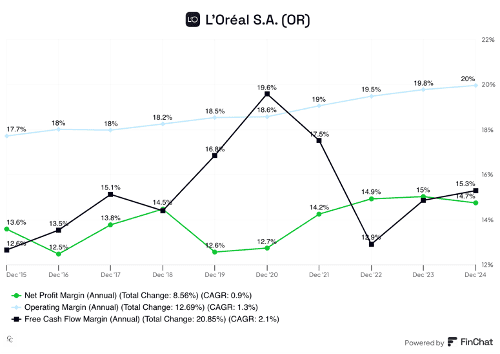

Supply: Finchat.

Nonetheless, as a holding firm with a number of manufacturers underneath its umbrella, L’Oréal’s complexity makes it tough to evaluate the detailed efficiency of every enterprise phase. This construction can generally obscure underlying points, and I stay cautious about assuming steady, uninterrupted development in income, margins, and web revenue.

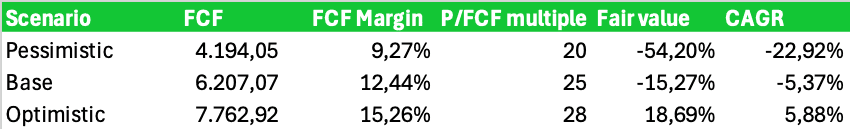

Pessimistic Situation: We thought-about a 20x P/FCF a number of with doable stagnation in gross sales, factoring within the dangers of a significant disaster within the coming years that would affect anticipated development. This ends in a -22.92% lower within the funding worth.

Base Situation: We raised the a number of to 25x, accounting for some development. Nonetheless, at present costs, we might nonetheless see a -5.37% lower in funding worth.

Optimistic Situation: Solely on this case would we notice positive factors, assuming a 28x a number of and the expansion L’Oréal expects over the following three years. 28x is the a number of I assign to high-gain companies with aggressive benefits and powerful development expectations.

As a result of we solely make investments if we gained’t lose cash underneath any situation, L’Oréal doesn’t appear to be a pretty funding at these costs. Our purpose retains being the identical: “Don’t lose cash.”

Comparative

Supply: Finchat.

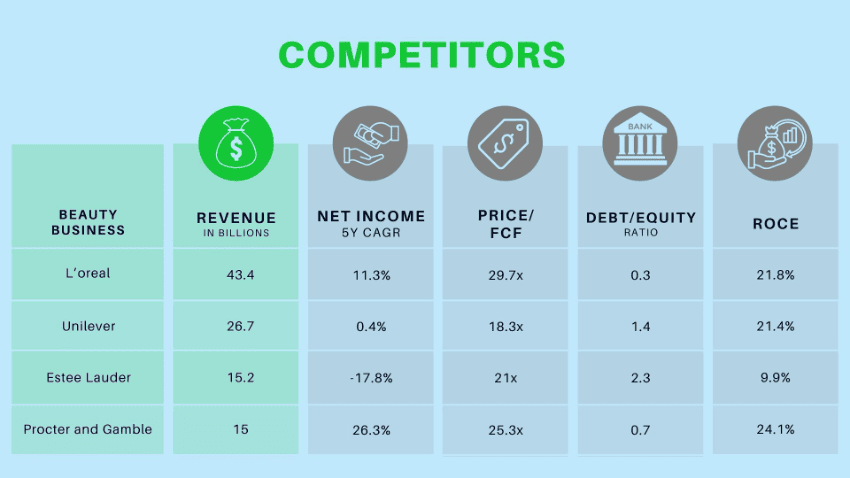

Amongst all magnificence corporations, L’Oréal is the biggest when it comes to market share. In comparison with Unilever and P&G, its income is solely derived from the sweetness phase.

One key aggressive benefit is L’Oréal’s resilience in Asia. Whereas the corporate reported a 3.2% decline in This autumn gross sales, Estée Lauder skilled a a lot sharper 11% decline in the identical interval.

L’Oréal continues to guide in innovation, submitting 694 patents in 2024 and investing €1.3 billion (3% of gross sales) in analysis and innovation.

Their AI-powered digital magnificence assistant, Magnificence Genius, has offered customized diagnostics and proposals to over 100,000 customers in 2024.

BETiq improves advertising effectivity and return on funding. Presently carried out in 6 international locations, it’s anticipated to develop to eight by 2025.

CreAItech makes use of AI-powered creativity to boost content material creation.

L’Oréal pays a 2.05% dividend, with a 6% improve in 2024, marking the best dividend development in 10 years. The corporate additionally accomplished €0.5 billion in share buybacks.

Dangers

Stagnation Danger – As L’Oréal reaches international saturation, future development could turn into tougher. Growth into Africa and Asia would require increased investments and elevated operational prices.

Asian Competitors – The wonder market in Asia is extremely aggressive, making it tough for L’Oréal to seize further market share.

Inflation & Forex Dangers – Presence in high-inflation international locations like Argentina and Turkey poses dangers, although some prices are offset by the latest energy of the Euro.

Political Dangers – Trump’s potential tariffs on imports might cut back L’Oréal’s margins within the essential U.S. market.

Retailer Dangers – Gross sales in pharmacies and drugstores have slowed on account of declining foot visitors, affecting total efficiency.

Growth Dangers – Transferring into dietary supplements requires important CAPEX funding, and a scarcity of expertise on this phase poses execution dangers

Conclusion

I don’t suppose we’ll ever see L’Oréal at considerably decrease valuations. Nonetheless, on account of its measurement, it should ultimately attain a degree the place its unbelievable sustainable development will decelerate. We will justify paying a premium for high-quality companies, however a valuation of 25-28x PE appears applicable.

Progress expectations for 2025 are 4-4.5%, indicating stabilization relatively than overperformance. At present valuations, I’m not shopping for, however I’ll monitor for a value drop. Nonetheless, for dividend-focused traders searching for a dependable blue-chip inventory, L’Oréal stays a pretty alternative.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.

_id_dd2064b4-93ca-49ac-8256-791f944b745f_size900.jpg)