The worth motion of Solana was fairly underwhelming over the previous week, mirroring the worsening local weather of the altcoin market. Apparently, the launch of the SOL futures exchange-traded funds (ETFs) in the course of the week did little or no to jolt the altcoin’s value again to life.

Following the extreme value downturn that hit the market, together with the Solana token, traders had been left questioning when it was greatest to “purchase the dip.” The most recent on-chain statement means that it’d lastly be time for traders to get again into the SOL market.

SOL Lengthy-Time period Buyers Fearful – A Purchase Sign?

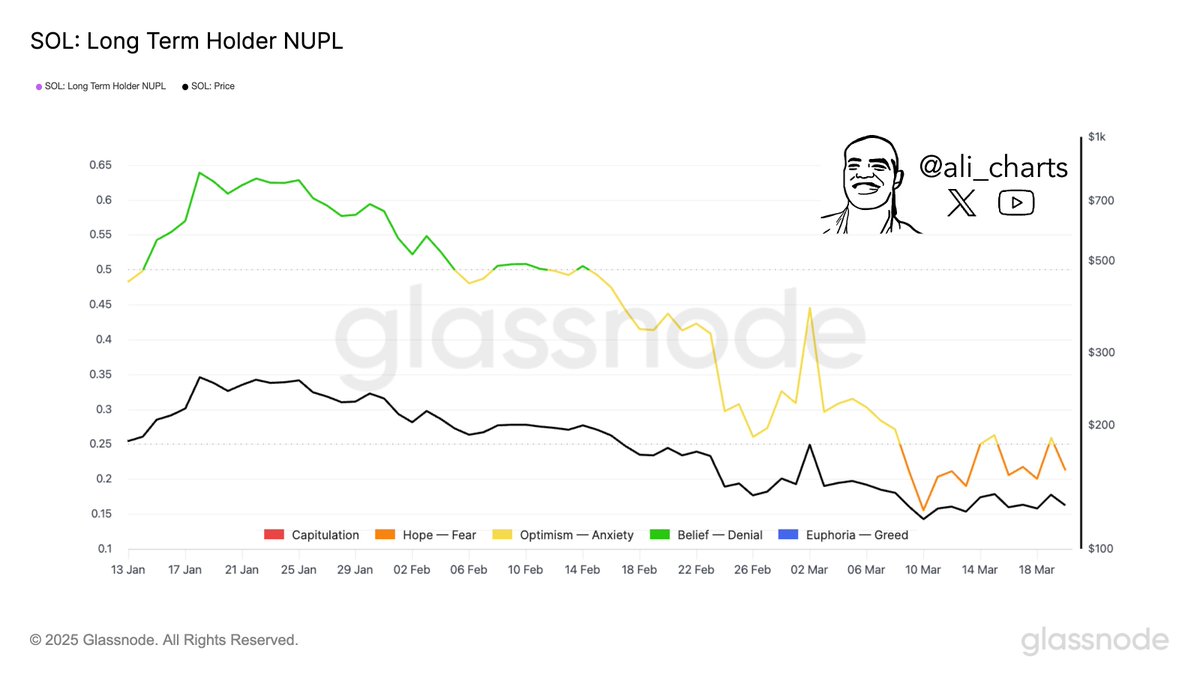

In a March 21 put up on the X platform, outstanding crypto analyst Ali Martinez stated long-term SOL holders at the moment are in worry. The related on-chain indicator right here is the “Lengthy-Time period Holder Internet Unrealized Revenue/Loss (NUPL)” metric, which measures the distinction between market cap and realized cap divided by market cap.

This NUPL indicator supplies perception into the ratio of long-term traders in revenue at each given time. When this metric’s worth is over zero, it signifies that extra traders are in revenue; whereas a less-than-zero worth for the NUPL indicator implies that extra traders are within the crimson than these in revenue.

Though an upward pattern for the metric means that extra cash are starting to enter revenue, it additionally implies that extra traders are inclined to take revenue — resulting in elevated bearish strain. However, a falling NUPL worth signifies traders’ decreased willingness to understand loss, leading to decreased promoting strain.

Supply: @ali_charts on X

As proven within the chart above, long-term Solana traders at the moment are in worry, because the NUPL metric slipped beneath the 0.25 mark. Based on earlier logic, this class of SOL holders is much less more likely to promote their belongings and notice their losses, signaling much less bearish strain for the altcoin.

Furthermore, Martinez famous that “sensible cash” traders have at all times proven a willingness to enter the market during times like this. “Be grasping when others are fearful,” the analyst stated in regards to the technique.

Traditionally, the crypto market tends to maneuver within the crowd’s wrong way. Therefore, it is likely to be time to “purchase the dip,” particularly with the long-term traders at present skeptical in regards to the promise of the Solana token.

Solana Worth At A Look

As of this writing, the worth of SOL sits simply beneath the $130 degree, reflecting a 0.4% decline up to now 24 hours. Based on CoinGecko information, the altcoin’s worth has dropped by virtually 5% up to now week.

The worth of SOL on the day by day timeframe | Supply: SOLUSDT chart on TradingView

Featured picture from Aivaras Sakurovas | Dreamstime.com, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.