Bitcoin (BTC) continues to face sturdy resistance under the $85K mark, with volatility and worry dominating market sentiment. After shedding the crucial $90K stage, BTC skilled a pointy decline, briefly dropping under the $80K mark final week. Bulls have since tried to stabilize the value, however promoting stress stays excessive, stopping any sustained restoration.

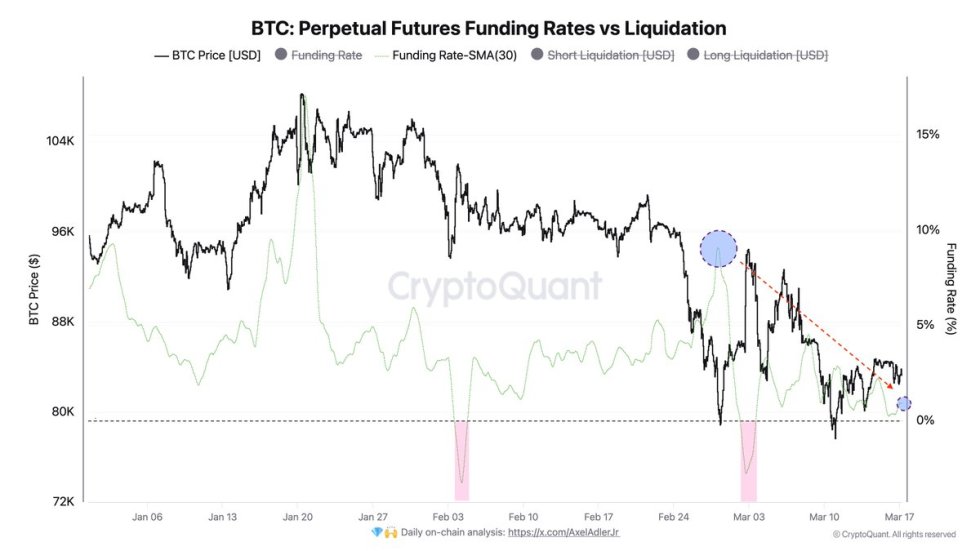

CryptoQuant knowledge reveals that the common Funding Fee SMA (30) has decreased by 9% for the reason that starting of March. This pattern signifies that destructive sentiment continues to dominate as merchants more and more guess on additional draw back. A declining funding price means that brief positions are gaining traction, confirming the bearish hypothesis that has pushed the marketplace for weeks.

With BTC failing to reclaim misplaced floor, macro uncertainty and investor warning proceed to weigh in the marketplace. For Bitcoin to reverse its downward pattern, bulls should regain management and push the value again above key resistance ranges. If the bearish pattern persists, BTC might face even decrease ranges, reinforcing issues in regards to the sustainability of the present cycle. The approaching days and weeks can be crucial in figuring out Bitcoin’s subsequent main transfer.

Bitcoin Faces Bearish Development As Market Struggles with Uncertainty

Bitcoin (BTC) is now buying and selling at its lowest ranges since late 2024, including to issues that this cycle might not ship the anticipated beneficial properties. Many buyers anticipated a fast and robust rally this 12 months, however as a substitute, BTC has confronted persistent promoting stress. Commerce struggle fears and macroeconomic uncertainty have closely impacted each the crypto and inventory markets, resulting in a chronic downturn throughout danger belongings.

For the reason that begin of the month, Bitcoin is down almost 20%, and there are not any clear indicators of a reversal but. The bearish pattern seems to be gaining momentum as BTC continues to wrestle under essential worth ranges. Regardless of this destructive sentiment, Bitcoin’s fundamentals stay sturdy, with ongoing institutional adoption and US President Trump’s plans for a strategic Bitcoin reserve offering potential catalysts for a restoration in the long run.

High analyst Axel Adler shared insights on X, revealing that the common Funding Fee SMA (30) has decreased by 9% since early March. In keeping with Adler, if this pattern continues all through the week, funding charges might flip destructive, signaling rising bearish sentiment and elevated brief positioning.

For Bitcoin to reverse this pattern, bulls should reclaim key worth ranges, push BTC again above $90K, and regain momentum. In any other case, continued destructive funding charges and weak market confidence might drive additional draw back within the coming weeks.

BTC Trades Beneath Key Shifting Averages As Bears Keep Management

Bitcoin (BTC) is at present buying and selling at $83,600, dealing with sturdy resistance at key shifting averages. BTC has struggled to reclaim the 200-day shifting common (MA) at $84,100 and the 200-day exponential shifting common (EMA) at $85,500, holding bulls on the defensive.

For BTC to regain bullish momentum, patrons should push the value above the $86,000 stage and reclaim the essential $90K mark. Breaking above these resistance ranges would verify a possible restoration section, shifting sentiment away from the bearish outlook that has dominated the market.

Nevertheless, if BTC fails to reclaim these ranges, the chance of additional draw back will increase. Dropping the $83K–$84K vary might lead to a breakdown under $80K, probably triggering one other wave of sell-offs. With macro uncertainty nonetheless weighing in the marketplace, bulls must regain management quickly to forestall additional losses. The subsequent few buying and selling classes can be crucial in figuring out Bitcoin’s short-term route.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.