The Nasdaq and S&P 500 are formally in correction territory. Properly, The Each day Breakdown seems to be for the shares which can be rallying.

Friday’s TLDR

Not all shares are down this 12 months

A more in-depth have a look at gold

The Backside Line + Each day Breakdown

We lately talked about how diversification might help shelter a portfolio from will increase in volatility. At the moment, 9 of the 11 S&P 500 sectors have been nonetheless optimistic on the 12 months, whereas gold was up about 10% and bonds have been optimistic on the 12 months.

In lots of instances, a diversified portfolio would nonetheless be down on the 12 months, however it could be higher than the ~10% pullback we’ve seen within the S&P 500.

Diversification is one software, relative energy is one other.

Seasoned buyers typically look towards relative energy to search out the shares which can be performing nicely relative to a selected benchmark. That benchmark might be vs. their sector — like how Apple or Amazon are performing vs. the tech sector — or in opposition to an index just like the S&P 500 and Nasdaq 100.

Discovering Relative Energy

The S&P 500 is down 10.1% from its report closing excessive, whereas the Nasdaq is down 13.3%. The indices are down 6.1% and eight.5% to date 12 months up to now, respectively.

Notably, 9 of the 11 S&P 500 sectors are nonetheless outperforming the indices on a year-to-date foundation. When excluding tech and shopper discretionary — which account for roughly 40% of the S&P 500 weighting — the worst-performing sector is industrials, down simply 2.3% this 12 months.

Let’s dig into particular person shares.

I combed by means of the S&P 100 — the 100 largest US firms by market cap — to search out shares which can be performing nicely relative to the S&P 500. Right here’s what we discovered:

68 shares are outperforming the S&P 500 on a year-to-date foundation.

Additional, two-thirds of them (46) are literally optimistic to date this 12 months.

30 shares are outperforming the S&P 500 and Nasdaq 100 in terms of the drawdown from their 52-week excessive.

Impressively, all however considered one of them are literally optimistic on the 12 months too (besides MasterCard, which is down a paltry 0.2%).

Of the 30 shares from the second bullet level, the ten finest performers to date this 12 months embody: Phillip Morris, Gilead Sciences, Amgen, AbbVie, Basic Electrical, 3M Co, T-Cell, Abbott Labs, Medtronic, and AT&T.

The subsequent seven — IBM, Johnson & Johnson, Coca-Cola, Deere, RTX Corp, Altria and AIG — are all up a minimum of 10% this 12 months.

The Backside Line

I understand I threw a whole lot of names on the market, however my level is fairly easy: Virtually half of the S&P 100 is definitely optimistic on the 12 months. That’s to not say this setting has been straightforward, as a lot of buyers’ favourite shares and sectors are beneath vital strain.

Discover how not one mega-cap tech inventory within the group above. That’s to not shun tech; it’s been an excellent long-term performer. Nevertheless it pays to look exterior of this group every so often to search out the shares which can be really performing the very best.

Wish to obtain these insights straight to your inbox?

Enroll right here

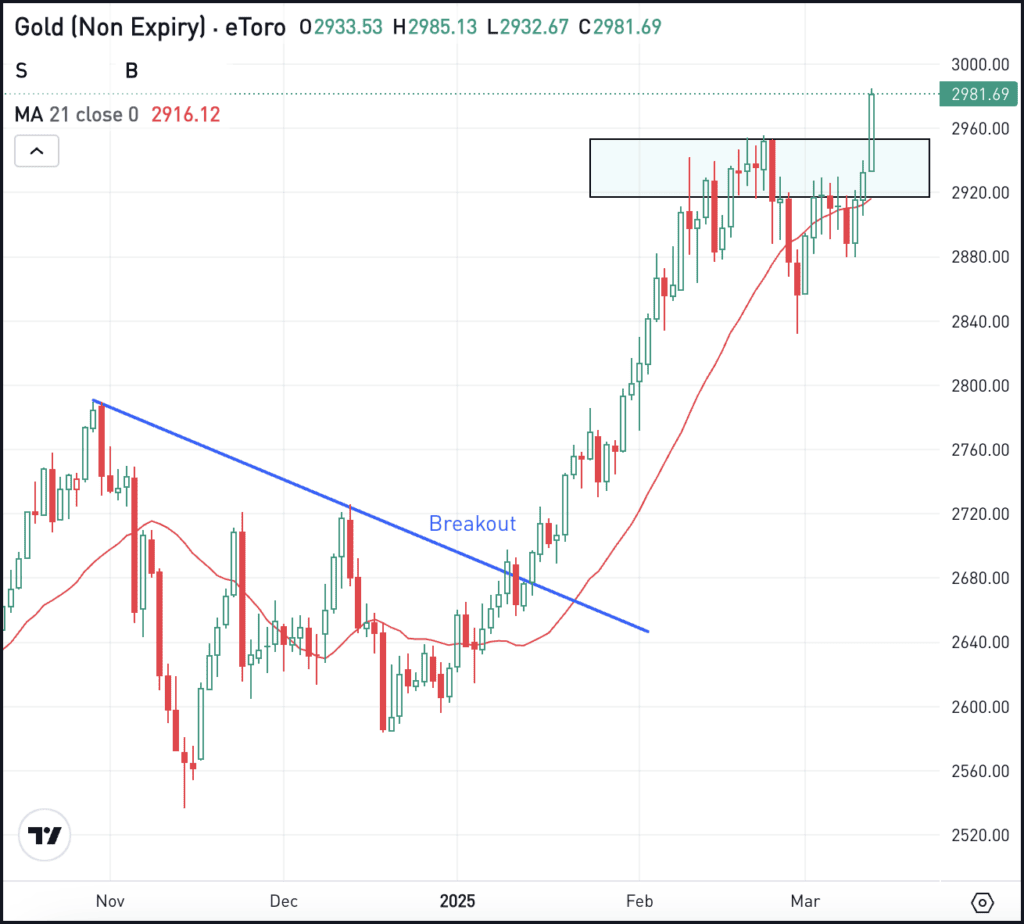

The setup — Gold

The gold ETF — GLD — continues to chug increased. Shares are up greater than 13% to date this 12 months and have rallied greater than 37% over the previous 12 months.

This simply outperforms the S&P 500, which is down greater than 6% to date this 12 months and is up simply 6.9% over the previous 12 months. Under is a have a look at bodily gold, which is nearing $3,000 an oz:

Ideally, bulls will wish to see gold costs keep above the $2,920 to $2,950 zone. On the GLD, that roughly interprets about $270 to $272.

If gold strikes beneath these ranges, it’s not essentially the tip of the world, nevertheless it’s the place the development would begin to lose its short-term momentum. Over the long run although, it’s exhausting to disclaim that this asset has executed fairly nicely.

Choices

For choices merchants, calls or name spreads might be one solution to commerce GLD on the lengthy aspect. In these situations, choices consumers restrict their danger to the worth paid for the calls or name spreads, whereas attempting to capitalize on a bounce within the inventory.

Conversely, buyers who anticipate draw back might speculate with places or put spreads.

To study extra about choices, think about visiting the eToro Academy.

Disclaimer:

Please notice that resulting from market volatility, among the costs might have already been reached and situations performed out.