Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin is just not the one one which has suffered. Buyers have gotten involved because the flagship cryptocurrency has adopted the latest decline within the S&P 500. But when previous efficiency is any indication, Bitcoin may be experiencing a resurgence.

Associated Studying

United States President Donald Trump assumed workplace in November for a second time period, however since then, the US inventory market has dropped by about 10%. For the reason that international recession hit the markets onerous in 2009, that is the worst begin to a US presidency. Though there are quite a few causes for this decline, uncertainty on financial technique and worries about inflation have contributed.

Previously, it has usually signaled impending volatility when the S&P 500 and Bitcoin decline concurrently. The bear market of 2022, which noticed extended losses, was the final time each markets fell precipitously on the similar time. Not all dips, although, result in protracted downturns. Some have led to a notable rebound, particularly for the reason that cryptocurrency’s halving cycles.

How is the market reacting to Trump’s second time period?

Since his return, the S&P 500 has fallen 9%, marking the worst begin to a presidency since 2009.

Again then, a recession drove the drop. This time, uncertainty is within the driver’s seat.

Let’s dive into the information 🧵👇 pic.twitter.com/A10F0qtweB

— CryptoQuant.com (@cryptoquant_com) March 12, 2025

Bitcoin And Shares Transferring Collectively—For Now

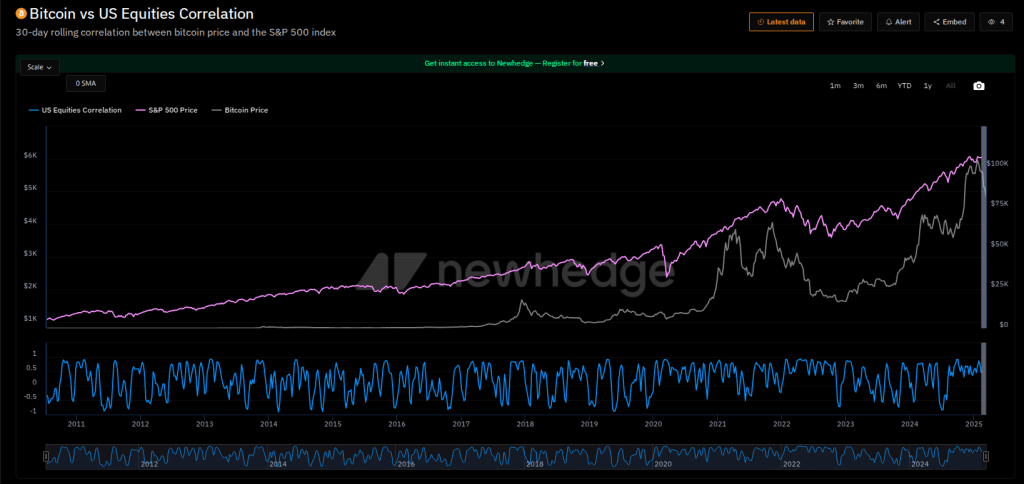

Bitcoin has lengthy been generally known as “digital gold,” however it’s now functioning extra like a tech inventory. Based on a CryptoQuant analysis, Bitcoin’s value has tracked conventional markets, notably the S&P 500. This sample is just not new. Throughout the COVID-19 pandemic in March 2020, the crypto and shares fell collectively earlier than recovering later that 12 months.

However IntoTheBlock analysts discovered that Bitcoin’s relationship to the S&P 500 has dropped to basically zero. This could counsel that, consistent with long-term holders’ sample, BTC is beginning to migrate exterior of standard finance.

Ought to this decoupling proceed, the motion within the value of Bitcoin may rely much less on modifications within the inventory market.

Historic Developments Recommend A Restoration

Based on CryptoQuant, prior information exhibits that Bitcoin has ceaselessly rebounded following robust corrections. For instance, in 2018, Bitcoin misplaced roughly 80% of its worth earlier than recovering in 2019. Equally, following the 2020 crash, Bitcoin reached recent all-time highs in 2021.

One other statistic to keep watch over is the Coinbase Premium Index, which measures the distinction in Bitcoin costs between Coinbase and Binance. When this indicator goes damaging after which returns to constructive territory, it has usually indicated an impending value rebound.

Associated Studying

Warning And Optimism Amongst Analysts

In the meantime, market analysts stay divided. Some warn that Bitcoin’s downturn might sign that the general inventory market rise is unsustainable. Tyler Richey, co-editor of Sevens Report Analysis, said that Bitcoin’s underperformance in comparison with its January peak might be a warning signal for equities.

Featured picture from Gemini Imagen, chart from TradingView

![[LIVE] Crypto News Today, October 24 – BNB Rallies After CZ Pardon, BTC Price Reclaims $110K and Everyone Is Waiting for CPI Data: Is Uptober Finally Here?! Best Crypto to Buy](https://coinsleague.com/wp-content/themes/jnews/assets/img/jeg-empty.png)