The Each day Breakdown takes a take a look at US shares forward of the month-to-month CPI report, which could possibly be a market-moving occasion this week.

Thursday’s TLDR

Inflation report due up at present

JPM seems to be for technical help

Delta’s disappointing information

What’s taking place?

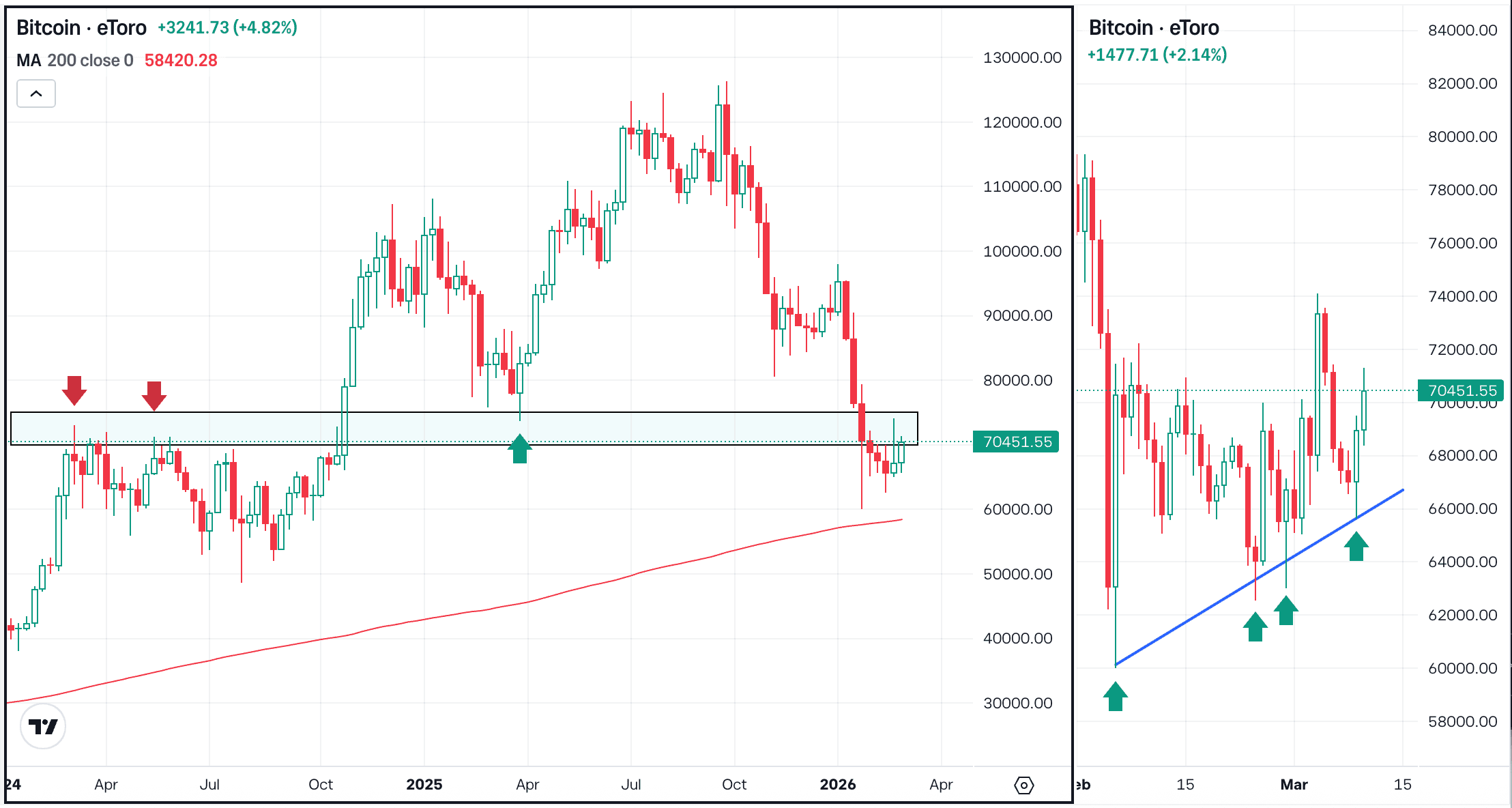

Markets tried to muster up a rally yesterday and got here up brief, with the S&P 500 and Nasdaq 100 falling 0.8% and 0.3%, respectively. On the plus aspect, Bitcoin gained greater than 5% and tech — whereas it nonetheless fell on the day — outperformed the S&P 500.

Now we’re seeing some follow-through on this morning’s pre-market motion, with US indices up about 1%.

There’s only one drawback: Inflation.

Right now’s inflation numbers drop at 8:30 a.m. with the CPI report. It’s one in all two main reviews every month that make clear inflation (the opposite is the PCE report, which the Fed places extra deal with).

Wall Avenue fears that inflation is coming again to life at a time the place financial energy is deteriorating. An in-line or decrease consequence could give them some reduction about that fear, whereas a higher-than-expected quantity could fan the flames a bit extra.

In both case, it’s all concerning the response to the information.

If this morning’s pre-market rally can carry over to the common session and acquire steam at present, maybe shares can put collectively a multi-day rally and end the week on a stronger observe.

Nevertheless, that risk loses steam if this morning’s rally falters and shares react poorly to the inflation report.

Wish to obtain these insights straight to your inbox?

Enroll right here

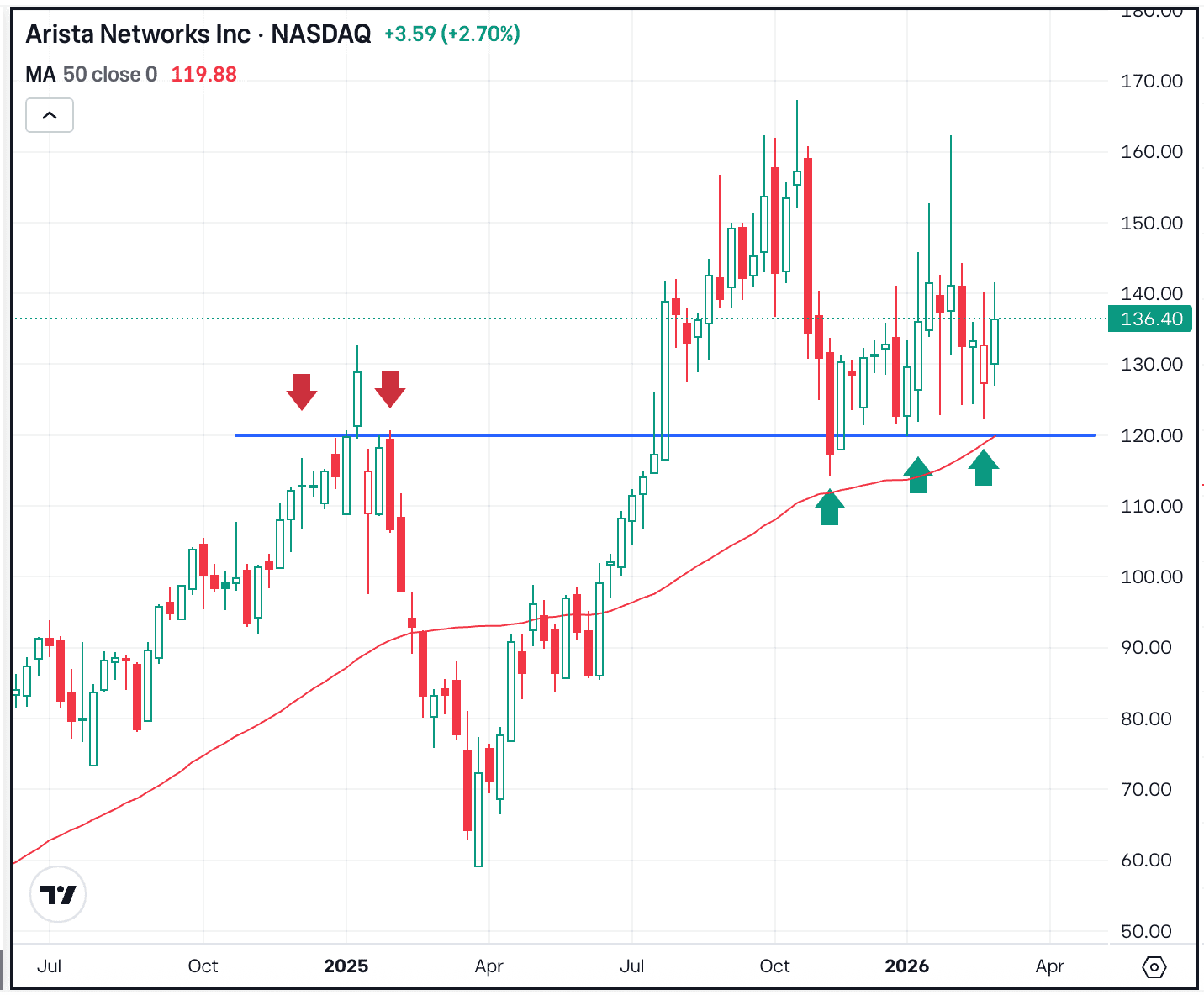

The setup — JPMorgan

Often called one of many highest high quality banking shares on the market, JPMorgan and the monetary area has succumbed to the market’s latest promoting strain.

Shares have fallen practically 20% from their report highs in mid-February, tumbling to a key degree on the charts. That’s as JPM exams down into its 200-day shifting common and a previous breakout degree.

JPMorgan fell arduous into what could possibly be a key technical space. If help holds up close to $225, then we might see a bigger bounce to the upside. On the flip aspect, help failing might result in extra volatility and promoting strain within the brief time period.

Shares of JPM commerce at roughly 12.5 occasions ahead earnings, properly beneath the S&P 500’s valuation of about 20 occasions earnings and barely above its long-term common of about 11.5 occasions earnings. Nevertheless, analysts anticipate roughly flat earnings progress this 12 months, which can be a turn-off for some buyers even when JPM is taken into account a high-quality firm.

Choices

For choices merchants, calls or bull name spreads could possibly be one method to speculate on help holding. On this state of affairs, choices patrons restrict their danger to the worth paid for the calls or name spreads, whereas making an attempt to capitalize on a bounce within the inventory.

Conversely, buyers who anticipate help to fail might speculate with places or put spreads.

For these trying to study extra about choices, contemplate visiting the eToro Academy.

What Wall Avenue is watching

DAL – Delta Air Traces shares tumbled as administration slashed its income and revenue outlook for Q1, citing “macro uncertainty” as its reasoning. American Airways shares additionally fell because it diminished its outlook as properly, whereas travel-related shares like Disney, Uber, Expedia and others had been additionally below strain due to the information.

INTC – Shares of Intel are in focus this morning, rising greater than 5% in pre-market buying and selling on reviews that Taiwan Semi has approached chip firms to type a three way partnership (JV) and function the foundry unit. Traders are hopeful that TSMC might additionally assist Intel amid its latest slide.

Disclaimer:

Please observe that as a consequence of market volatility, a few of the costs could have already been reached and situations performed out.