The Every day Breakdown takes a more in-depth have a look at leveraged ETFs, which have been extremely unstable within the present market surroundings.

Friday’s TLDR

Leverage can damage

Breaking down Berkshire inventory

The Backside Line + Every day Breakdown

Leverage can are available many kinds lately. For example, it may possibly come from choices, margin, and leveraged ETFs*. Whereas leverage can flip into an addictive use of capital when instances are good, the state of affairs can get fairly darkish when volatility will increase.

Observe the latest efficiency of some standard leveraged ETFs (primarily based buying and selling volumes):

Buyers utilizing leveraged-bull ETFs could also be struggling this 12 months. For example, whereas the QQQ ETF is down 4.5% for the 12 months, the 3x leveraged lengthy ETF (TQQQ) is down greater than 16%. Or discover how the semiconductor ETF — the SMH — is down 9.3% for the 12 months, whereas the 3x leveraged ETF (SOXL) is down virtually 30% this 12 months!

You would possibly see “3x leveraged ETFs” however then marvel why these automobiles aren’t precise multiples of the underlying asset. For instance, why the TQQQ ETF is down 16.4% as a substitute of down 13.5% (a -4.5% loss for QQQ multiplied by 3). This is called “decay.”

Leveraged ETFs lose worth over time because of day by day rebalancing to keep up their leverage ratio. This course of can erode returns over time, and significantly in unstable markets. For example, even when the underlying index have been to stay flat, the worth of the leveraged ETF can lower because of this day by day rebalancing mechanism.

On the desk above, you’ll discover that the leveraged-bear ETFs are up on the 12 months — which is predicted given the latest value motion — however maybe not up fairly as a lot as traders would have hoped in some circumstances.

Once more, that’s “decay” at work.

There Are Positives, Too

Regardless of a number of the pitfalls of leveraged ETFs, they are often helpful too.

Lengthy-term traders in these belongings can endure from decay — even after they’re proper on the path of the underlying index or asset. Nevertheless, short-term traders utilizing these automobiles attempting to benefit from present market circumstances or as a hedge on their portfolio can revenue from them when timed appropriately.

The Backside Line

Finally, unstable environments like this spotlight the hazards and the alternatives that may come from utilizing leveraged ETFs. They are often worthwhile in some circumstances, however they may also be harmful when traders have an excessive amount of publicity to them — particularly when the underlying path seems to be mistaken.

Typically talking, the extra leverage that’s concerned, the higher timing traders will want.

On the flip facet, some ETFs exist — just like the SPLV, which follows the 100 least unstable shares within the S&P 500 — that aren’t designed to seize volatility, however keep away from it.

No matter traders determine — be it with or with out leveraged ETFs, utilizing choices to hedge, elevating money to buffer elevated volatility, or standing agency and doing nothing — it must be primarily based on what’s finest for their very own threat tolerance, funding targets, and portfolio.

*Leveraged ETFs monitor belongings and attempt to multiply their returns. For instance, if a 2x leveraged ETF have been to extend in worth, that enhance can be double an similar, non-leveraged ETF. Nevertheless, if that 2x leveraged ETF decreases in worth, that lower will double, too. They’re usually short-term merchandise and will not be acceptable for all traders.

Need to obtain these insights straight to your inbox?

Enroll right here

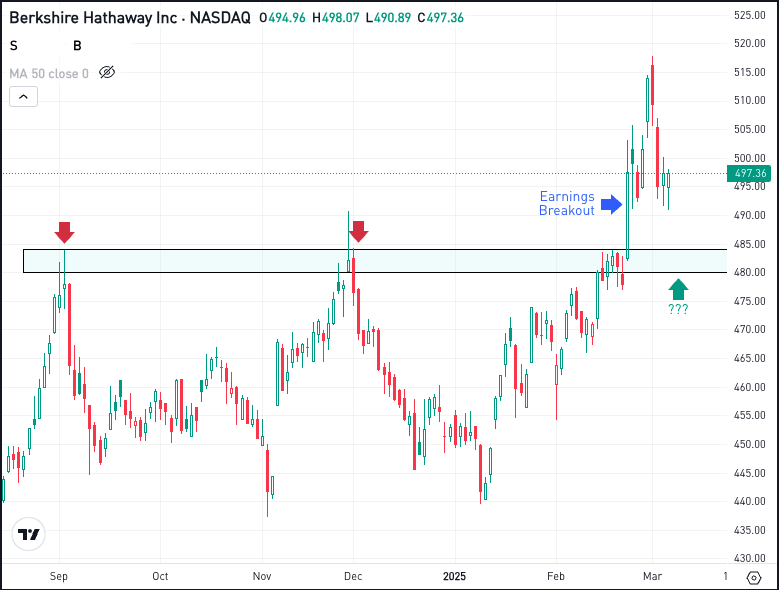

The setup — Berkshire Hathaway

Thursday was a tricky day in markets, however Berkshire Hathaway really held up fairly properly. Regardless of the 1.8% fall for the S&P 500, BRK.B fell simply 0.1%.

To not point out, shares are up virtually 10% on the 12 months, whereas the S&P 500 is definitely down about 2.5% to date in 2025. In different phrases, Warren Buffett’s agency has been doing fairly properly recently.

That’s why some traders could also be watching this one in case of a dip.

Control the $480 to $485 space. Ought to BRK.B pull again that far, it will characterize a dip of about 7% from the latest document highs.

If Berkshire pulls again and holds this space as assist, we might see a rebound. If assist fails, then extra bearish momentum might ensue.

Choices

One draw back to BRK.B is its share value. As a result of the inventory value is so excessive, the choices costs are extremely excessive, too. This may make it troublesome for traders to method these corporations with choices.

In that case, many merchants could choose to only commerce a couple of shares of the widespread inventory — and that’s superb. Nevertheless, one different is spreads.

Name spreads and put spreads enable merchants to take choices trades with a a lot decrease premium than shopping for the calls outright. In these circumstances, the utmost threat is the premium paid.

Choices aren’t for everybody — particularly in these eventualities — however spreads make them extra accessible. For these trying to be taught extra about choices, take into account visiting the eToro Academy.

Disclaimer:

Please notice that because of market volatility, a number of the costs could have already been reached and eventualities performed out.