Bybit’s CEO, Ben Zhou, has supplied updates on the restoration of funds stolen throughout a serious hack on the trade. The incident, which occurred on February 21, concerned roughly $1.4 billion price of cryptocurrency, making it one of many largest hack on a centralized trade within the crypto market.

The assault, attributed to the Lazarus Group, resulted within the lack of 400,000 ETH-related tokens and different property. Zhou acknowledged that round 20% of the stolen funds have “gone darkish,” whereas 77% stay traceable, and three% have been frozen.

Rising Considerations Over Decentralized Protocols

Bybit CEO Zhou emphasised that the upcoming weeks are essential for halting the hackers’ efforts to money out by exchanges, over-the-counter platforms, and peer-to-peer channels. He famous that the stolen ETH tokens from Bybit is being quickly transformed into Bitcoin and moved throughout a number of wallets.

The hackers predominantly used the decentralized liquidity protocol THORChain, accounting for 72% of the conversion exercise. This has contributed to file weekly transaction volumes on THORChain, which reached over $4.5 billion based on knowledge from DeFiLlama.

The heavy use of THORChain by the attackers has triggered inside debates in regards to the position of decentralized platforms in facilitating illicit transactions. One key THORChain member, TCB, introduced his departure from the protocol, citing considerations over the numerous quantity of stolen funds being processed.

TCB remarked that sustaining a totally decentralized, permissionless system turns into difficult when it’s closely exploited for laundering funds. A short lived vote to halt Ethereum transactions on THORChain has been proposed, however no last determination has been made.

In distinction, different cross-chain platforms are taking extra rapid motion. Chainflip, one other decentralized trade, briefly halted its swapping providers upon detecting the hackers’ actions.

The protocol additionally introduced plans for brand new upgrades to forestall stolen funds from passing by its system. These strikes mirror an ongoing rigidity between preserving the ideas of decentralization and addressing the sensible dangers related to permitting unrestricted fund flows.

Bybit Challenges in Restoration Efforts

As aforementioned, Zhou disclosed that vital parts of the stolen ether have grow to be untraceable. For instance, $79,655 ETH was processed by a non-KYC trade known as eXch, whereas one other $100 million price of ether flowed by the OKX Web3 proxy.

3.4.25 Government Abstract on Hacked Funds:Whole hacked funds of USD 1.4bn round 500k ETH, 77% are nonetheless traceable, 20% has gone darkish, 3% have been frozen.Breakdown:– 83% (417,348 ETH, ~$1B) have been transformed into BTC with 6,954 wallets (Common 1.71 btc every) . This and…

— Ben Zhou (@benbybit) March 4, 2025

Of this quantity, $65 million stays untraceable pending additional updates from OKX Web3. In the meantime, the FBI has additionally urged exchanges and validators to chop off the Lazarus Group’s entry, citing the group’s involvement in what it known as the “largest cash heist in human historical past.”

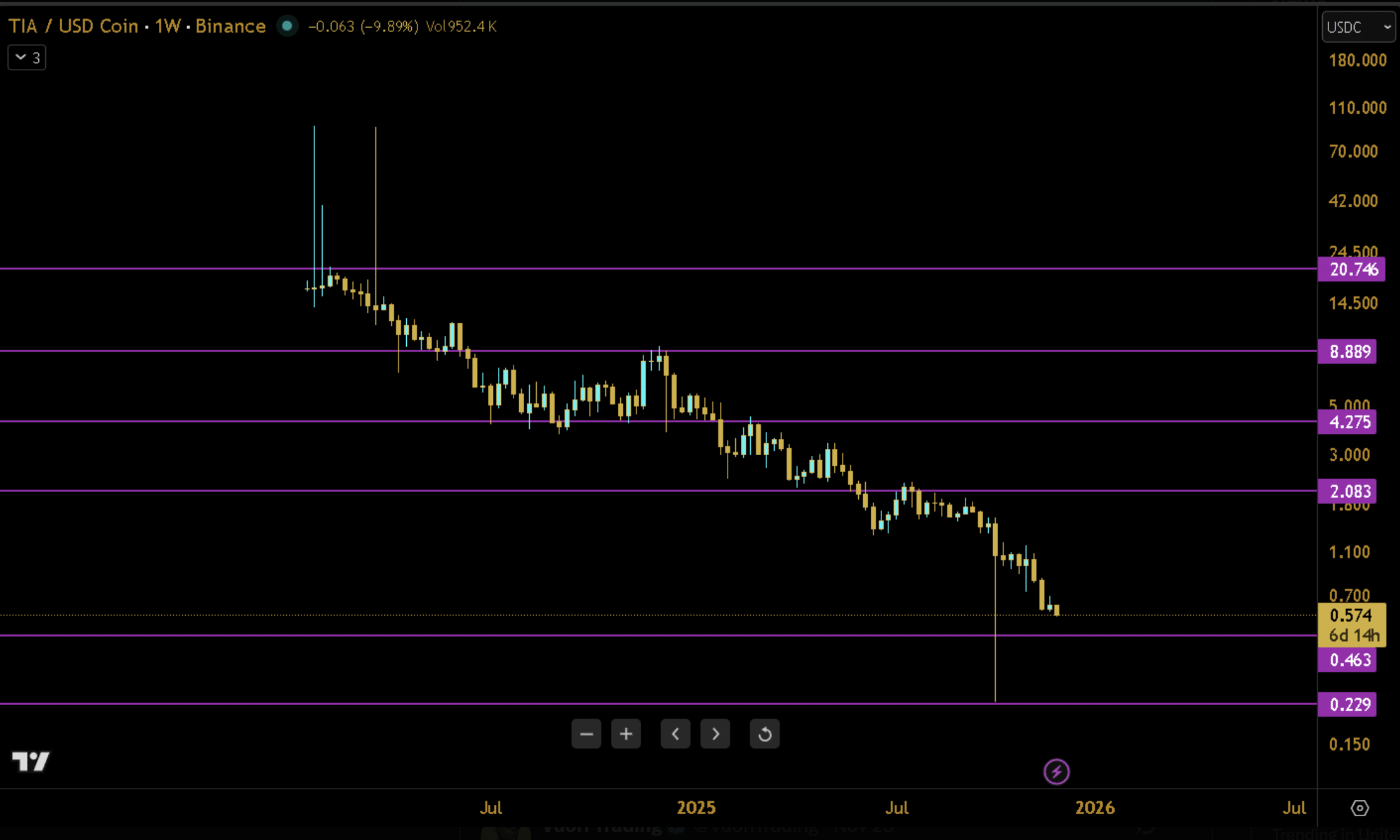

Featured picture created with DALL-E, Chart from TradingView