1. Introduction

Greggs, the UK’s main bakery chain, has lengthy been a staple on British streets, famend for its inexpensive and handy meals on the go. Nonetheless, the financial panorama within the UK is shifting, presenting new challenges. Regardless of these pressures, Greggs continues to increase, posting robust monetary efficiency and refining its strategic strategy to maintain progress.

For buyers, the query stays: Is Greggs well-positioned to face up to these challenges and ship long-term worth? This text delves into Greggs’ monetary efficiency, the broader financial context, and the strategic initiatives that would assist the corporate navigate unsure occasions.

2. Monetary Efficiency: A Balancing Act

Greggs reported strong financials for 2024, with complete gross sales reaching £2.014 billion, reflecting an 11.3% year-over-year enhance. Like-for-like (LFL) gross sales in company-managed shops rose by 5.5%, underscoring shopper resilience.

Nonetheless, a notable deceleration in gross sales progress was noticed all year long:

First half of 2024: 7.4% LFL gross sales progress

Third quarter: 5.0% progress

Fourth quarter: 2.5% progress

Greggs’ administration attributes this slowdown to diminished foot site visitors on excessive streets, signaling that even robust manufacturers aren’t resistant to macroeconomic forces.

Supply: Greggs filings, Creator evaluation

From an operational perspective, Greggs’ price construction stays beneath strain. Inflationary pressures have elevated bills associated to uncooked supplies and wages affected by the will increase in Nationwide Minimal Wage and the extra nationwide insurance coverage contributions, impacting general profitability. In response, Greggs has carried out selective worth hikes, similar to growing the value of its iconic sausage roll from £1.20 final yr (was £1 in 2022) to £1.30, representing an 8% enhance.

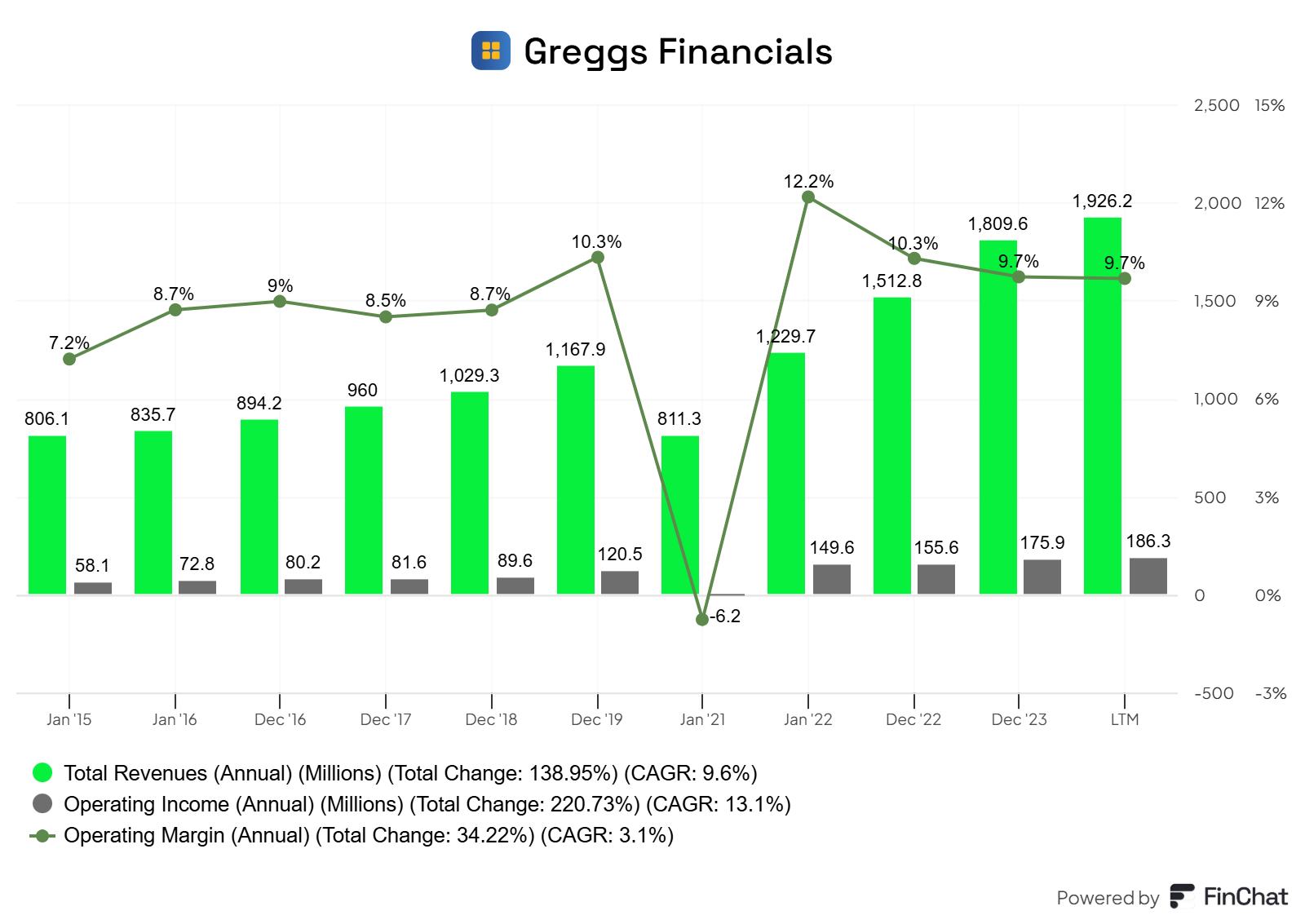

Supply: Finchat.io, Observe: This chart doesn’t embody the most recent 2 quarters as Greggs doesn’t report profitability metrics within the quarterly outcomes.

Regardless of these price pressures, the corporate’s operational efficiencies and economies of scale have helped mitigate margin erosion, demonstrating the resilience of its enterprise mannequin. Consequently, working margins at ranges near 10% stay above these seen within the pre-pandemic durations (besides 2019 that stood at 10.3%).

3. Financial Headwinds: GDP and Shopper Confidence

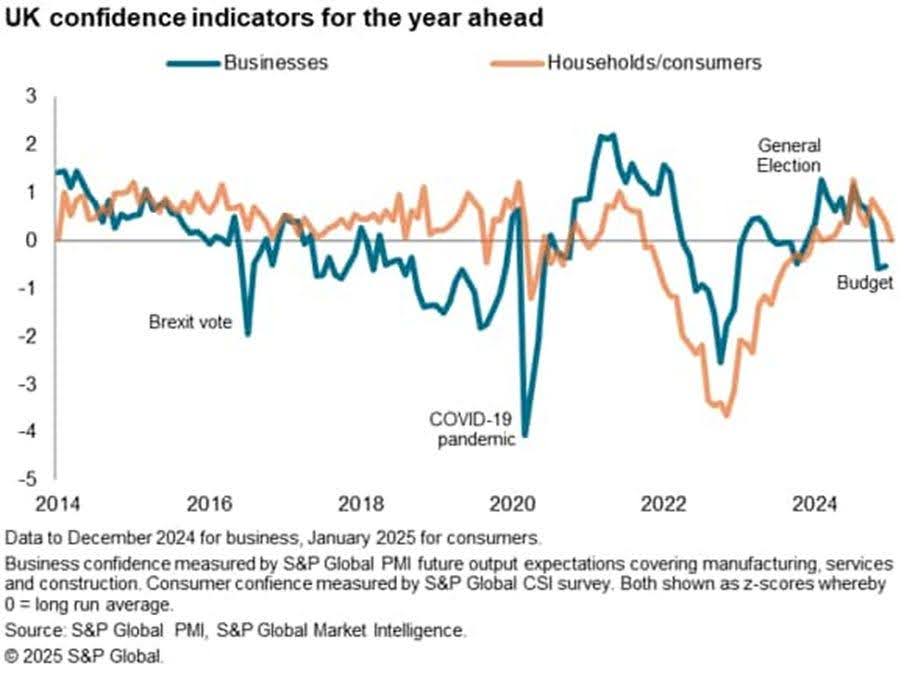

The UK financial system is presently dealing with a difficult interval, with weak shopper confidence and stagnant GDP progress reshaping spending habits. Though the Financial institution of England not too long ago diminished rates of interest from 4.75% to 4.5%, this transfer appears inadequate to drive progress.

This chart additionally highlights the insecurity amongst each customers and households, following the latest finances announcement.

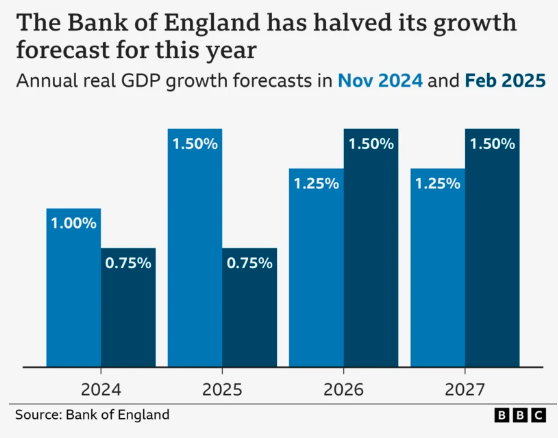

Moreover, the Financial institution of England has revised its GDP progress forecast, slashing its 2025 progress projection to simply 0.75%, whereas inflation is predicted to hit 3.7% by year-end. These components recommend that the UK is getting into a stagflationary atmosphere, elevating considerations concerning the future progress prospects of food-on-the-go retailers similar to Greggs.

4. Strategic Initiatives: Development Amid Uncertainty

Regardless of financial headwinds, Greggs stays dedicated to its long-term progress technique. A number of key initiatives underpin its resilience and potential for continued success.

Retailer Enlargement and Market Penetration

Greggs continues to increase its bodily footprint, opening 145 new shops in 2024, bringing its complete areas to over 2,600 retailers. The corporate goals to achieve 3,500 shops nationwide, capitalizing on robust model loyalty and geographic growth alternatives.

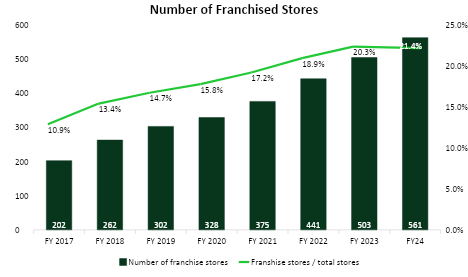

Supply: Greggs filings, Creator evaluation

Key parts of its growth technique embody:

Extra Drive-Thrus: Catering to the rising demand for comfort, significantly outdoors city facilities.

New Codecs: Smaller grab-and-go retailers and retail park areas to diversify its attain.

Franchise Partnerships: Collaborating with third-party operators to speed up growth.

Supply: Greggs filings, Creator evaluation

This aggressive growth technique alerts confidence in future long run demand, however the sustainability of this progress hinges on financial stability.

Digital Transformation, Supply Development and Extra

Recognizing evolving shopper habits, Greggs has closely invested in digital transformation. The corporate has strengthened its supply partnerships with Uber Eats and Simply Eat, increasing its attain past conventional brick-and-mortar gross sales. Digital ordering and loyalty packages play a key position in its technique, driving buyer engagement and retention.

In H1 2024, 18.3% of transactions at company-owned shops had been scanned by means of the Greggs App, up from 10.6% final yr, signaling improved buyer loyalty. In the meantime, supply gross sales grew to six.7% of complete gross sales, in comparison with 5.3% in H1 2023.

One other key progress driver is night gross sales, that are outpacing the corporate’s general like-for-like progress. Night commerce caters to a wider vary of customers past breakfast hours.

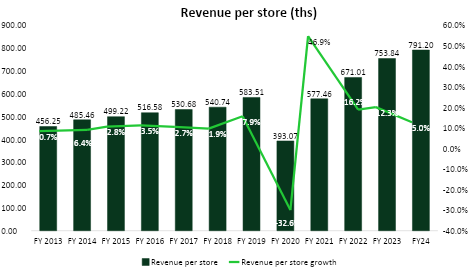

These developments all level to at least one factor: increased income per retailer. With constant execution, Greggs is well-positioned for sustained growth.

Supply: Greggs filings, Creator evaluation

5. Valuation

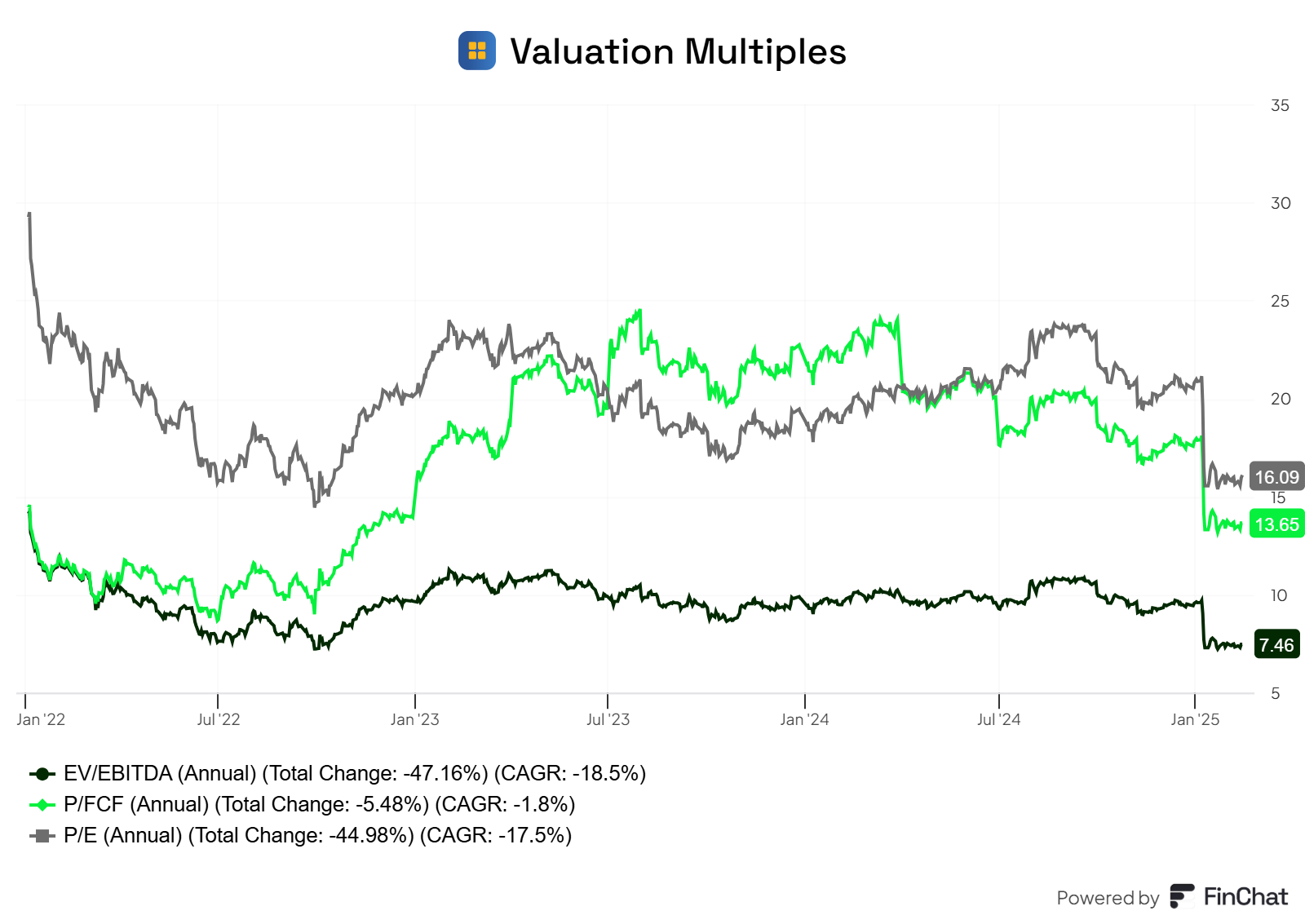

Greggs is presently buying and selling at one among its most tasty valuations prior to now decade. With a P/FCF of 13.6x, among the many lowest ranges since 2015, it displays a compelling 7.3% FCF yield. Taking a look at EV/EBITDA, the one time it was decrease within the final 10 years was in 2015 at 7.4x, with at present’s 7.5x being the second lowest.

Over the identical interval, EBITDA has grown from £95.5M to £258.9M, reflecting an 11% CAGR, whereas FCF has expanded from £52.6M to £158.8M, a 12.3% CAGR. In the meantime, its Return on Fairness has elevated from 15.6% in 2015 to twenty-eight.7% within the first half of 2024!

Given this robust efficiency and Greggs’ ongoing progress technique, the present valuation seems overly conservative.

Supply: Finchat.io

6. Dangers and Alternatives

Greggs presents a combined however compelling funding case. Whereas financial headwinds persist, the corporate’s strategic variations and robust model fairness help its long-term potential.

Funding Dangers

Financial Uncertainty: Extended inflation and weak shopper confidence may proceed to hinder gross sales progress.

Value Pressures: Rising wages, ingredient prices, and power bills might erode revenue margins.

Aggressive Panorama: Greggs faces growing competitors from grocery store meal offers and quick-service restaurant chains.

Funding Alternative

Resilient Enterprise Mannequin: Greggs’ value-focused proposition positions it properly in occasions of financial uncertainty.

Enlargement Potential: Robust pipeline of recent retailer openings and various gross sales channels.

Digital and Supply Development: Investments in digital ordering and supply companies present further income streams.

7. Conclusion: Is Greggs a Purchase?

Whereas short-term volatility is predicted, long-term buyers might even see worth in Greggs’ regular income progress, robust model, and strategic positioning. For these trying to acquire publicity to the UK shopper sector, Greggs stands out as a high-quality inventory with stable fundamentals and long-term progress potential. Let me know within the feedback if you happen to agree!

Disclosure: I personal Greggs in my eToro portfolio.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any specific recipient’s funding aims or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.