We proceed our evaluation of Trump 2.0. Usually, a single coverage dominates annually following a brand new administration’s election (e.g., tax reform in 2017, the commerce conflict in 2018, COVID-19 in 2020, and industrial coverage/CHIPS Act/IRA in 2021). Nonetheless, Trump 2.0 is addressing a number of insurance policies concurrently. The noise-to-signal ratio is exceptionally excessive—deal with what issues and what we all know, as outlined beneath. A lot of the tariff debate falls into the class of “recognized unknowns,” with each scope and sequencing nonetheless unsure.

What we all know:

Tariffs: FX markets are the place commerce coverage reveals up probably the most, and presently markets are pricing in a situation resembling a worldwide tariff. Trump needs international locations to barter with him straight. He threatens with reciprocal tariffs to get international locations to speak to him (working example, Modi). If reciprocal tariffs take impact, EM international locations can be hit worst (India, Argentina, Mexico, Brazil, Vietnam, Taiwan, Indonesia).

a) From an investments viewpoint, we expect that companies sectors will outperform items sectors. Firms which might be pro-border-adjustable tax (winners): Boeing (BA), Normal Electrical (GE), Caterpillar (CAT), financials comparable to Financial institution of America (BAC), JP Morgan (JPM), Mastercard (MA), Prudential (PRU.L). Firms that are anti-border-adjustable tax (losers): Walmart (WMT), Nike (NKE), Hole (GAP)., Toyota (TM).

b) Lastly, we expect China is handled in another way than different international locations. Trump doesn’t need any US firm to function in China, interval. US corporations levered to China will proceed come underneath strain.

Traditionally, shares do nicely within the 1st 12 months of a brand new president until there’s a recession. The final 4 cycle of 1st years of a president have produced +20% returns. It’s the second 12 months when shares come underneath strain when insurance policies filter by means of the economic system.

Since 1973, financials have outperformed the S&P 500 throughout each 1st 12 months of a brand new president (aside from one 12 months, 2009 monetary disaster). Healthcare shares have outperformed the S&P 500 within the 1st 12 months of each Republican administration since Reagan, 1981.

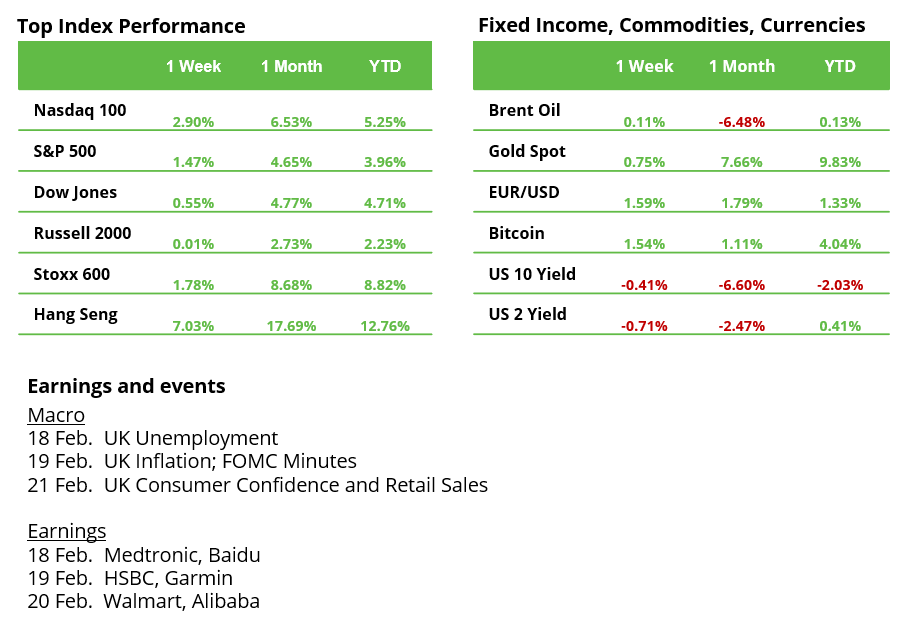

Which monetary markets indicators matter probably the most to the brand new administration (per Treasury Secretary Scott Bessent’s latest interview with Larry Kudlow): 1. 10-year yield, 2. Value of oil. 3. Value of gold – we monitor these to gauge the route of coverage.

If Congress needed to do an-unpaid-for-tax cuts, the bond market would ship a punishment. Therefore, deal with lowering spending to historic ranges first (DOGE). Sectors that come underneath strain as a consequence of decreased spending: shopper staples, vitality, training, transportation. Optimistic for protection shares.

For H1 2025, we expect that the US market is nicely supported by liquidity provided by the US Treasury. On January twenty first, the US hit the debt ceiling (US can’t concern internet new debt). As an alternative, Treasury is now paying its payments, a liquidity tailwind (400-500 USD bil.) for markets (preserve yields low), monetary situations loosen. In impact, much like QE. This may keep till Congress raises the debt ceiling (can concern new debt), and till then assist preserve yields/USD in verify. Counter forces (greater yields) are: 1. Sticky CPI, 2. Tariffs, 3. Finances deficit

Bottomline: Trump 2.0’s coverage method, significantly round tariffs, is making a excessive degree of uncertainty within the markets. Key sectors more likely to outperform embrace financials, companies, and border-adjustable tax corporations, whereas these uncovered to China or reliant on world commerce might face strain. Liquidity from the US Treasury and a weakening USD might assist the market in H1 2025, however dangers stay, together with tariffs and sticky inflation.

In Focus: German Elections; DAX on Document Run Regardless of Recession

Expectations for the Upcoming Election: Polls present the CDU/CSU main comfortably, adopted by the AfD in second place. The SPD and Greens are in a decent race for third, whereas the FDP, Die Linke, and BSW wrestle with the five-percent threshold. Key questions stay: how sturdy will the CDU/CSU carry out, which coalition accomplice will they select, and can a single accomplice suffice? With CDU chief Friedrich Merz ruling out cooperation with the AfD, the 2029 election might change into considerably extra fascinating, particularly if the AfD’s assist continues to develop. Brief-term market reactions are attainable in case of an sudden consequence or tough coalition talks, however long-term components like rates of interest, inflation, and the worldwide economic system stay extra essential.

DAX Evaluation: One week earlier than the German federal election (Sunday, 23 February), the DAX continued its record-breaking rally, whereas the German economic system stays in recession. This obvious discrepancy is well defined: DAX corporations generate most of their revenues overseas. In key export markets just like the US, China, and France, situations usually are not good however stay higher than in Germany. International giants like SAP, Siemens, and Infineon profit from megatrends comparable to digitalization, automation, and renewable vitality.

These German Shares Belong on Your Watchlist: Key challenges embrace infrastructure enlargement (ThyssenKrupp, Hochtief, Bilfinger), paperwork discount and digitalization (SAP, Software program AG, Bechtle), vitality transition (Siemens Vitality, Nordex, Encavis), housing (Vonovia, LEG Immobilien), future applied sciences (Infineon, Carl Zeiss Meditec), and reforms in pensions and healthcare (Fresenius, Siemens Healthineers, Medios).

Germany Sticks to Its Debt Brake: With a debt-to-GDP ratio of 63 %, Germany stays stable by worldwide requirements. Japan is 4 occasions extra indebted at 250 %, whereas Italy (135 %) and the US (123 %) have roughly double the debt ranges. To achieve a debt ratio of 101 % just like the UK, Germany would want to tackle round €1.59 trillion in extra debt. Even a fraction of this might finance much-needed investments with out jeopardizing long-term fiscal stability. Notably, Germany is the one nation in our comparability (see chart) with a declining debt ratio over the previous 20 years.

Debt Alone Gained’t Resolve Germany’s Structural Points: Its low debt ranges present important fiscal leeway for development and disaster administration – a possibility that is still largely untapped.

Bottomline: The upcoming German election is unlikely to disrupt markets until coalition negotiations show unexpectedly tough. Buyers ought to deal with structural themes, digitalization, automation, and vitality transition, whereas monitoring potential fiscal shifts post-election, significantly concerning infrastructure and industrial coverage.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.