Nomad Meals ($NOMD) is Europe’s main frozen meals firm. Its ERP backdrop could possibly be a yummy alternative to get publicity to some family names in a strong and rising trade.

Key Highlights

Nomad Meals is a portfolio firm with sturdy manufacturers within the frozen meals trade

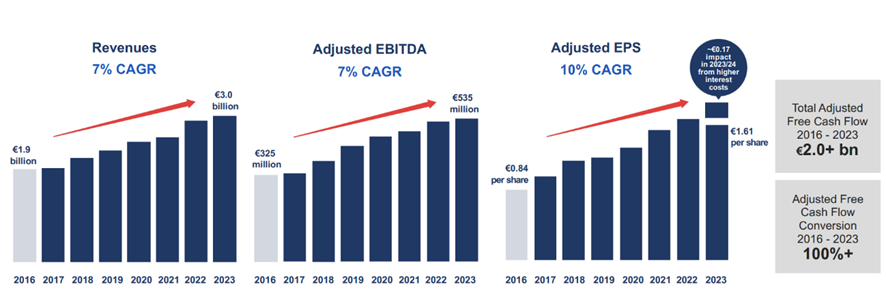

Regardless of its transitionary ERP issues the corporate reveals a robust progress trajectory

Nomad Meals at the moment trades at a reduction making use of a conservative valuation mannequin

The Enterprise and the Business

As Warren Buffett famously stated, “Firms which have the highest share of customers’ minds have each pricing energy and model loyalty, which lead to wealth creation for shareholders.” Nomad Meals is an ideal instance. Rising up in an Italian family, Captain Findus fish sticks have been at all times a staple in our eating regimen—a outstanding achievement, contemplating how explicit Italians are about meals. This exemplifies the power of Nomad Meals: an organization that, by way of a collection of strategic acquisitions, has constructed a compelling portfolio of family manufacturers, now commanding 20% of the European frozen meals market.

On prime of Findus, fashioned in 1941 and marketed in Italy, France, Spain, Sweden, Switzerland and Norway, the opposite manufacturers are family names with lengthy histories and native heritage of their respective markets. The Birds Eye model was established in 1922 and is primarily marketed within the UK and Eire. The iglo model, based in 1956, has a longstanding historical past and is marketed in Germany and different continental European international locations. Ledo (established in 1958) and Frikom (established in 1975) are the lead manufacturers with sturdy heritage in south-eastern Europe.

Frozen meals merchandise are significantly engaging as a result of they handle vital international meals tendencies. Customers more and more favor merchandise that permit them to organize meals rapidly and with confidence and count on merchandise to be wholesome and good worth for cash. As well as, customers are more and more targeted on decreasing meals waste. Frozen meals merchandise can have all of those traits. They’re simple to organize, they cut back the necessity for synthetic preservatives, they’re usually higher worth for cash than chilled alternate options they usually cut back waste in any respect factors within the provide chain and in addition in-home (as a result of lengthy shelf life, and the benefit of portionability).

Nomad Meals – Investor Presentation

Competitors

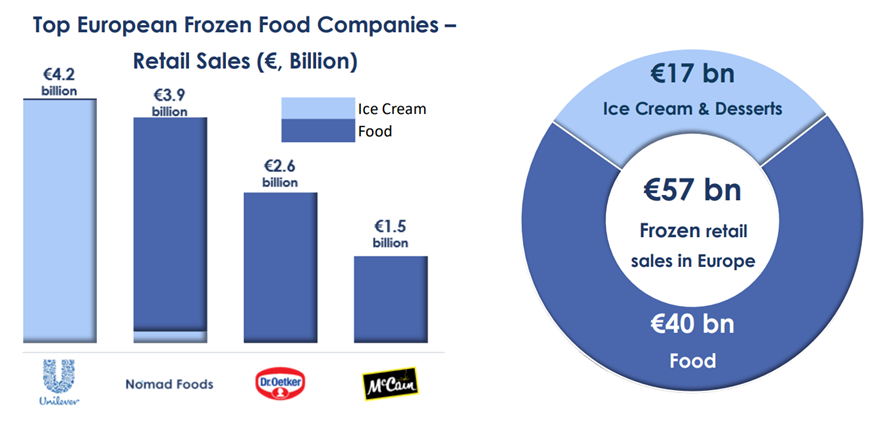

The primary frozen meals producers in Europe are Nomad Meals, Unilever, Dr Oetker and McCain. Unilever instructions the ice cream market with manufacturers like Magnum, Ben & Jerry’s and Wall’s. Dr Oetker is legendary for its frozen pizzas, whereas McCain is the preferred model for frozen potatoes. There are additionally quite a lot of non-public labels, just like the grocery store chains, that provide low price frozen merchandise below their very own manufacturers.

Regardless of a aggressive surroundings, Nomad Meals is energetic in segments totally different from its branded opponents, the place it may command a superior market share. Nomad Meals product combine is closely skewed in the direction of protein and greens which account for 75% of its revenues. Its market share has laid the foundations of its aggressive benefit. Certainly, Nomad Meals advantages from economies of scale, long-term retail relationships, and a various product and geographic combine. Its well-established manufacturers give the corporate a robust model fairness technique, with main spontaneous model consciousness in a number of areas.

Furthermore, the corporate has optimized its sourcing technique. By working a centralized procurement and provide chain aligned with its geographic footprint, Nomad Meals successfully reduces distribution prices. It sources merchandise globally from a large community of suppliers, minimizing the danger of over-reliance on any single provider. Moreover, the corporate operates 18 manufacturing services strategically situated close to its foremost markets. This diversified manufacturing setup permits for higher logistics administration, balancing manufacturing prices with excessive customer support ranges.

Nomad Meals – Investor Presentation

Market

The consumption of frozen meals is backed by clear secular tendencies. The consumption of frozen meals cuts down meal preparation, giving households again extra time for what issues most. Frozen meals is inexpensive in comparison with their chilled equivalents. This issues for 93% of European customers, who modified their solution to store to handle expenditures in a value of residing disaster. Lastly, frozen meals are considerably extra sustainable each for retailers and last customers. Certainly, they permit to cut back waste for his or her important longer shelf life.

During the last ten years the European savory frozen meals market has grown round 3% whereas experiencing an enormous spike in class demand all through the COVID pandemic, pushed by the aforementioned means to deal with international meals consumption tendencies. Moreover, the quantity of area that frozen meals as a class occupies inside the grocery retail surroundings is comparatively secure as a result of fastened quantity of freezer area on the retailer that’s not uncovered to reductions in shelf area in favor of different classes or codecs, as will be the case in shelf-stable elements of the retailer. Anyway, these different meals classes grew solely 2% in the identical time period.

Strategic Alternatives

In comparison with their US counterparts, Europeans devour a lot much less frozen meals per capita, favoring contemporary choices on account of misconceptions about their poor high quality. Per capita consumption of frozen meals within the US is eighteen.2 kg, whereas the European common is round 8 kg. Controlling for the dietary variations between European and US customers, this development remains to be important and will slim within the close to future. This opens up compelling progress alternatives for European producers.

Nomad Meals progress initiatives focus round strategic acquisitions, geared toward figuring out and executing on engaging progress alternatives to consolidate their core product combine. Nomad Meals possesses strong acquisition experience, supported by a robust administration staff and entry to capital.

The corporate can also be targeted on its core product classes – fish, greens, and poultry – which account for 67% of its branded retail gross sales. Efforts to reinforce these classes embody bettering product high quality, refreshing packaging, and optimizing in-store execution by way of higher product assortment, show methods, and promotions. Given its present comparatively low penetration at poultry and potato markets in European international locations, Nomad Meals has a lot area for additional progress.

Lastly the corporate needs to extend margins and money flows by way of disciplined price administration and provide chain optimization. This contains initiatives like lean manufacturing, manufacturing unit footprint optimization, and enhancing procurement productiveness, in addition to creating stronger promotional packages, value structure, and commerce phrases. Though over the previous a number of quarters Nomad Meals’ profitability has been below strain, margins stay secure and should improve sooner or later, offering more money for distributions to shareholders.

Dangers

Nomad Meals – Investor Presentation

There are some dangers related to a profitable execution of Nomad Meals’ plans. For instance, an elevated consolidation within the frozen meals market may cut back the gross sales of the corporate. On the identical time, an inflationary surroundings might cut back the flexibility of the corporate to cross by way of value will increase to customers. Anyway, the vertically built-in operations of Nomad Meals give it an edge within the advanced pipelines of chilly provide chains towards its opponents in addition to higher value management capabilities.

Lastly, Nomad Meals depends on gross sales to a restricted variety of giant meals retailers. The meals retail segments are extremely concentrated, with Nomad Meals’ prime 10 retail prospects accounting for about 32% of its annual income. Ought to these retailers carry out poorly, the corporate’s enterprise could possibly be adversely affected. Regardless of this being a severe risk, Nomad Meals managed to extend its revenues annually over the past ten years, which means that its gross sales channels and advertising and marketing capabilities can face numerous challenges.

Nomad Meals Valuation

However what’s the worth of Nomad Meals?

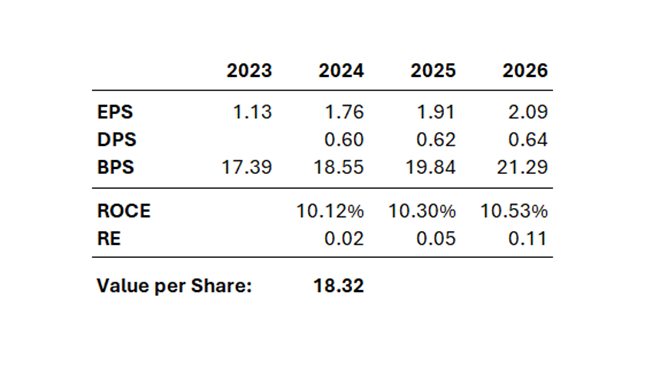

I’ll use the Residual Earnings Mannequin to worth the enterprise, detailed in Accounting for Worth by Stephen Penman (Columbia Enterprise Faculty Publishing, 2010). Some main advantages from utilizing this mannequin are the low variety of inputs, low quantity of hypothesis added and strict connection to the fundametals.

I’ll assume EPS of €1.76, €1.91 and €2.09 for FY 2024, FY 2025 and FY 2026. These are essentially the most up to date estimates of the monetary analysts following the corporate. Plus, I’ll assume DPS (Dividend per Share) of €0.60, €0.62 and €0.64, in keeping with the corporate’s dedication. I’ll assume a ten% Price of Capital, that’s cheap contemplating the present risk-free rates of interest. I may even assume a 0% progress charge for the RE (Residual Earnings). This strategy has two key advantages: it considerably reduces the danger of overpaying for progress and aligns with market principle, which means that residual earnings are inclined to diminish over time. Given a BPS (Guide Worth per Share) in FY 2023 of €17.39, we are actually able to compute the worth per share of the corporate:

The BPS for FY 2024 and FY 2025 is computed including the EPS and subtracting DPS from earlier yr BPS. We compute ROCE (Return on Frequent Fairness) because the ratio of EPS and former yr BPS. The Residual Earnings are computed subtracting the Price of Capital from the ROCE, permitting us to deal with the Financial Income of the corporate. The result’s then multiplied by the earlier yr BPS. Lastly, we low cost future Residual Earnings with a ten% Price of Capital, assuming no progress for the longer term intervals, and we add it to the bottom BPS.

As we are able to see the ensuing worth per share is €18.32, displaying roughly a 17% premium from the present value of Nomad Meals. This valuation is very conservatory, which means that it could be enough for the corporate to ship their commitments to see this appreciation mirrored within the inventory value.

Conclusion

The present ERP headwinds have led to a downward revision of steering for the tip of 2024. This follows a difficult interval for the frozen meals trade, marked by inflationary pressures and the cost-of-living disaster. Regardless of these difficulties, Nomad Meals not solely maintained its profitability but in addition elevated its revenues—a formidable testomony to the corporate’s resilience and power.

With its business flywheel gaining momentum and its enterprise mannequin supported by clear secular tendencies, the transitional challenges confronted by this outstanding firm might current a pretty alternative for buyers looking for publicity to a rising trade inside the European market.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any explicit recipient’s funding goals or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.