Plus: Microsoft and OpenAI are sus about DeepSeek

GM. The market’s a messy fruit cocktail. Don’t be concerned tho’ – we have made it drinkable, so you do not have to choke on the pits.

📝 Bitwise information for a Dogecoin ETF.

🍋 Information drops: Microsoft and OpenAI are sus about DeepSeek, Gary Gensler goes again to MIT + extra

🍍 Market taste at the moment

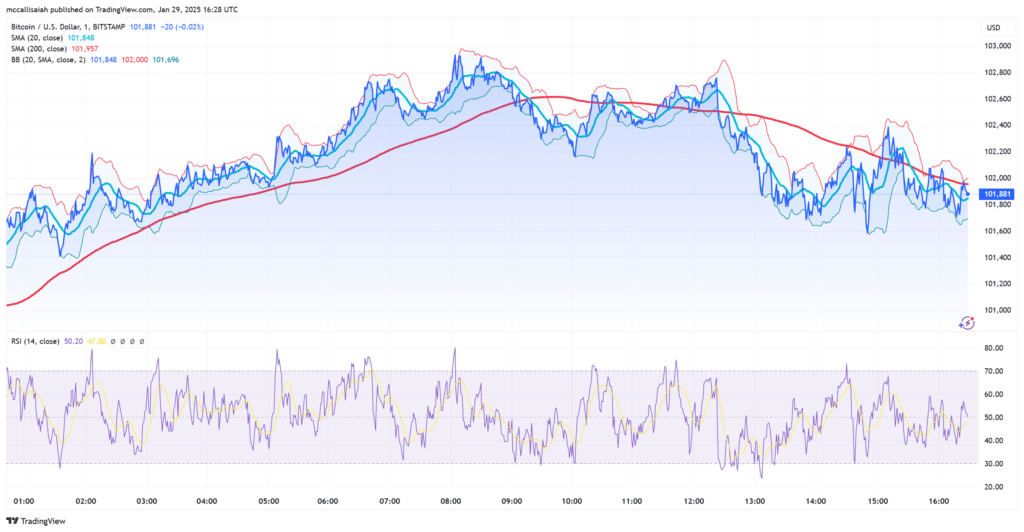

The Worry & Greed Index hasn’t moved since yesterday – nonetheless parked at 72 in Greed.

Within the meantime, there’s a number of crimson throughout the board, prolly as a result of persons are going risk-off forward of the FOMC assembly at 2 PM EST at the moment. Btw, if you happen to’re too busy to regulate it – you understand the place to seek out us. We’ll provide the tea tomorrow.

Proper now, no one’s anticipating a lot from the assembly. Nonetheless, 10xResearch is saying there’s an opportunity the Fed is likely to be much less aggressive than we expect.

Why? With the uncertainty round US tariffs, they may not need to push too arduous on their “let’s hold rates of interest excessive” stance from December.

And about Bitcoin’s latest dip? 10xResearch says all the things’s nonetheless A-OK so long as BTC holds above $99,611 within the quick time period. In the meantime, the medium-term outlook additionally stays constructive if we stay above $91,864.

Trying even additional forward, there’s one massive motive to remain bullish long-term: increasingly more main gamers are serious about BTC investments.

The newest contender: the Czech Nationwide Financial institution (CNB), which could grow to be the primary European central financial institution to spend money on Bitcoin as a part of diversifying its $146B in overseas alternate reserves.

If accepted, this plan might contain $7.3B price of BTC buys.

🥝 Memecoin harvest

Watching these memecoins go up is like scrolling TikTok at 3 AM – lowkey embarrassing, however nonetheless enjoyable.

Identify

24H Change

PUMPKIN PKIN

▲44K%

STONKS STONKS

▲150%

OSOL OSOL

▲129%

Ski Masks Cat SKICAT

▲66%

Knowledge as of 09:30 AM EST.

Take a look at these memecoins and many extra right here.

Final 12 months, Bitcoin and Ethereum ETFs lastly acquired accepted within the US. And that was underneath an administration that wasn’t precisely like this 🤞 with crypto.

Now? Totally different story. The brand new administration is predicted to be essentially the most crypto-friendly one the US has ever seen. So, naturally, ETF issuers checked out one another, cracked their knuckles, and stated, “Let’s simply get f*cking wild.”

Working example: Bitwise filed an S-1 with the SEC for a Dogecoin ETF.

Sure, it is simply the S-1 – so the SEC is simply reviewing the thought in precept, however there is no precise approval timeline but. Till Bitwise information the 19b-4, the SEC does not need to set a call deadline.

And whereas there’s nonetheless a protracted strategy to go, this registration is a big step ahead.

The enjoyable half? DOGE is not alone. Here is what else is on the ETF ready record:

… phew, sorry, acquired drained. Fast water break… Aight, let’s proceed:

Mainly, issuers appear to be poking the SEC to see how far they’ll go (and this record most likely is not stopping right here).

And if these ETFs do get accepted, it is a massive deal:

Simpler to purchase: no want for crypto wallets, personal keys, or exchanges;

Extra liquidity: extra buying and selling = extra demand = potential worth enhance. Fast mafs;

Institutional cash influx: hedge funds, pension funds, and enormous establishments usually tend to make investments via ETFs;

Regulatory blessing: ETFs run on regulated markets, making crypto really feel much less just like the darkish and scary underground;

Legitimacy: if an asset will get an ETF, it is just about TradFi saying, “Okay, effective, you possibly can sit with us.”

That stated, simply because ETFs are being filed left and proper does not imply they’re going to all get accepted.

Matt Hougan, Bitwise’s CIO, says that not each crypto even deserves an ETF. Some are too illiquid, too simple to control, or simply straight-up not prepared.

So yeah, some will make it, some will not – the SEC holds the ultimate name.

Liking the juice? 🍋 Don’t gatekeep this one – share the Every day Squeeze and let your folks get a style of Web3 sweetness!

Honest warning, tho’: you’ll have to hold the load of changing into a hero.

🍋 Information drops

🔍 Microsoft and OpenAI are attempting to determine if DeepSeek acquired their arms on OpenAI’s knowledge with out permission. Apparently, somebody might need been pulling huge quantities of knowledge from OpenAI’s API late final 12 months.

😡 Senator Elizabeth Warren is not thrilled about Trump’s Commerce Secretary decide, Howard Lutnick. She’s calling out his ties to Tether, which she says is “a identified facilitator of legal exercise.” 🙄.

💼 Scott Martin, aka “Burnt Toast,” is now the CEO of Doodles, the Ethereum-based NFT mission. Appears like NFT firms are swapping company execs for people who find themselves really within the trade – Yuga Labs and Cool Cats did the identical.

🤖 Gary Gensler is heading again to MIT, this time to co-lead a FinTech AI mission. He will not have SEC-level energy, however with MIT’s robust ties to tech corporations and policymakers, his work might nonetheless form AI’s position in finance.

🤔 Fascinated with utilizing Coinbase? We took a deep dive into the nice, the dangerous, and all the things in between – try our evaluate.