Final evening, President Trump signed the “Digital Property” govt order (EO), and let’s simply say Bitcoiners are feeling… bitter. Initially, rumors swirled that this is likely to be the lengthy anticipated Strategic Bitcoin Reserve (SBR) laws. However nope — not even shut. Bitcoin reserve didn’t get a single point out.

As a substitute, the EO mentioned:

“The Working Group shall consider the potential creation and upkeep of a nationwide digital asset stockpile and suggest standards for establishing such a stockpile, doubtlessly derived from cryptocurrencies lawfully seized by the Federal Authorities via its legislation enforcement efforts.”

Translation: This EO seems to be like a obscure “let’s research shitcoins” roadmap slightly than a daring step towards a Strategic Bitcoin Reserve. Should you had been hoping for a nation state orange capsule second, this ain’t it.

However earlier than you rage tweet, take a deep breath. There’s a silver lining. The EO does outlaw CBDCs — an enormous win for freedom cash and a extra Bitcoin-aligned future.

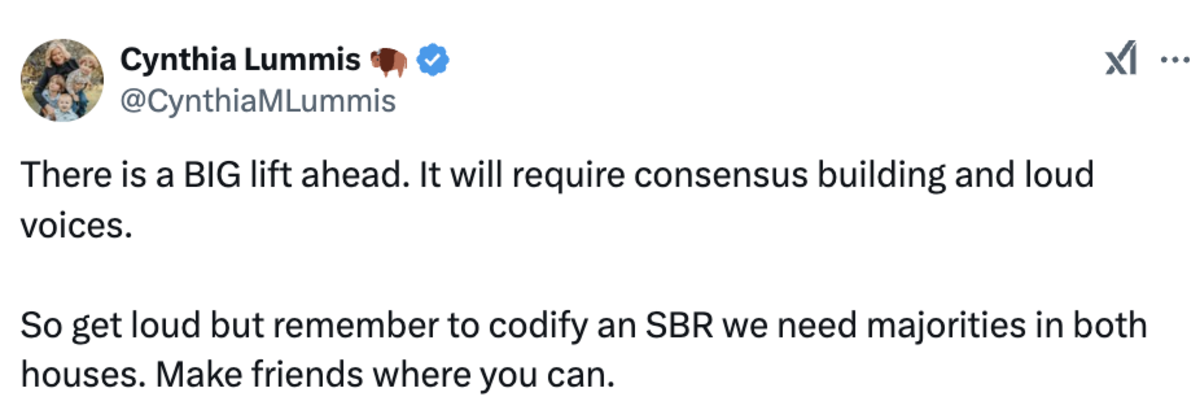

And, as Senator Cynthia Lummis reminded us yesterday, her Strategic Bitcoin Reserve Invoice is “a BIG raise”:

Why is that this excellent news? Let’s break it down:

Government Orders Are Fragile: EOs are fast to implement however could be simply reversed by the following administration. They’re political Publish-it Notes, not everlasting fixes.Laws Is Sturdy: Legal guidelines handed via each homes of Congress are far more durable to repeal. Lummis’ long run technique goals to cement Bitcoin’s position within the U.S. financial system for generations, not simply the following election cycle. She is taking the low time choice route, and I salute her for that.

Senator Lummis mentioned it herself in an X DM she allowed me to share:

“Even when the EO had been an outright Strategic Bitcoin Reserve, the following administration (after Trump) may undo it (what’s performed administratively can typically be undone administratively). So, in an effort to get the 20-year minimal HODL, which my invoice requires, and meaningfully handle America’s debt, we’ve got to undergo the legislative course of (passage via each the Home and Senate) to get it to the President’s desk for signature.

It’s actually vital that we’ve got momentum for a marathon, not a dash. I don’t need folks getting discouraged. The trajectory is to the moon however we’ve got to keep it up and work the method. Heaps to do however the EO was an ideal jumping-off level to get us there.”

So sure, the EO appears like a fast win for crypto execs wanting to pump their baggage. However the true struggle for Bitcoin’s future is simply starting.

A congressionally permitted SBR is healthier than an SBR through Government Order. Full cease!

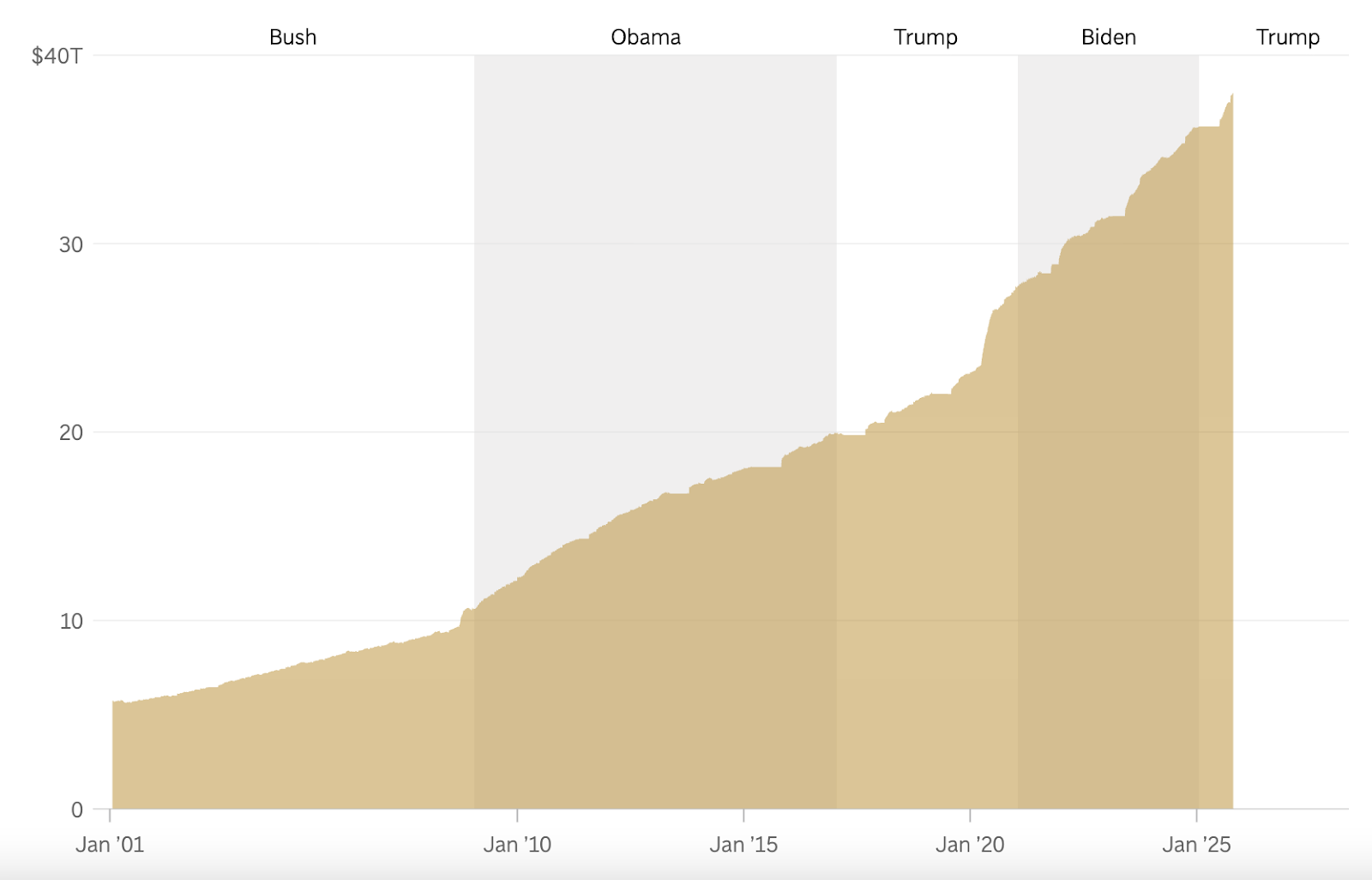

Bitcoin has all the time thrived in adversity. Whether or not it’s bans, restrictions, or now the “nationwide digital asset stockpile” nonsense, Bitcoin’s resilience is unmatched. As Senator Lummis works to push the Strategic Bitcoin Reserve Invoice via Congress, particular person states are already main the cost. States are introducing Bitcoin-specific reserve laws, not obscure “digital asset” plans.

In the meantime, international momentum is constructing. Putin didn’t say, “nobody can management digital property,” he mentioned “nobody can management Bitcoin”. Nation states aren’t about to FOMO into $TRUMP or FARTCOIN. They’re watching, studying, and inching nearer to Bitcoin.

Bitcoin wins as a result of it’s superior cash. Every bit of reports, even setbacks, is finally bullish for Bitcoin as a result of it exposes weaknesses in fiat and strengthens Bitcoin’s narrative. So keep affected person. The gradual burn can be price it.

See you in Vegas — and bear in mind: finest cash wins.

This text is a Take. Opinions expressed are fully the creator’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.