Please see this week’s market overview from eToro’s world analyst group, which incorporates the newest market information and the home funding view.

Most markets rose steadily in anticipation of Donald Trump’s presidency

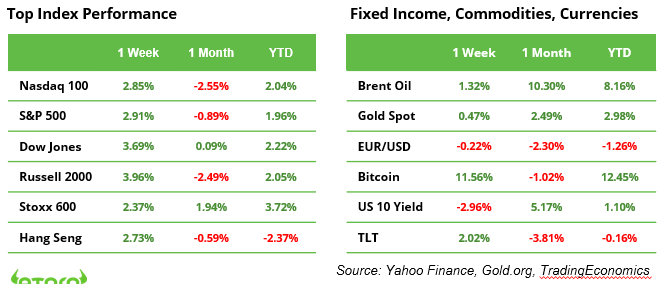

Final week provided one thing for each sort of investor. Bond and small-cap traders discovered some reduction in softer-than-expected inflation information, which induced the US 10-year yield to fall from 4.76% to 4.62%. Worth traders had been happy with strong US financial institution earnings, all of which exceeded expectations. Progress and AI traders welcomed TSMC’s announcement of a deliberate enhance in capital expenditures for 2025 to roughly $40 billion, sparking hypothesis about which portion will fund a brand new state-of-the-art manufacturing facility within the US.

In the meantime, cryptocurrency fanatics had been astonished by the launch of a Trump memecoin, which skyrocketed to billions in market worth. This surge additionally lifted Bitcoin by 11% (to a brand new alltime excessive of $108,900), though it induced a decline in lots of altcoins. China’s GDP progress within the fourth quarter of 2024 rose to five.4%, arguably pushed by front-loaded exports looking for to keep away from larger tariffs beneath Trump’s presidency.

Main fairness indices closed the week in optimistic territory. The S&P 500 and Nasdaq 100 had been up by 3%, whereas the Dow Jones and Russell 2000 gained 3.7% and 4.0%, respectively. The European STOXX 600 and the China-focused Cling Seng additionally posted features of two.4% and a pair of.7%, respectively. The UK FTSE 100 Index reached a brand new all-time excessive above 8,500 factors on Friday (see chart).

Macro Outlook for the week

This week in macro, traders will concentrate on the UK’s unemployment and wage progress information, following final week’s lower-than-expected inflation, retail gross sales, and GDP figures. Markets are factoring in important fee cuts by the Financial institution of England in 2025, aiming to facilitate a delicate touchdown for the financial system.

Consideration will even flip to Germany’s financial sentiment index, as traders search indicators of enhancing sentiment, notably in mild of current GDP information displaying the financial system contracted for a second consecutive yr. Notably, Germany stays the one main industrialized nation the place GDP per capita is projected to remain beneath 2019 ranges by means of 2025.

FTSE 100 Index reached a brand new all-time excessive above 8,500 factors on Friday

Who decides the destiny of the yen, the Financial institution of Japan or Donald Trump?

The yen and the euro have been dropping floor in opposition to the greenback for months, with the dollar buoyed by a robust US financial system and the “Trump Commerce,” pushed by proposed tax cuts and looming tariffs.

Final week introduced some reduction: EUR/USD climbed above 1.027, whereas USD/JPY fell 1% to 156.2. Yen merchants responded to Financial institution of Japan (BoJ) Governor Kazuo Ueda’s hints of a possible fee hike this Friday, following key inflation information due earlier that day.

Nevertheless, Japan’s choices stay restricted. Years of sluggish progress and excessive public debt preserve the financial system reliant on low rates of interest. Whereas the BoJ may stabilise the yen, a significant rally appears unlikely. A weaker US greenback might show extra impactful than any BoJ coverage shift.

The yen’s destiny could in the end relaxation with Trump. His inauguration on Monday might form markets, with a robust greenback nonetheless the baseline beneath his “America First” agenda. Nevertheless, softer tariffs or fiscal insurance policies might weaken the greenback and provides the yen some respite.

Earnings season: large names reporting

The earnings season is getting into its essential second week, with seven of the world’s prime 100 largest corporations reporting their 2024 This fall earnings (see beneath). Traders ought to recognise that some inventory costs could have been influenced by the upcoming presidential transition. In his ultimate days, Joe Biden allotted $26 billion to wash power initiatives. In the meantime, Donald Trump has repeatedly acknowledged his intention to impose a 20% tariff on all items bought to the US, and a 60% tariff particularly on items from China. Execution orders, signed by Trump in his first week, might change federal insurance policies from the beginning and trigger surprising market actions.

Macro and earnings information releases

Macro

UK unemployment, Germany ZEW (22/1), Japan CPI, BoJ fee resolution, International PMI (24/1)

Earnings

21 Jan. Netflix, Charles Schwab, 3M, United Airways

22 Jan. Procter & Gamble, Johnson & Johnson, GE Vernova, Amphenol

23 Jan. GE Aerospace, Texas Devices, American Airways

24 Jan. American Categorical, Verizon, NextEra Power

This communication is for data and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any specific recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.