Final up to date on January twelfth, 2025 at 02:14 pm

Whereas Bitcoin’s rise has undoubtedly created immense wealth, the distribution of that wealth raises important questions on who really advantages from its perpetual worth development—and at what price.

For a lot of, Bitcoin was initially seen as an inclusive monetary instrument, providing a substitute for conventional banking programs. Its potential to empower unbanked and underbanked populations, notably in growing nations, stays considered one of its most compelling guarantees. Nevertheless, the rise in Bitcoin’s worth and the tradition of “HODLing” have made this imaginative and prescient harder to comprehend.

In its early days, Bitcoin’s low price allowed people from all walks of life to build up and profit from its appreciation. Immediately, nonetheless, the typical individual in lower-income brackets is usually priced out of the market. Whereas Bitcoin can nonetheless be bought in fractions, the notion of it being a high-value asset discourages participation from those that would possibly profit most from its monetary inclusion potential.

The Focus of Wealth in Bitcoin

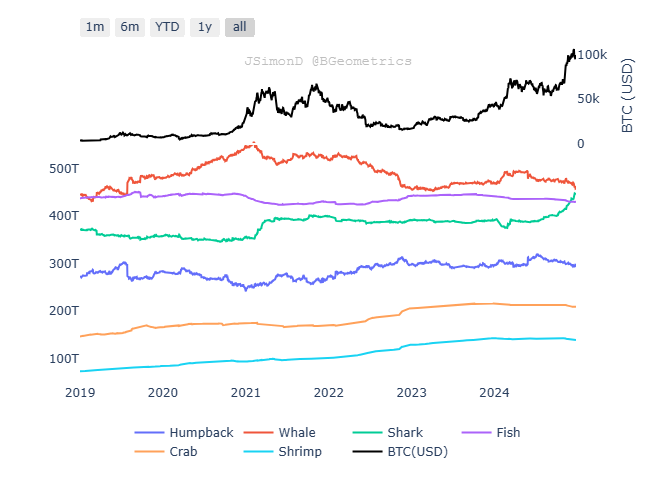

A key concern surrounding Bitcoin is its extremely concentrated possession. Knowledge reveals {that a} small fraction of Bitcoin addresses—generally known as “whales”—management a majority of the provision. As of late 2024, roughly 2% of Bitcoin addresses maintain almost 95% of all Bitcoin in circulation. These whales, who acquired Bitcoin in its infancy when costs had been a fraction of a cent, have amassed fortunes as Bitcoin’s worth has surged over time.

For instance, take into account Mr. Smith, a software program engineer who bought almost 20,000 Bitcoins in 2010 at $0.15 every with a modest $3,000 funding. By the point Bitcoin gained mainstream consideration, his holdings had been price thousands and thousands, permitting him to retire early and journey the world. Equally, Kane Ellis, a tech entrepreneur from South Australia, mined Bitcoin when it was simply $1.60 per coin. Immediately, tales like his—shopping for a Maserati or cashing out thousands and thousands—gasoline the favored picture of Bitcoin as a wealth generator. But these narratives obscure the truth for brand spanking new traders coming into the market at larger costs and going through larger monetary dangers.

The rising involvement of institutional gamers in Bitcoin has additional tilted the steadiness of energy. Companies, hedge funds, and funding corporations now maintain substantial quantities of Bitcoin, including to the focus of wealth. A distinguished instance is MicroStrategy, a enterprise intelligence agency that has change into considered one of Bitcoin’s largest company holders. As of late 2024, MicroStrategy holds over 423,000 BTC, a place price billions of {dollars}.

Bitcoin Accumulation HeatMap Over the Years.Supply: BGeometrics

Moreover, establishments profit from economies of scale, reminiscent of decrease transaction charges and entry to superior buying and selling instruments, giving them a aggressive edge over smaller traders. This additional exacerbates the hole between rich gamers and the broader inhabitants as the advantages of Bitcoin’s development change into more and more concentrated.

This focus of wealth implies that as Bitcoin’s worth will increase, the financial advantages disproportionately accrue to early adopters and rich traders. Latecomers, notably these with out substantial capital to take a position, are sometimes left with minimal returns—or worse, losses—when costs inevitably fluctuate. This dynamic undermines Bitcoin’s potential to function a democratizing monetary instrument.

Perpetual Worth Will increase: A Double-Edged Sword

Bitcoin’s perpetual worth will increase create a paradox. On one hand, its rising worth has attracted thousands and thousands of retail traders and legitimized Bitcoin as a retailer of worth akin to digital gold. Then again, these worth will increase create obstacles to entry for lower-income people, successfully pricing them out of significant participation.

The speculative nature of Bitcoin’s market additional exacerbates this situation. Bitcoin’s worth development is basically fueled by investor hypothesis somewhat than the creation of tangible items or providers, in contrast to conventional investments like shares or actual property. This hypothesis advantages these with the monetary sources to purchase and maintain Bitcoin throughout unstable intervals, whereas these with restricted capital usually face important dangers. Market crashes, for instance, disproportionately hurt smaller traders who’re compelled to promote at a loss, reinforcing present inequalities.

Speculative bubbles, an indicator of Bitcoin’s worth historical past, illustrate how this dynamic performs out. Throughout these bubbles, costs usually soar far past Bitcoin’s utility or intrinsic worth. Rich traders can afford to carry their property throughout downturns, finally reaping important positive aspects when costs rebound. In distinction, smaller traders who entered throughout a peak are sometimes left with monetary losses. This cycle perpetuates wealth focus amongst those that already possess the means to endure the market’s swings.

Volatility and Financial Mobility

Bitcoin’s volatility presents one other important barrier to financial mobility. For these with substantial sources, volatility may be a chance to generate wealth via well-timed investments. Nevertheless, for people with restricted means, the market’s wild worth swings create a high-risk setting that always results in monetary losses.

This dynamic locks many potential customers out of the advantages of Bitcoin’s development. When the market crashes, these with much less capital are ceaselessly compelled to promote at a loss, whereas wealthier traders can afford to attend for restoration. This creates a suggestions loop through which the rich accumulate extra Bitcoin, additional entrenching wealth inequality.

The Position of “HODL” Tradition in Wealth Inequality

The “HODL” tradition—the place Bitcoin holders refuse to promote, anticipating additional worth will increase—has performed a major function in shaping Bitcoin’s present trajectory. Whereas this behaviour contributes to shortage and, by extension, worth appreciation, it additionally exacerbates wealth inequality. By limiting the provision of Bitcoin in circulation, the “HODL” tradition ensures that entry to Bitcoin turns into more and more tough for brand spanking new contributors, notably these in lower-income brackets.

This cultural phenomenon additionally shifts Bitcoin additional away from its unique goal as a decentralized forex for peer-to-peer transactions. As an alternative of facilitating on a regular basis financial actions, Bitcoin has change into a long-term speculative asset, hoarded somewhat than spent. This undermines its utility as a medium of change and its potential to foster monetary inclusion.

RELATED: HODL or Spend? Bitcoin’s Identification Disaster within the Age of Lengthy-Time period Buyers

For Bitcoin to regain its promise of democratizing finance, there have to be a cultural and sensible shift. Encouraging broader participation and using Bitcoin for transactions somewhat than hypothesis may assist bridge the hole between its early adopters and newer contributors. With out such adjustments, Bitcoin dangers entrenching the very financial disparities it was designed to problem.

The Want for a Shift in Bitcoin’s Trajectory

If Bitcoin is to fulfil its promise of decentralization and monetary empowerment, important adjustments are vital. Technological developments, reminiscent of enhancements in transaction scalability and decrease charges, may make Bitcoin extra accessible and sensible for on a regular basis use. Initiatives just like the Lightning Community, which goals to facilitate sooner and cheaper Bitcoin transactions, characterize steps in the best route.

Equally vital is a cultural shift throughout the Bitcoin group. Transferring away from a purely speculative mindset towards one which prioritizes inclusion and utility may assist broaden Bitcoin’s attain. This would possibly contain encouraging using Bitcoin for transactions somewhat than hoarding and selling schooling initiatives to demystify its adoption for much less tech-savvy customers.

Moreover, policymakers and builders should work to deal with the obstacles that forestall lower-income people from collaborating within the Bitcoin ecosystem. Options reminiscent of simpler onboarding processes, decrease minimal funding thresholds, and community-driven initiatives may assist make Bitcoin extra equitable and inclusive.

Last Ideas: Rethinking Bitcoin’s Position in Wealth Redistribution

Bitcoin’s journey from a decentralized forex to a speculative retailer of worth has been each outstanding and polarizing. Whereas it has created immense wealth for early adopters and institutional traders, it has additionally highlighted important flaws in its skill to foster financial equality. The focus of wealth, the speculative nature of its market, and the rising dominance of institutional gamers all level to a necessity for reevaluation.

To actually align with its unique beliefs, Bitcoin should evolve right into a instrument that works for everybody, not simply the rich. This may require each technological improvements and a cultural shift throughout the Bitcoin group. By fostering larger accessibility and inspiring broader participation, Bitcoin can reclaim its promise as a pressure for monetary empowerment and inclusion.

In the end, the query stays: can Bitcoin transcend its speculative origins to change into a car for social good? The reply is dependent upon the collective efforts of its group, builders, and stakeholders. If Bitcoin’s trajectory continues on its present path, it dangers changing into a logo of exclusion somewhat than empowerment. Nevertheless, with the best adjustments, it will probably nonetheless understand its potential as a transformative pressure within the world monetary panorama.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein needs to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. At all times conduct due diligence.

If you want to learn extra market analyses like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”