KeyTakeaways:

EU banks are launching stablecoins with new rules providing clearer pointers.US banks are testing stablecoins however want clearer guidelines on reserves and insurance coverage.Ripple’s RLUSD stablecoin positive factors traction as central banks discover digital currencies.

The U.S. and European banks are getting ready to problem their stablecoins.

As famous by Bloomberg, this development comes as regulatory frameworks solidify, providing conventional monetary establishments a clearer path ahead within the crypto market.

The introduction of the EU’s Markets in Crypto-Belongings Regulation (MiCA) and the continued improvement of blockchain cost options are driving banks to compete with established crypto companies.

European Banks Seize Stablecoin Alternatives

In Europe, the regulatory readability supplied by MiCA is encouraging an rising variety of banks to develop and problem stablecoins. MiCA, set to take impact on Dec. 30, 2024, requires stablecoin issuers to acquire licenses and adjust to reserve administration and investor safety requirements.

Nonetheless, France’s Societe Generale, Forge (SG-Forge) has opened its Euro-backed stablecoin to retail traders. Different European banks, together with Oddo BHF SCA from Frankfurt and Revolut in London, additionally need to launch Euro-pegged stablecoins.

Presently in discussions with round ten different banks for potential partnerships, SG-Forge sees the development as a step towards widespread adoption. As extra monetary establishments discover stablecoin issuance, there’s rising confidence within the viability of those digital belongings in conventional banking ecosystems.

US Banks Await Readability on Stablecoin Laws

Throughout the Atlantic, U.S. banks intently monitor regulatory adjustments to find out after they can start providing stablecoins. Whereas some banks, like JPMorgan Chase, have already began testing blockchain-based cost programs, the shortage of clear rules round reserve necessities and federal insurance coverage for stablecoin-backed deposits presents hurdles.

JPMorgan has carried out inside transfers utilizing its JPM Coin however is awaiting additional regulatory readability on open-access stablecoin issuance. The financial institution anticipates broader market acceptance inside the subsequent three years, with stablecoins and tokenized deposits coexisting as complementary cost strategies.

Ripple’s RLUSD Stablecoin and the Rise of Central Financial institution Digital Currencies

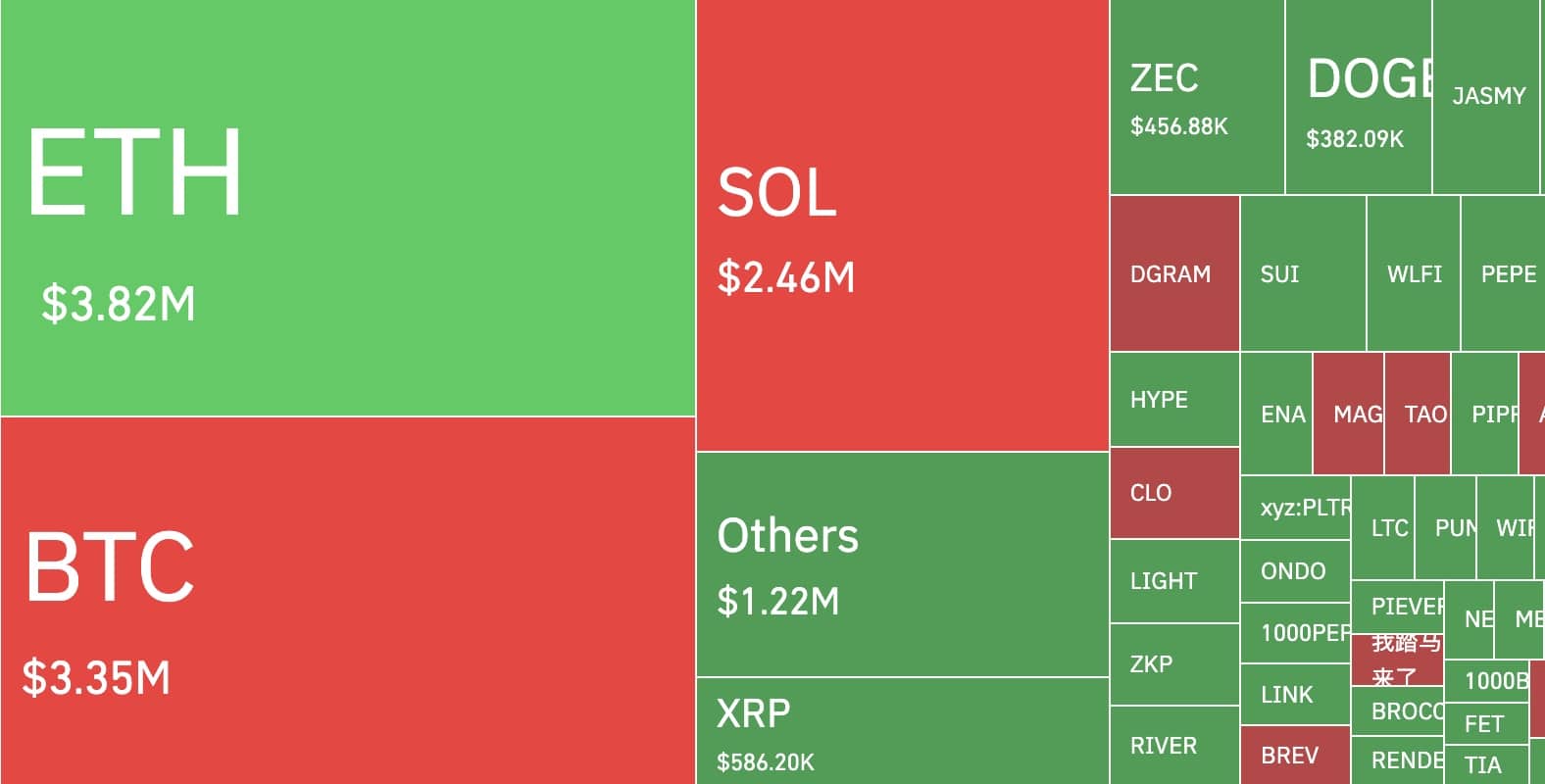

Amidst rising industrial financial institution curiosity in stablecoins, Ripple’s RLUSD stablecoin, launched on Dec. 16, 2024, has instantly impacted the worldwide crypto market. The RLUSD stablecoin has already been listed on the Unbiased Reserve trade in Singapore, increasing its attain in Asia.

In the meantime, central banks proceed their exploration of central financial institution digital currencies (CBDCs), which might ultimately rival and even substitute bank-issued stablecoins in wholesale cost programs. A number of monetary establishments are additionally contemplating creating consortium-backed cash for broader blockchain interoperability.