As of December 15, 2024, the groundwork for an enormous wave of Bitcoin adoption is firmly in place. Pushed by the convergence of regulatory readability, institutional infrastructure, and corporate-friendly accounting requirements, Bitcoin is positioned to rework international finance at an unprecedented scale. Michael Saylor’s imaginative and prescient of Bitcoin probably reaching $1 million per coin now not feels speculative — it’s more and more possible.

Michael Saylor, the co-founder of MicroStrategy and a distinguished Bitcoin advocate, has lengthy pointed to a few key catalysts that might propel Bitcoin adoption amongst establishments and companies:

1. Spot Bitcoin ETF Approval

Spot Bitcoin Change-Traded Funds (ETFs) enable conventional buyers — comparable to pension funds, mutual funds, and retail buyers — to realize publicity to Bitcoin with out instantly buying or holding the asset. These ETFs are already authorized and in full swing, attracting important institutional cash. The approval has supplied a bridge between the standard monetary system and Bitcoin, delivering elevated liquidity and value discovery.

2. Conventional Financial institution Custody Companies

Main monetary establishments now provide Bitcoin custody companies, legitimizing Bitcoin as an asset class. Banks comparable to JPMorgan, Citibank, and Goldman Sachs have moved into Bitcoin custody, offering safe, regulated storage for Bitcoin. For conventional buyers, this represents a vote of confidence from the monetary institution. It reduces perceived dangers of holding Bitcoin whereas encouraging broader institutional adoption.

3. Truthful Worth Accounting Guidelines from FASB

The Monetary Accounting Requirements Board (FASB) has enacted transformative modifications to the best way companies account for Bitcoin on their stability sheets. Beneath the earlier accounting guidelines, firms holding Bitcoin needed to mark it down as an impairment loss if its value declined, even quickly. Nevertheless, they may not mark up the worth if the worth rebounded, resulting in an uneven and overly cautious therapy of Bitcoin in company monetary reporting.

https://x.com/saylor/standing/1734962747740152007

As of December 2024, the brand new FASB guidelines enable firms to account for Bitcoin holdings at truthful market worth. This transformation means:

• Bitcoin can now be reported at its present market worth on monetary statements.

• Firms can acknowledge beneficial properties when Bitcoin’s value will increase, eradicating a major reporting drawback.

• The accounting therapy is now aligned with different marketable property, making Bitcoin a much more engaging possibility for firms.

This seemingly technical change eliminates a significant hurdle that beforehand discouraged companies from holding Bitcoin. With truthful worth accounting, companies can confidently allocate Bitcoin to their treasury reserves with out worry of distorted monetary statements.

The impression of the brand new FASB accounting guidelines can’t be overstated. For firms, this growth makes Bitcoin a sensible and interesting asset for treasury administration and long-term funding. Right here’s why:

1. Enhanced Steadiness Sheet Transparency

By permitting Bitcoin to be marked to truthful worth, companies can now present a extra correct reflection of their monetary well being. If Bitcoin appreciates, these beneficial properties will likely be mirrored in quarterly and annual monetary stories, boosting investor confidence.

2. Improved Company Treasury Technique

Bitcoin, typically dubbed “digital gold,” is more and more seen as a hedge towards inflation and foreign money debasement. The FASB rule change empowers CFOs to allocate company reserves to Bitcoin with out accounting penalties, positioning it as a viable various to money and conventional safe-haven property like gold.

3. Attracting Shareholder Curiosity

Institutional and retail buyers favor firms with sturdy, clear stability sheets and progressive treasury methods. By holding Bitcoin and accounting for it at truthful worth, companies can entice buyers in search of publicity to Bitcoin’s upside whereas benefiting from the corporate’s core operations.

4. Normalization of Bitcoin on Company Ledgers

The FASB rule serves as an endorsement of Bitcoin’s legitimacy as a company asset. By treating it like different monetary devices, it reduces stigma and will increase acceptance.

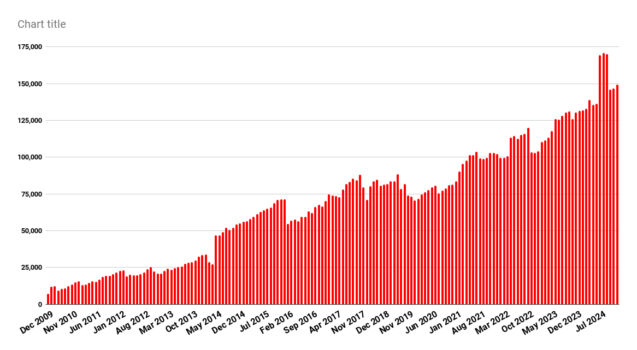

With all three catalysts — Spot ETFs, Financial institution Custody, and FASB Accounting — now in play, Bitcoin adoption is accelerating quickly. Right here’s how these forces work together:

• Spot Bitcoin ETFs gas demand from institutional buyers and retail contributors, driving liquidity and value appreciation.

• Financial institution Custody Companies handle the safety and regulatory issues of establishments, making Bitcoin simpler to retailer and handle.

• FASB Truthful Worth Guidelines allow companies to confidently add Bitcoin to their stability sheets, additional validating Bitcoin as a long-term retailer of worth.

As establishments and companies allocate growing quantities of capital to Bitcoin, the ensuing demand will naturally drive up its value. Rising costs will entice much more curiosity, making a constructive suggestions loop.

Michael Saylor’s prediction of Bitcoin reaching $1 million per coin hinges on the thought of Bitcoin turning into the world’s premier retailer of worth — a substitute for gold, money, and bonds. With the regulatory and structural obstacles now eliminated, Bitcoin’s adoption amongst establishments and companies will speed up exponentially.

Right here’s the pathway to $1 million:

• World companies allocate simply 1–5% of their treasury reserves to Bitcoin.

• Institutional buyers combine Bitcoin as a strategic asset of their portfolios, much like gold.

• The full addressable marketplace for Bitcoin grows as confidence in its infrastructure and regulatory framework strengthens.

• Bitcoin strategic reserves begin to take maintain everywhere in the globe.

With a hard and fast provide of 21 million cash and growing demand from a few of the largest monetary gamers on the planet, Bitcoin’s value appreciation is inevitable.

The alignment of spot Bitcoin ETFs, financial institution custody companies, and FASB’s truthful worth accounting guidelines marks a turning level for Bitcoin adoption. For establishments and companies, the obstacles have been eliminated, and the incentives to embrace Bitcoin are stronger than ever.

What was as soon as seen as a speculative asset has now matured right into a professional, scalable retailer of worth. As adoption accelerates, Bitcoin’s value trajectory towards $1 million seems not simply practical, however inevitable.

The items are in place — it’s solely a matter of time.

Observe me on X https://x.com/jmoroles1981