Este artículo también está disponible en español.

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, appears to be drawing consideration as analysts observe market metrics that signifies the potential subsequent transfer for ETH.

Latest knowledge from CryptoQuant has highlighted patterns in accumulation and exchange-traded fund (ETF) inflows, offering an in depth take a look at Ethereum’s potential trajectory because it underperforms relative to Bitcoin within the present cycle.

Associated Studying

Analyzing Traits in Accumulation and ETF Inflows

In a sequence of posts shared on social media platform X, CryptoQuant analysts dissected Ethereum’s key metrics. One of many standout observations was Ethereum’s steadiness in accumulation addresses. These addresses now maintain roughly 19.5 million ETH, valued at round $78 billion.

For comparability, Bitcoin accumulation addresses maintain about 2.8 million BTC, price $280 billion. Whereas the greenback worth of Bitcoin held is 4 instances bigger than Ethereum, this aligns with their relative market capitalizations, providing insights into investor behaviour.

One other essential metric spotlighted was the regular influx into Ethereum-focused ETFs over the previous months. Notable spikes have been recorded on a number of key dates, together with $1.1 billion on November 11 and $839 million on December 4, 2024.

In line with the CryptoQuant analysts, these constant inflows are a robust indicator of institutional shopping for curiosity, reinforcing Ethereum’s rising enchantment amongst large-scale buyers.

The Ethereum ETF has seen regular inflows in current months.

Key spikes on:

Nov 11, 2024: $1,100MNov 21, 2024: $754MNov 25, 2024: $629MNov 27, 2024: $883MDec 4, 2024: $839M

These inflows mirror sturdy shopping for strain. pic.twitter.com/OIwWNmRPYB

— CryptoQuant.com (@cryptoquant_com) December 10, 2024

Regardless of the sturdy ETF demand, Ethereum’s value actions have been much less dramatic in comparison with Bitcoin’s efficiency on this cycle. Traditionally, Ethereum’s value peaks have trailed Bitcoin’s, as seen through the 2021 bull run.

At the moment, Bitcoin hit an all-time excessive (ATH) in March with a 480% achieve, whereas Ethereum peaked few months after with roughly 1,114% enhance. Nonetheless, within the present cycle, Ethereum seems to be underperforming, signaling a shift in market dynamics.

Taker Quantity and Potential Progress

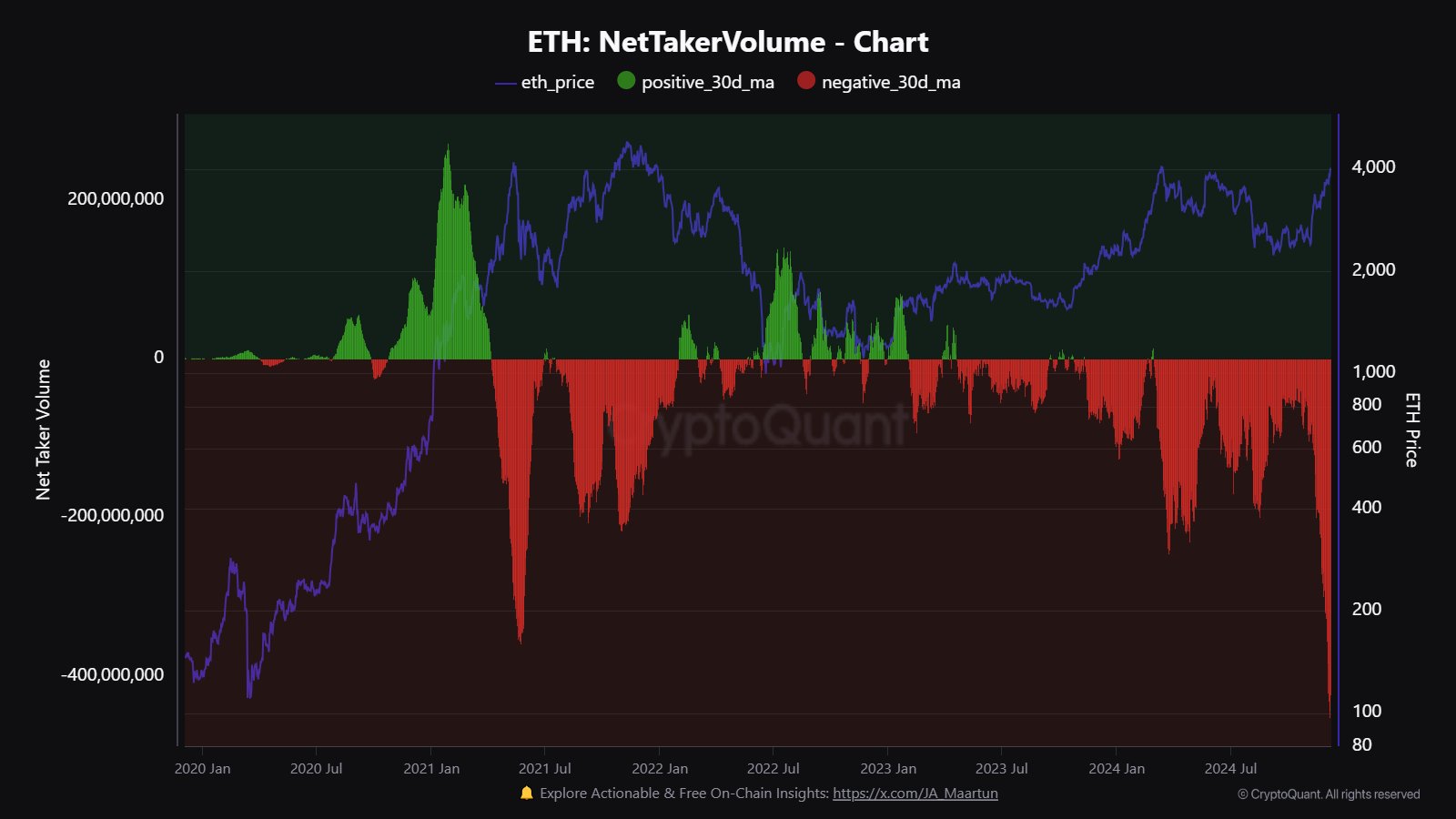

Moreover, a big space of concern the analysts talked about is the Ethereum’s taker quantity, which displays market sentiment by evaluating aggressive shopping for and promoting exercise.

CryptoQuant reported that Ethereum’s taker-seller quantity has hit a file low of -400 million. This aggressive promoting exercise is paying homage to patterns noticed earlier than its ATH in 2021. Whereas the present promoting strain could appear bearish, it may additionally sign a market nearing a essential pivot level.

Ethereum Taker Quantity is at its lowest degree on file.

Ethereum’s value weak point is because of excessive taker-seller quantity, now at a file low of -400 million, indicating aggressive promoting.

An analogous sample occurred earlier than Ethereum’s peak in Could 2021. Regardless of this, there should… pic.twitter.com/OmRYvAzjxI

— CryptoQuant.com (@cryptoquant_com) December 10, 2024

The analysts emphasised that Ethereum’s underperformance on this cycle doesn’t preclude the potential for important development.

Associated Studying

The interaction between accumulation patterns, ETF inflows, and taker quantity means that Ethereum may nonetheless have room for upward momentum.

Featured picture created with DALL-E, Chart from TradingView