Victoria d’Este

Printed: December 09, 2024 at 12:13 pm Up to date: December 09, 2024 at 12:14 pm

Edited and fact-checked:

December 09, 2024 at 12:13 pm

In Transient

Bitcoin surged previous $100K, Ethereum reclaimed $4K, whereas Toncoin had a quiet week regardless of institutional backing and adoption updates.

Bitcoin Information & Macro

As you’d anticipate, Bitcoin completely dominated the highlight this week, smashing previous the long-anticipated $100,000 barrier. The surge was fueled by heavy institutional buy-in. The runaway success of Bitcoin ETFs like BlackRock’s iShares Bitcoin Belief, has propelled confidence to new highs. BlackRock’s belief alone now controls over 500,000 BTC, valued at $48 billion — a testomony to institutional religion in Bitcoin.

Supply: Thomas Fahrer

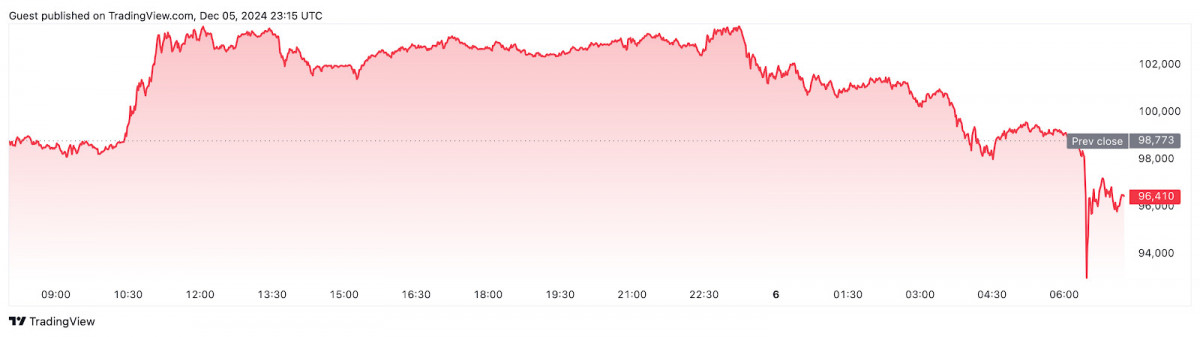

Nonetheless, the climb wasn’t with out its drama. A flash crash briefly despatched BTC tumbling to $93,000, wiping out $303 million in lengthy positions in minutes. However Bitcoin proved its mettle, snapping again to the $100,000 vary. Analysts see this consolidation as a pause earlier than the subsequent leg up, with targets of $115,000 looming as liquidity continues to flood in.

Bitcoin was buying and selling at $96,410 on the time of publication. Supply: TradingView

MicroStrategy doubled down on its Bitcoin wager, scooping up $1.5 billion value of BTC in a single week.

MicroStrategy stays the most important company Bitcoin holder. Supply: BitcoinTreasuries

This aggressive transfer underscores the rising development of companies utilizing Bitcoin as a strategic asset to protect in opposition to inflation and forex dangers. Such daring acquisitions ripple by way of the market, stoking optimism and drawing recent members, each institutional and retail.

Additionally, you will have heard of South Korea’s fleeting martial legislation, which triggered a pointy selloff within the BTC/KRW pair. So Bitcoin’s nonetheless delicate to geopolitical shocks.

BTC/KRW exercise on South Korea-based crypto change Upbit. Supply: Upbit

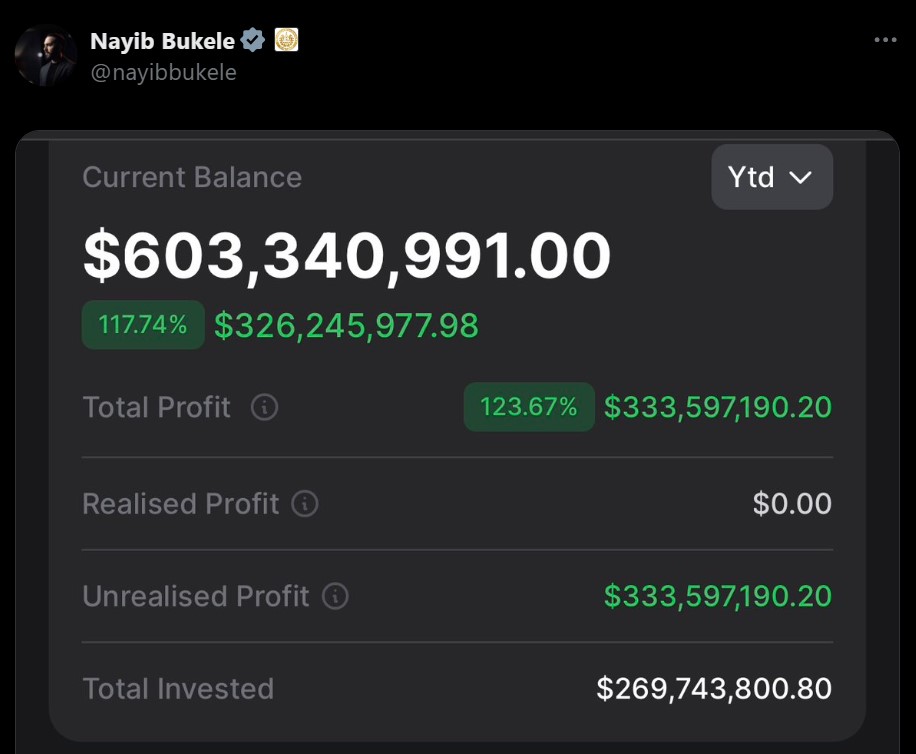

In the meantime, El Salvador’s BTC stash soared, with unrealized good points topping $300 million. Positive sufficient, it is a highly effective validation of its Bitcoin-first financial coverage. Whispers have been stirred of different nations contemplating related strikes.

Supply: Nayib Bukele

The broader image reveals Bitcoin tightening its grip available on the market. With dominance climbing to 57%, altcoins are taking a backseat, and futures markets are buzzing with bullish bets.

BTC Value Evaluation

On the technical entrance, BTC spent the week teasing merchants with a flirtation across the (as soon as) legendary $100K milestone.

BTC/USD 1D Chart, Coinbase. Supply: TradingView

The preliminary breakout above $100K appeared promising, with a push to $102K, however the rally fizzled quick. Sellers stepped in onerous, driving the value again to $97K, the place patrons made their stand. This pullback wasn’t simply technical; it felt just like the market testing whether or not the bulls had the resolve to defend their floor.

BTC/USD 4H Chart, Coinbase. Supply: TradingView

Zooming into the 4-hour chart, BTC has been caught in a good squeeze, bouncing between $97K assist and $100K resistance. The failed push above $100K gave strategy to a textbook bear flag, hinting at a possible breakdown if momentum fades additional. Nonetheless, patrons have defended the 50-EMA on intraday strikes, displaying there’s life left on this vary. A decisive breakout above $100K would open the floodgates for a rally towards $105K, whereas dropping $97K might set off a slide to $95K or worse. Both method, this isn’t simply one other vary – it’s a battleground.

Ethereum Information & Macro

Ethereum additionally received a chunk of the highlight, reclaiming the $4,000 mark for the primary time since March. Institutional traders are piling in as Ether ETFs are seeing a jaw-dropping $1.3 billion in inflows over two weeks.

Supply: Anthony Sassano

BlackRock’s $500 million increase to its ETH ETF holdings is a transparent sign that Ethereum isn’t simply driving Bitcoin’s coattails — it’s carving out its personal path as BTC cruises previous $100,000.

Blackrock ETH ETF holdings. Supply: Arkham Intelligence

The climb previous the $4,000 resistance isn’t a mere a psychological win – it’s setting the stage for Ether to push into uncharted territory.

Ethereum’s energy relative to Bitcoin can be turning heads. After months of lagging, the ETH/BTC pair is displaying indicators of life. Specialists are calling for a strong rebound within the months forward. This resurgence is backed by Ethereum’s fundamentals, together with the Beacon Chain’s rising reliability and a gradual stream of developments in layer-2 scaling.

The ETH/BTC ratio is up 9.14% over the previous 30 days. Supply: TradingView

Past value motion, Ethereum’s dominance in DeFi and NFTs stays rock-solid. Weekly NFT gross sales topped $187 million, additional showcasing the community’s unparalleled versatility.

Prime NFT collections by seven-day gross sales volumes. Supply: CryptoSlam

With buying and selling volumes hitting recent highs and Ethereum’s ecosystem increasing, it’s clear that Ether is way from performed making massive strikes.

ETH Value Evaluation

Talking of strikes, Ethereum’s battle across the $4,000 milestone has just about outlined the previous week. On the every day chart, a rally pushed the value above this psychological degree, breaking out from weeks of consolidation.

ETH/USD 1D Chart, Coinbase. Supply: TradingView

However the failure to maintain closes above $4,000 signaled a shift — rejection candles and rising promote strain hinted at fading bullish momentum. The 20-EMA acted as assist in the course of the climb however is now underneath strain. Whereas the broader uptrend stays intact above the 50-EMA, the decisive shut under $4,000 has flipped it into resistance, elevating questions on short-term energy.

ETH/USD 4H Chart, Coinbase. Supply: TradingView

On the 4-hour chart, a false breakout at $4,100 triggered a pointy selloff, with the 50-EMA catching the dip as short-term assist. A descending triangle close to $4,000 broke down, intensifying the transfer decrease. The RSI mirrored this shift, sliding towards oversold territory and reinforcing bearish momentum. Assist round $3,840, tied to prior every day lows, has stabilized value motion for now, suggesting doable accumulation. If bulls can reclaim $4,000 with conviction, it might set the stage for one more take a look at of $4,100. For now, the market seems caught in a tug-of-war, reassessing its conviction at this key degree.

Toncoin Information & Macro

It’s been a gradual week for TON Coin, with comparatively few main developments. On December 3, Pantera Capital dropped information of a file funding into the TON ecosystem, together with an additional $20 million raised for additional blockchain initiatives.

Supply: Panteracapital.com

Whereas this alerts severe institutional backing, the market barely flinched, doubtless reflecting a

broader cool-off in crypto sentiment.

A few days later, P2P.org introduced its growth into TON staking, letting customers stake as little as one TON with no pool limits.

TON tokens locked in liquid staking protocols. Supply: Tonstat

The transfer makes staking extra accessible, boosting TON’s usability. However once more, the market response was underwhelming, displaying that even adoption-focused updates couldn’t stir a lot motion this week.

In the meantime, Telegram founder Pavel Durov testified in a French court docket on December 6 following his latest arrest. Whereas the case isn’t instantly tied to TON, Durov’s connection to the blockchain retains these authorized strikes on the radar for TON watchers. His remarks — expressing religion within the French authorized system whereas staying mum on the allegations — did little to influence the coin.

Pavel Durov and his lawyer David-Olivier Kaminski arrive on the Paris judicial court docket on December 6, 2024. © Thomas SAMSON / AFP

So yeah, it’s been a quiet stretch for TON. However who is aware of – perhaps it’s the calm earlier than the storm?

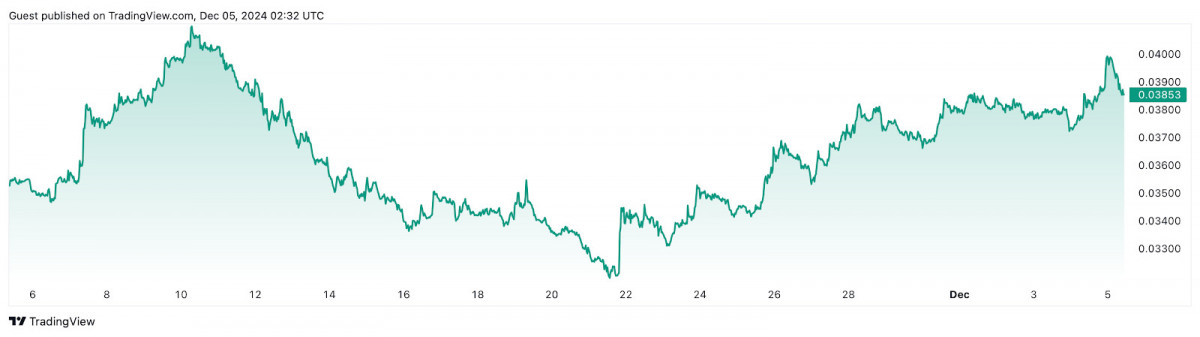

TON Value Evaluation

On the 1D chart, Toncoin (TON) began the week with a pointy rally, breaking above $6.60 resistance and pushing towards $7, fueled by sturdy bullish momentum. The 20-day EMA supported the transfer, staying properly above the 50-day EMA — a traditional signal of sustained upward strain.

TON/USD 1D Chart. Supply: TradingView

However as the value approached the $7 psychological barrier, momentum light. A transparent rejection sparked a decisive sell-off, breaking assist at $6.70 and ending the week close to $6.50 — a bearish sign heading into subsequent week. The $6.30 degree, a previous pivot zone from late November, now stands as a crucial assist, whereas $6.80 flips into fast resistance.

TON/USD 4H Chart. Supply: TradingView

The 4H chart reveals the rally stalling right into a rising wedge — a bearish setup that delivered on its breakdown. The rejection at $6.80 led to an accelerated drop, with the 50-EMA on this timeframe flipping from assist to resistance. RSI confirmed the shift, sliding from overbought into oversold as promoting strain intensified. Key weekly ranges — $6.50 and $6.30 — are actually pivotal. If $6.30 offers method, the subsequent cease could possibly be $6.00, a significant demand zone. Bulls might want to reclaim $6.80 to regain management, however the tone for now could be firmly bearish.

Disclaimer

In keeping with the Belief Mission pointers, please notice that the data offered on this web page isn’t supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or some other type of recommendation. You will need to solely make investments what you possibly can afford to lose and to hunt unbiased monetary recommendation when you have any doubts. For additional data, we recommend referring to the phrases and situations in addition to the assistance and assist pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover.

About The Writer

Victoria is a author on quite a lot of expertise matters together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to jot down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on quite a lot of expertise matters together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to jot down insightful articles for the broader viewers.