This week, the monetary world and Bitcoin value are bracing for a cascade of vital financial experiences, together with the Federal Open Market Committee minutes (FOMC), alongside a high-stakes occasion throughout the cryptocurrency market.

From Federal Reserve deliberations to the expiration of billions in Bitcoin and Ethereum choices, an ideal storm of things may amplify volatility within the days forward.

Federal Reserve FOMC Minutes Set the Tone for Danger Property Like Bitcoin Value

Wednesday, November 27, marks the discharge of the Federal Reserve’s November assembly minutes—a date that holds Wall Avenue’s collective consideration. Traders will comb via, in search of any shifts in technique, like rethinking the two% inflation benchmark or easing up on charges. Any lean towards financial loosening may jolt danger belongings to life, and crypto received’t miss the social gathering.

“The Fed’s coverage route in these unsure occasions may decide the trajectory of worldwide monetary markets,” mentioned monetary analyst Mark Brown.

https://twitter.com/financefelix/standing/1861055149432545449

Inflation takes heart stage on Wednesday, November 27, because the PCE value index—the Fed’s go-to metric—will drop for traders to view. Most forecasts put it at a modest 0.2% month-over-month and a pair of.3% year-over-year.

Stripping out meals and power, core PCE inflation may hit 2.8%, hinting at mounting financial pressure. Including weight to the day, Q3 2024 GDP revisions are set to provide a sharper learn on financial efficiency.

Additionally on the calendar is the revision of U.S. GDP figures for Q3 2024, which can present a recent lens into the nation’s financial well being. Irrespective of how the information lands—above or under projections—its shockwaves will ripple via the markets, shaking up every thing from blue chips to meme cash.

DON’T MISS: Finest New Cryptocurrencies to Spend money on 2024

Merchants Put together for Volatility with $10 Billion in Bitcoin and Ethereum Choices Expiring

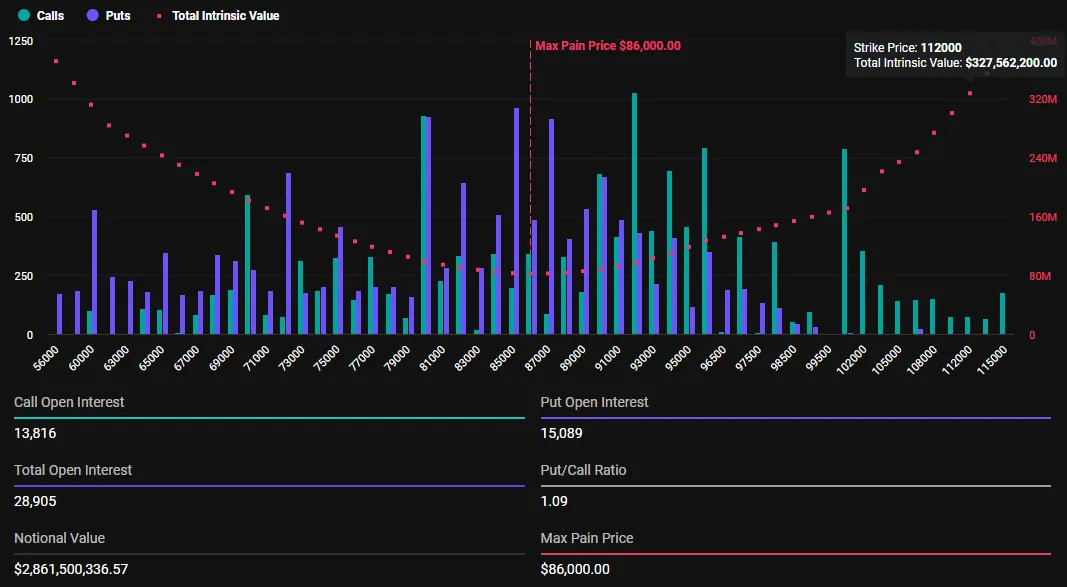

One other layer of rigidity is that on November 29, $10 billion price of crypto choices hit their expiration dates, creating an electrical cost available in the market. Bitcoin leads the motion, with $9.1 billion tied up and a put/name ratio of 0.80, whereas Ethereum’s $1.24 billion wagers mirror a 0.77 ratio.

The max ache ranges—$77,000 for Bitcoin and $2,800 for Ethereum—are a battleground of diverging predictions, setting merchants on edge.

Mega choices expirations like these usually spawn short-lived market chaos as merchants scramble to reposition. “Pullbacks could come,” veteran dealer Peter Brandt remarked, “however the long-term bull run for crypto stands agency.”

Crypto Faces a Essential Intersection

The query stays whether or not cryptocurrencies will climate this twin problem with resilience or see intensified volatility that exams investor confidence. For now, all eyes are on this action-packed week that would redefine short-term narratives throughout each conventional and digital monetary landscapes.

Whether or not you’re a crypto fanatic or an financial observer, this week guarantees to ship key insights—and the potential for dramatic market shifts. Buckle up as a result of volatility is knocking on the door.

EXPLORE: 20 New Crypto Cash to Spend money on 2024

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The publish What Does FOMC Minutes Tomorrow Imply For Bitcoin Value and Crypto Bull run? appeared first on .