Bitcoin’s current value motion has been nothing wanting exhilarating, however past the market buzz lies a wealth of on-chain information providing deeper insights. By analyzing metrics that gauge community exercise, investor sentiment, and the BTC market cycles, we will acquire a clearer image of Bitcoin’s present place and potential trajectory.

A lot Of Upside Remaining

The MVRV Z-Rating compares Bitcoin’s market cap, or value multiplied by circulating provide, with its realized cap, which is the typical value at which all BTC have been final transacted. Traditionally, this metric indicators overheated markets when it enters the crimson zone, whereas the inexperienced zone suggests widespread losses and potential undervaluation.

View Dwell Chart 🔍

Presently, regardless of Bitcoin’s rise to new all-time highs, the Z-score stays in impartial territory. Earlier bull runs noticed Z-scores attain highs of seven to 10, far past the present stage of round 3. If historical past repeats, this means vital room for additional value development.

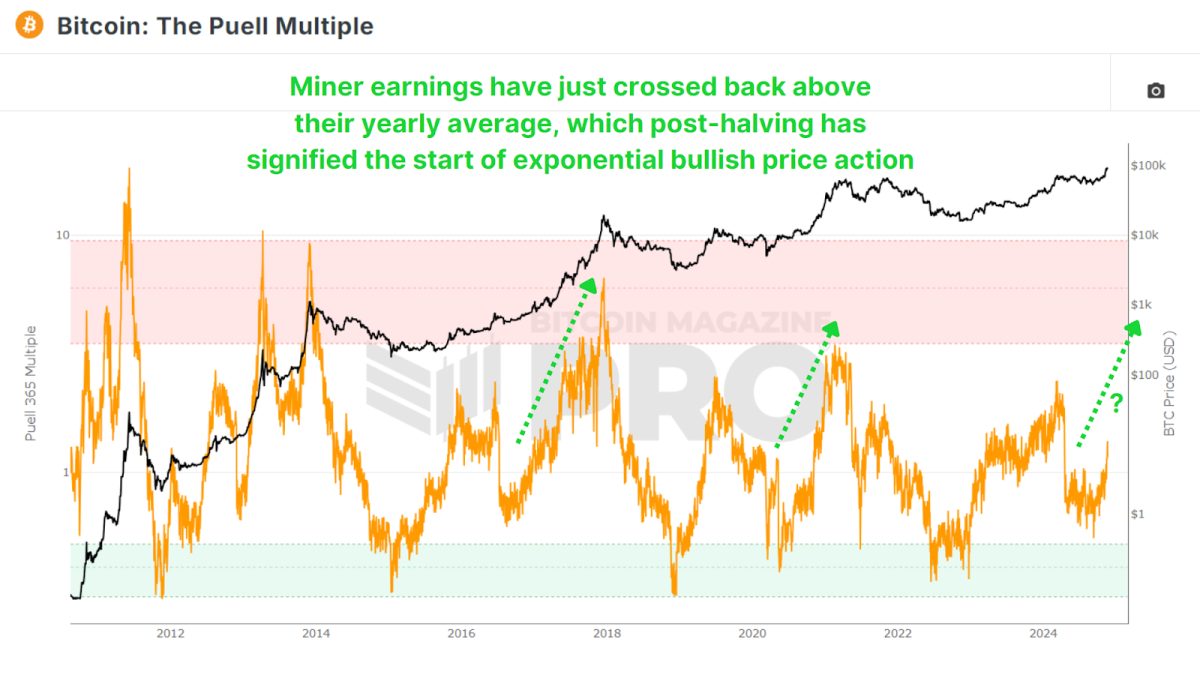

Miner Profitability

The Puell A number of evaluates miner profitability by evaluating their day by day USD-denominated income to their earlier one-year transferring common. Publish-halving, miners’ earnings dropped by 50%, which led to a multi-month interval of decreased earnings because the BTC value consolidated for many of 2024.

View Dwell Chart 🔍

But even now, as Bitcoin has skyrocketed to new highs, the a number of signifies solely a 30% improve in profitability relative to historic averages. This implies that we’re nonetheless within the early to center levels of the bull market, and when evaluating the patterns within the information we appear to be we’ve the potential for explosive development akin to 2016 and 2020. With a post-halving reset, consolidation, and a lastly a reclaim of the 1.00 a number of stage signifying the exponential section of value motion.

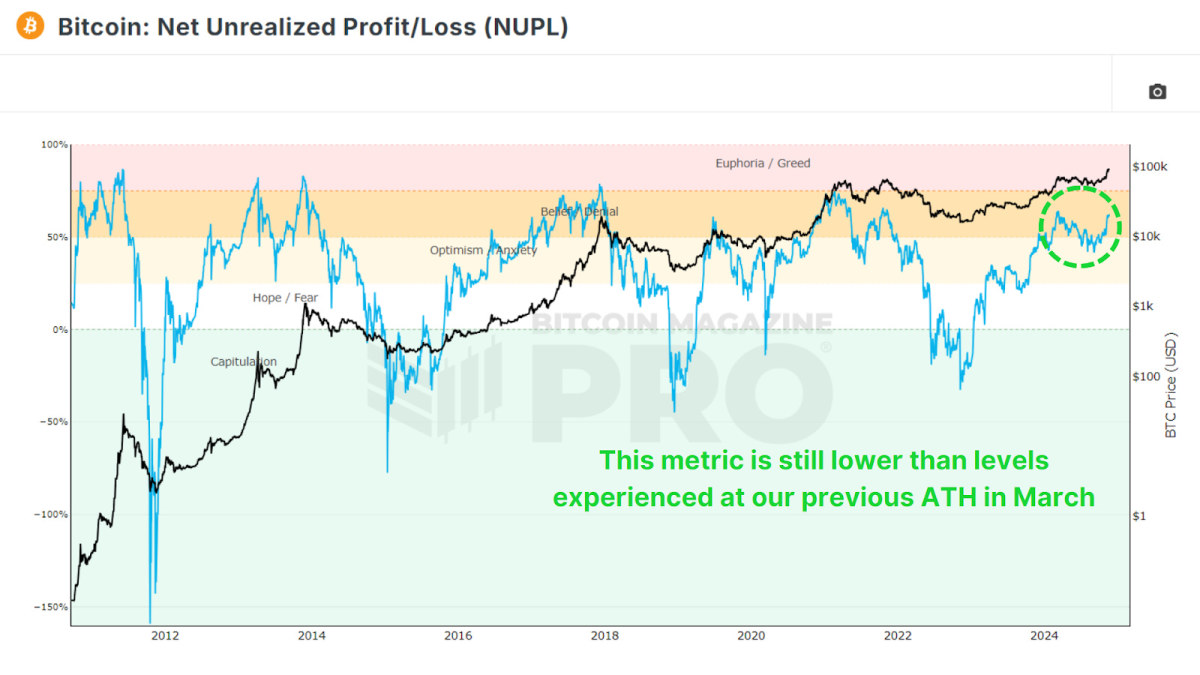

Measuring Market Sentiment

The Internet Unrealized Revenue and Loss (NUPL) metric quantifies the community’s total profitability, mapping sentiment throughout phases like optimism, perception, and euphoria. Much like the MVRV Z-Rating as it’s derived from realized worth or investor cost-basis, it seems on the present estimated revenue or losses for all holders.

View Dwell Chart 🔍

Presently, Bitcoin stays within the ‘Perception’ zone, removed from ‘Euphoria’ or ‘Greed’. This aligns with different information suggesting there’s ample room for value appreciation earlier than reaching market saturation. Particularly contemplating this metric remains to be at decrease ranges than this metric reached earlier this 12 months in March once we set out earlier all-time excessive.

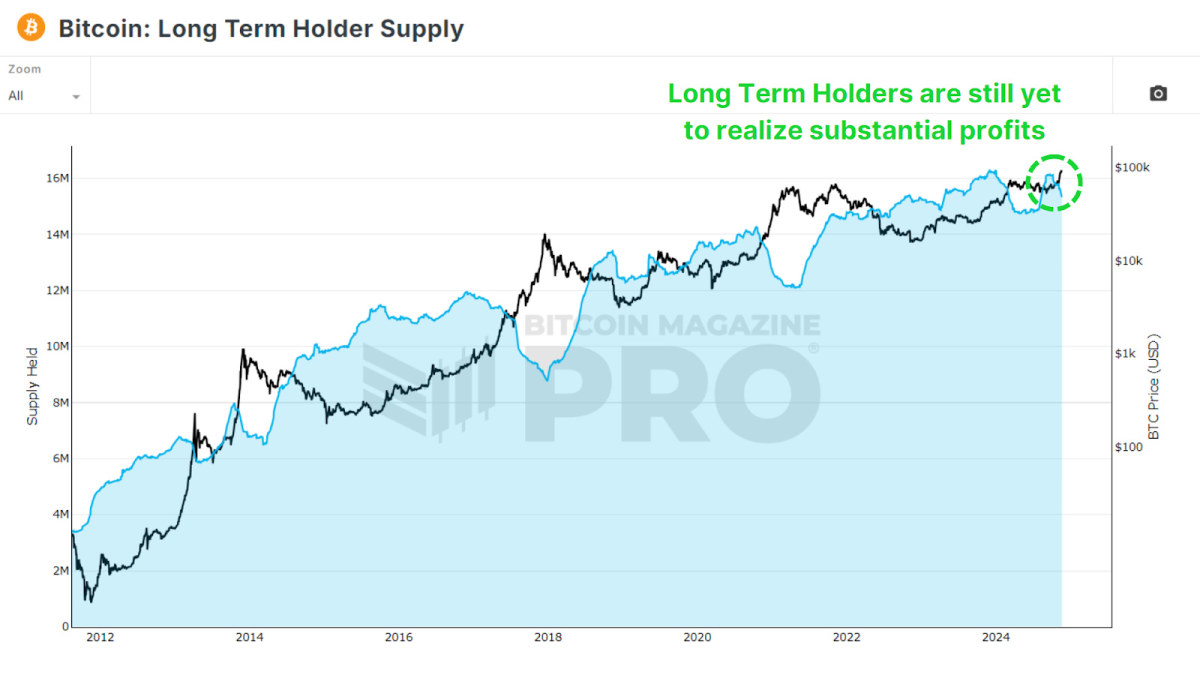

Lengthy-Time period Holder Developments

The share of Bitcoin held for over a 12 months, represented by the 1+ Yr HODL Wave, stays exceptionally excessive at round 64%, which remains to be greater than at every other level in Bitcoin historical past previous to this cycle. Prior value peaks in 2017 and 2021 noticed these values fall to 40% and 53%, respectively as long-term holders started to comprehend income. If one thing comparable have been to happen throughout this cycle, then we nonetheless have tens of millions of bitcoin to be transferred to new market contributors.

View Dwell Chart 🔍

To date, solely round 800,000 BTC has been transferred from the Lengthy Time period Holder Provide to newer market contributors throughout this cycle. In previous cycles, as much as 2–4 million BTC modified fingers, highlighting that long-term holders have but to money out totally. This means a comparatively nascent section of the present bull run.

View Dwell Chart 🔍

Monitoring “Good Cash”

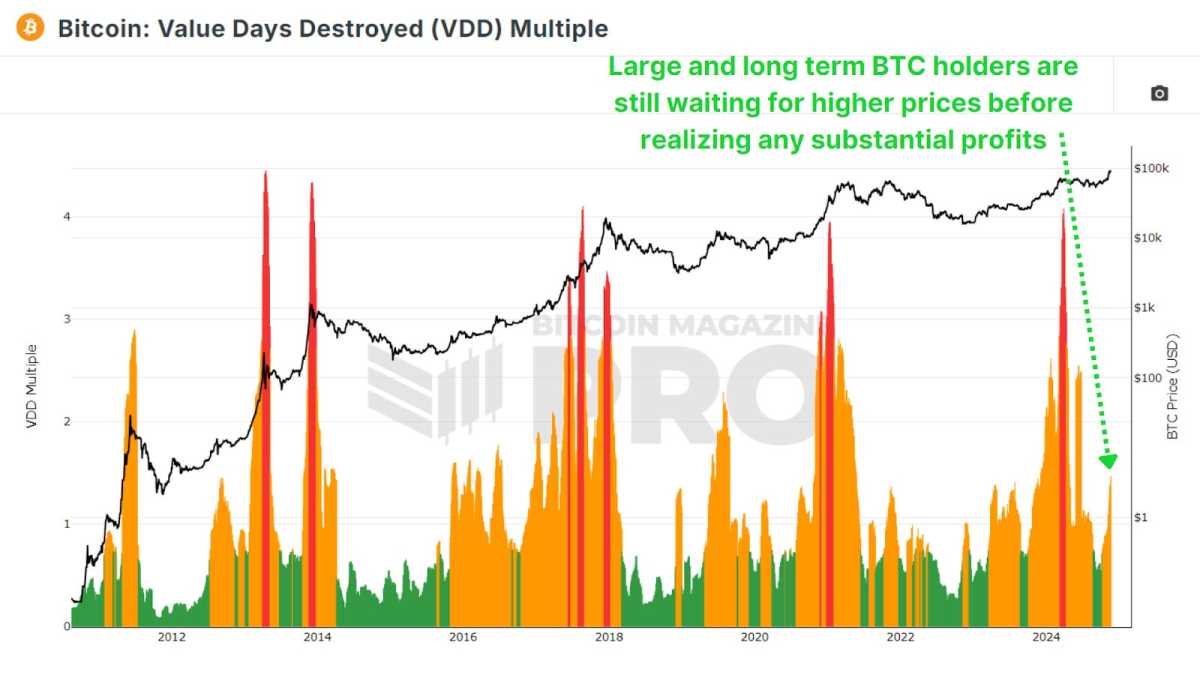

The Coin Days Destroyed metric weighs transactions by the holding length of cash, emphasizing whale exercise. We are able to then multiply that worth by the BTC value at that cut-off date to see the Worth Days Destroyed (VDD) A number of. This provides us a transparent perception into whether or not the most important and smartest BTC holders are starting to comprehend income of their positions.

View Dwell Chart 🔍

Present ranges stay removed from the crimson zones usually seen throughout market tops. This implies whales and “sensible cash” will not be but offloading vital parts of their holdings and are nonetheless awaiting greater costs earlier than starting to comprehend substantial income.

Conclusion

Regardless of the rally, on-chain metrics overwhelmingly counsel that Bitcoin is much from overheated. Lengthy-term holders stay largely steadfast, and indicators just like the MVRV Z-score, NUPL, and Puell A number of all spotlight room for development. That stated, some profit-taking and new market contributors sign a transition into the mid to late-cycle section, which might doubtlessly be sustained for many of 2025.

For traders, the important thing takeaway is to stay data-driven. Emotional choices fueled by FOMO and euphoria might be pricey. As an alternative, observe the underlying information fueling Bitcoin and use instruments just like the metrics mentioned above to information your individual investing and evaluation.

For a extra in-depth look into this matter, try a current YouTube video right here: What’s Occurring On-chain: Bitcoin Replace