Please see this week’s market overview from eToro’s international analyst staff, which incorporates the most recent market knowledge and the home funding view.

Robust Large Tech earnings can’t take away US election nervousness

Final week, Alphabet, Meta, Microsoft, Amazon, and Apple all delivered their earnings stories for the most recent quarter. Alphabet and Amazon shocked with stronger-than-expected outcomes, whereas Microsoft disenchanted with a warning of slower development attributable to capability constraints. Mixed, the 5 tech giants generated $450 billion in income, which they’re set to speculate closely in AI. Amazon CEO Andy Jassy even referred to it as a “once-in-a-lifetime alternative”.

Large Tech is reportedly seeing clients spend extra time on AI-enhanced platforms, resulting in extra advert impressions and product gross sales. This development justifies additional will increase in capital expenditure budgets, with a mixed run price of $250 billion per yr. Microsoft (in partnership with OpenAI), Alphabet, and Meta are investing closely in their very own massive language fashions, whereas Amazon and Apple select to construct on the efforts of a number of exterior suppliers.

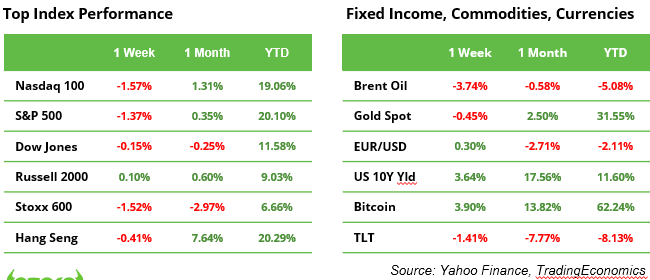

Large Tech earnings couldn’t forestall fairness markets from retreating although. Uncertainty surrounding the end result of the US elections and considerations about ballooning authorities debt despatched the S&P 500 and Nasdaq down by 1.4% and 1.6%, respectively. Bond traders demanding the next danger premium for holding authorities debt pushed the US 10-year rate of interest as much as 4.4%. Nevertheless, new macroeconomic knowledge on development, inflation and the roles market recommend that the Fed’s almost definitely transfer this week is to chop the coverage price by 0.25%. In response to an outlook of weaker international development and a drop in oil costs of practically 4% over the previous week, OPEC+ determined over the weekend to postpone a deliberate manufacturing improve.

The market is awaiting the US election end result earlier than selecting a course in the direction of yr finish.

Fed seen to chop its coverage rate of interest with one other 0.25% on Thursday

The most recent US financial knowledge didn’t present a best-case state of affairs for Wall Road however remained acceptable for traders, reinforcing expectations for a small Fed price minimize on Thursday. The market has practically absolutely priced in a 0.25% discount to a variety of 4.50% to 4.75%. The information pointed to a cooling labour market, barely slower development, and stagnant core PCE inflation. Whereas these alerts assist a “smooth touchdown”, recession dangers have elevated in consequence, which can lead traders to take a position on additional price cuts within the medium time period. Fed Chair Powell’s press convention may present essential insights into the longer term course of the rate-cutting cycle.

US presidential election: will it’s Trump or Harris?

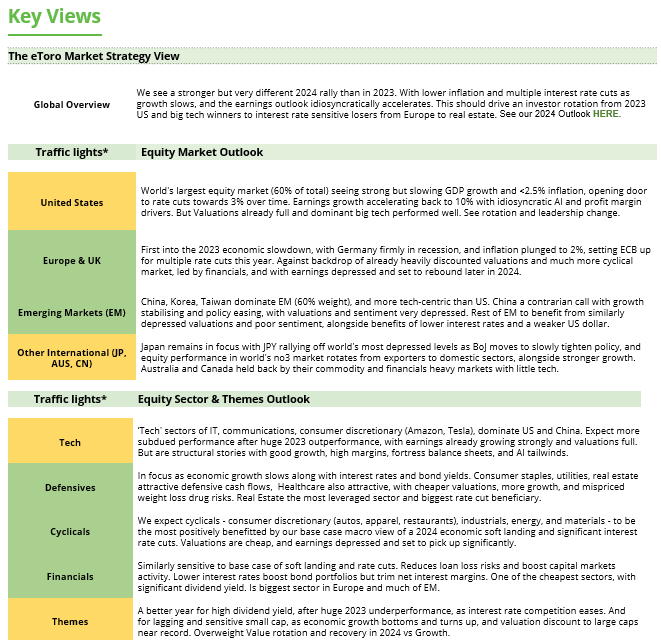

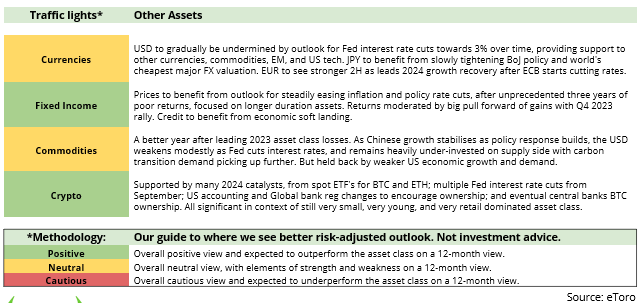

The end result of the US elections carries important weight, because the profitable candidate will set the tone for the approaching years. Nevertheless, it stays difficult to gauge how a lot a president can genuinely affect GDP development or inventory market efficiency. Extra important than political management is the general well being of the economic system, which presently positions the US comparatively strongly. The Federal Reserve retains ample flexibility to answer surprising developments. Whereas current dangers improve vulnerability to shocks, the long-term outlook stays constructive. Even so, the financial affect of political choices shouldn’t be underestimated.

On the core of this heated election-year debate lies tax coverage, a key difficulty sharply dividing the candidates. Republicans advocate tax cuts to stimulate financial development, with Trump proposing a drastic 60% tariff on Chinese language imports—a dangerous transfer with potential repercussions for US shoppers. In distinction, Democrats are calling for tax hikes on the wealthiest to deal with rising revenue inequality, a shift that might profoundly affect sectors like luxurious items, telecommunications, and monetary companies.

Trump’s insurance policies may favour the defence sector, whereas a Harris victory may deliver the healthcare sector into sharper focus. By way of vitality coverage, fossil fuels and renewables stand in stark opposition, creating uncertainty for companies. Nevertheless, there may be bipartisan consensus on the urgent want for funding in US infrastructure and on the significance of sustaining technological management over China.

Earnings and occasions

Rate of interest choices by the Fed and the Financial institution of England are the primary macroeconomic releases the market will give attention to this week. Apart from, China and Germany will publish new commerce steadiness knowledge. All this exercise takes place on Thursday 7 November.

Many corporations report earnings this week, together with 100 out the S&P 500. A range:

Earnings releases:

4 Nov. Palantir, Constellation Vitality

5 Nov. Ferrari, Deutsche Submit, Unicredit

6 Nov. Qualcomm, Arm, Novo Nordisk

7 Nov. Barrick Gold, Cameco, Arista Networks, Rivian, Airbnb, The Commerce Desk

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding targets or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product usually are not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.