Bitcoin has reached native highs beneath $69,000 after weeks of regular bullish value motion, igniting pleasure and warning throughout the market. Traders are bracing for potential volatility, as this important value zone has triggered sharp rejections 5 instances prior to now few months.

Whereas optimism is excessive for a surge past $70,000, uncertainty stays as merchants look ahead to indicators of a breakout or one other pullback.

Key information from CryptoQuant reveals that liquidation ranges on main exchanges are rising, signaling {that a} decisive transfer might be imminent. This improve in liquidations means that merchants are positioning themselves for large swings within the coming week, both anticipating a continuation of Bitcoin’s uptrend or bracing for a rejection from this vital resistance stage.

As Bitcoin approaches this significant threshold, the following few days might decide whether or not it’ll break new floor or face one other retrace. Your entire market is on edge, ready to see if Bitcoin will lastly push previous this resistance and enter uncharted territory.

Bitcoin Worth Swings Intensify

The crypto market is at a pivotal second, with Bitcoin and plenty of altcoins pushing towards native highs, reversing the unfavorable value motion of current months. Optimism is constructing amongst analysts and traders, who see Bitcoin’s rally as an indication of renewed power throughout the market.

Nevertheless, there are rising issues that the trail to new highs might not be a easy upward climb. As an alternative, we could witness a sequence of ups and downs because the market navigates key resistance ranges.

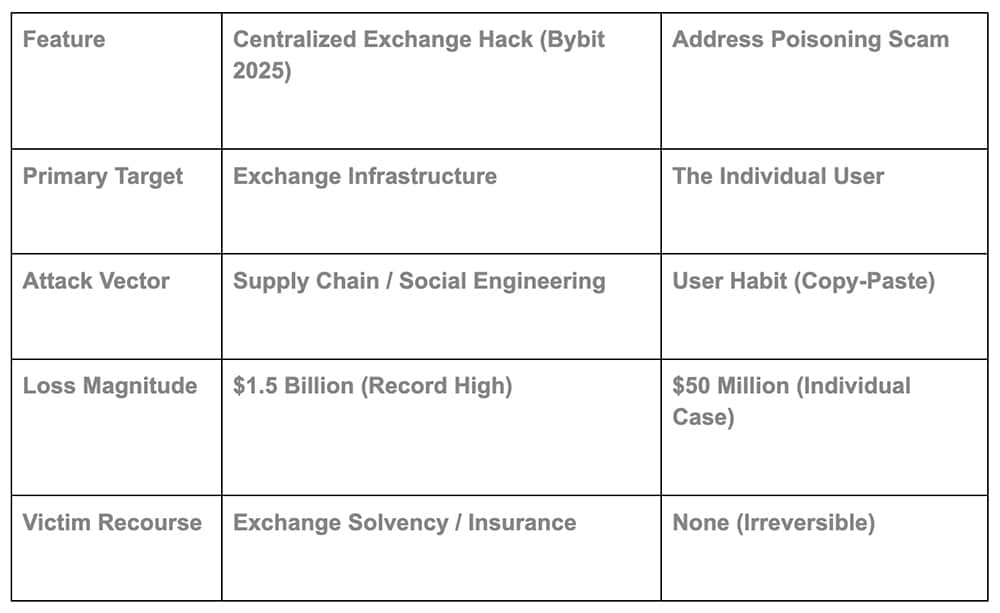

Key information from CryptoQuant, shared by Axel Adler on X, highlights the rising potential for volatility. Adler’s evaluation reveals a pointy rise in futures liquidations throughout main exchanges comparable to Binance, ByBit, and OKX.

If this development continues, the market might expertise heightened volatility as early as subsequent week. His chart of whole Bitcoin futures liquidations exhibits a sample of rising liquidations, indicating that merchants could also be over-leveraging as they guess on Bitcoin’s value actions.

The upcoming week is shaping as much as be one of the crucial essential durations of this market cycle. As liquidation ranges improve and the market approaches important resistance zones, each bulls and bears are making ready for a significant transfer. Traders are hopeful that Bitcoin will break by means of and set off a market-wide rally, however warning stays excessive amid the looming potential for volatility.

BTC Worth Motion Particulars

Bitcoin (BTC) is at the moment buying and selling at $68,300 after lately setting the next excessive on the 4-hour value chart. The cryptocurrency has been in a constant uptrend since October 10, showcasing a clearly outlined bullish construction that has excited traders.

Nevertheless, there’s a vital threat that the worth could goal decrease liquidity ranges to seek out the mandatory gasoline for an additional push upward.

If BTC drops beneath the important $66,600 mark, it might sign a deeper correction because the market seeks decrease demand ranges. Such a retracement would possible immediate warning amongst merchants, as they reassess their positions in gentle of potential help ranges.

Conversely, if Bitcoin efficiently breaks above the psychologically necessary $70,000 threshold, it might set off a wave of FOMO (worry of lacking out) amongst traders. This surge in shopping for stress might speed up the worth motion, driving BTC towards new all-time highs.

The approaching days are essential as merchants carefully monitor BTC’s skill to carry its floor above key help ranges or break by means of this vital resistance. The market sentiment stays cautiously optimistic, with members eagerly waiting for the following main transfer.

Featured picture from Dall-E, chart from TradingView