Este artículo también está disponible en español.

Bitcoin is holding sturdy above $67,000 after setting a brand new native excessive of round $68,300, fueling pleasure amongst traders. This bullish momentum is pushed by worth motion and supported by key market information signaling a possible uptrend continuation.

Associated Studying

Daan, a prime crypto analyst, shared essential insights exhibiting that Bitcoin ETFs have been shopping for closely for the previous 4 days. This surge in institutional demand is a optimistic sign for the market, because it might additional propel Bitcoin towards new all-time highs.

The following few days shall be essential for Bitcoin’s trajectory, with many merchants and traders eyeing a possible breakout to historic ranges. The anticipation grows as BTC edges nearer to those highs, making the upcoming worth actions pivotal in shaping the market’s path.

Bitcoin Demand Rising

The entire market is buzzing with pleasure and volatility, with Bitcoin main the way in which by establishing a transparent uptrend since early September.

Analysts and traders are attributing a part of this surge to the Federal Reserve’s current rate of interest cuts, however different vital elements affect Bitcoin’s worth motion.

Key information shared by Daan, a prime crypto analyst, reveals that Bitcoin ETFs have seen substantial inflows over the previous week.

The final 4 buying and selling days alone have witnessed a mixed $1.639 billion in inflows, making this week one of the crucial profitable because the inception of Bitcoin ETFs. This surge in institutional demand indicators that conventional traders are more and more assured in Bitcoin’s future, driving up demand and boosting the worth.

Regardless of the present optimism, there’s warning amongst market observers. Traditionally, durations of heightened pleasure and euphoria out there are sometimes adopted by worth retracements or consolidation.

Associated Studying

Bitcoin tends to mark native tops when sentiment peaks, which might sign a cooling-off interval earlier than the subsequent main transfer. Traders are intently looking forward to indicators of a possible pullback or whether or not Bitcoin will proceed to climb towards new all-time highs within the weeks forward.

Key Ranges To Watch

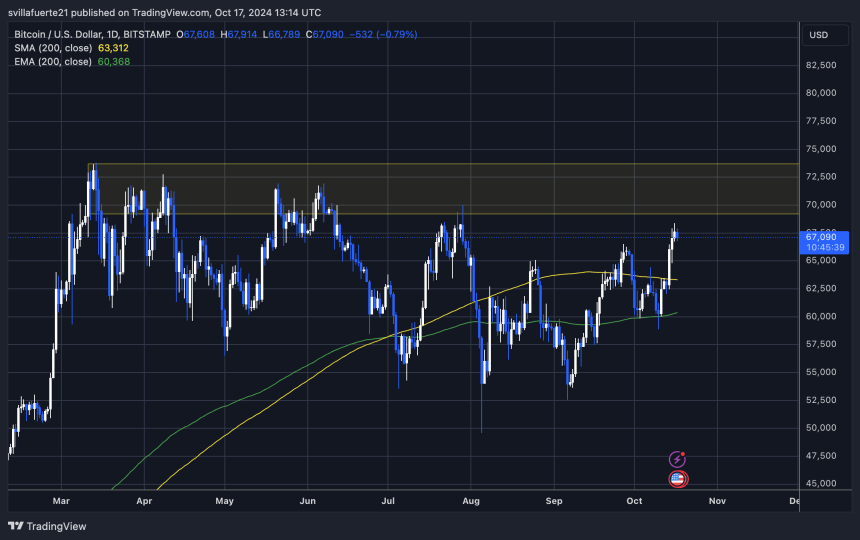

Bitcoin is buying and selling at $67,000 after a 2% retrace from its current native prime at $68,388. Regardless of this slight pullback, the worth is holding firmly above the earlier excessive of $66,500, signaling a robust consolidation part that might set the stage for one more transfer larger.

For the bullish momentum to proceed, BTC should keep its place above $66,500. If it does, the worth might quickly push towards new highs.

Nevertheless, if Bitcoin fails to carry above this essential degree, a wholesome retrace to the day by day 200-day transferring common (MA) would nonetheless point out power out there. The 200-day MA has traditionally been a dependable help degree throughout uptrends, offering a basis for additional positive factors.

Associated Studying

If the worth falls under the 200-day MA, a deeper correction to $60,000 is probably going. This degree represents vital demand and will supply one other shopping for alternative earlier than the subsequent leg.

Featured picture from Dall-E, chart from TradingView