Please see this week’s market overview from eToro’s world analyst crew, which incorporates the most recent market information and the home funding view.

Deal with ECB price choice and Q3 earnings

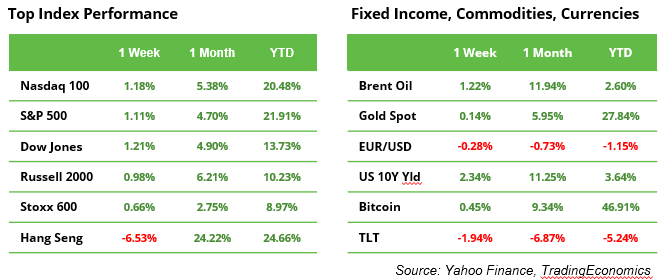

Markets moved comparatively little final week. Within the US, equities noticed each the S&P 500 and Dow Jones indices climb the ‘wall of worries’ to report highs above 5,800 and 42,860, respectively. The yield on the US 10-year Treasury rose above 4% following a robust September jobs report on 4 October. In Hong Kong, the Dangle Seng index dropped by 6% as further financial stimulus was mentioned however not dedicated. Oil costs hovered round $79 for Brent and $75 for WTI, with uncertainty over the subsequent steps within the Center Jap battle protecting markets cautious.

This week, past the discharge of US retail gross sales information and a spread of macroeconomic indicators from China, the primary focus might be on the ECB price choice and the Q3 earnings season, with main firms in monetary providers, know-how, and healthcare reporting their outcomes.

ECB underneath strain to step up the tempo of rate of interest cuts

The ECB is predicted to chop rates of interest by 25 foundation factors to three.25% on Thursday. Over the medium time period, the central financial institution could regulate charges extra quickly and deeply than beforehand anticipated. Analysts predict price cuts at each assembly by to March, heightening the give attention to Lagarde’s feedback through the upcoming press convention. These expectations are rooted in inflation falling under 2% for the primary time since 2021 and the continued struggles of the German economic system. Germany accounts for 28.6% of the Eurozone’s GDP and is dealing with a second consecutive yr of recession. Decrease borrowing prices might increase orders, revive industrial manufacturing, and help rising exports. Nonetheless, to sustainably stimulate progress, further measures, resembling fiscal incentives and innovation promotion, are important.

The Conflict of the Empires

China will launch its first estimate of Q3 GDP progress on 18 October, adopted by the US and the Euro Space on 30 October. In China, progress is predicted to have slowed barely to 4.6% from 4.7% in Q2. Within the earlier quarter, US progress was a surprisingly robust 3.0%, whereas the Euro Space noticed a marginal improve of 0.6% (see chart). Particularly, China and the EU proceed to conflict over commerce as every seeks to revive its financial progress to earlier ranges.

China’s stimulus: a primary step, however not an answer to all issues

Stimulus packages alone can’t tackle China’s deep-rooted structural points. With round 60% of the inhabitants proudly owning depreciated property, there are persistent deflation dangers and shopper reluctance. For inventory costs to develop sustainably, help should attain the actual economic system and be mirrored in financial information. Better readability about deliberate measures can be vital, together with proactive steps within the coming months. Regardless of an improved outlook, lowered transparency within the Chinese language inventory market could deter buyers. Commodities provide oblique funding alternatives, as China accounts for 40% of worldwide copper demand and leads in gold demand.

Hurricane Milton to drive up orange juice costs?

Florida, which produces 70% of the US’ orange juice, faces a possible setback as hurricane Milton broken main orange-growing areas final week. This follows latest challenges, together with low manufacturing ranges and excessive costs. Final month, orange juice futures in New York reached an all-time excessive attributable to lowered output in Florida and Brazil, the place a historic drought and greening illness have severely impacted manufacturing. If harm attributable to Milton seems to be important, orange juice costs might rise additional attributable to lowered provide.

Earnings and occasions

Tech earnings from Dutch chip gear maker ASML, main Taiwanese foundry TSMC and streaming providers supplier Netflix might be vital to observe as they could set the tone for a restoration of know-how shares from the sell-off in Q2. A income replace from French luxurious items maker LVMH might be seen as an indicator for Western firm gross sales in China.

Macro releases:

17 Oct. ECB price choice, US retail gross sales

18 Oct. China GDP progress Q3, industrial manufacturing, retail gross sales

20 Oct. China FDI (overseas direct investments, beforehand -31.5%)

Earnings releases:

15 Oct. Financial institution of America, Citigroup, Goldman Sachs, UnitedHealth, Johnson & Johnson, LVMH

16 Oct. ASML, Morgan Stanley, Abbott Laboratories, Alcoa

17 Oct. TSMC, Infosys, Nestle, Netflix, Intuitive Surgical

18 Oct. Procter & Gamble, American Categorical