Victoria d’Este

Revealed: October 11, 2024 at 6:23 pm Up to date: October 11, 2024 at 5:30 pm

Edited and fact-checked:

October 11, 2024 at 6:23 pm

In Temporary

Cryptocurrency belongings have seen a big enhance in worth since 2010, pushed by investor curiosity and monetary makes use of. Aave’s v3.2 replace introduces Liquid eMode, bettering asset classification and borrowing methods.

Cryptocurrency belongings have grown at a really spectacular fee. All the worth of cryptocurrencies elevated from virtually nothing in 2010. This exponential rise will be attributed to rising investor curiosity in addition to the rising variety of monetary makes use of for digital belongings.

The discharge of v3.2 by Aave is one current instance. This replace highlights the continual innovation within the business by introducing notable enhancements to the borrowing and threat administration instruments.

The addition of Liquid eMode, which expands on the Excessive-Effectivity Mode (eMode) that was beforehand in place, is likely one of the replace’s main options. With this enchancment, belongings could also be extra exactly categorized in line with their Mortgage-to-Worth (LTV) ratios, liquidation bonuses, and thresholds. The power to use a number of eModes to a single asset provides shoppers unparalleled flexibility over their collateral and borrowing methods, which is why this growth is critical.

Recognizing and Decreasing Dangers

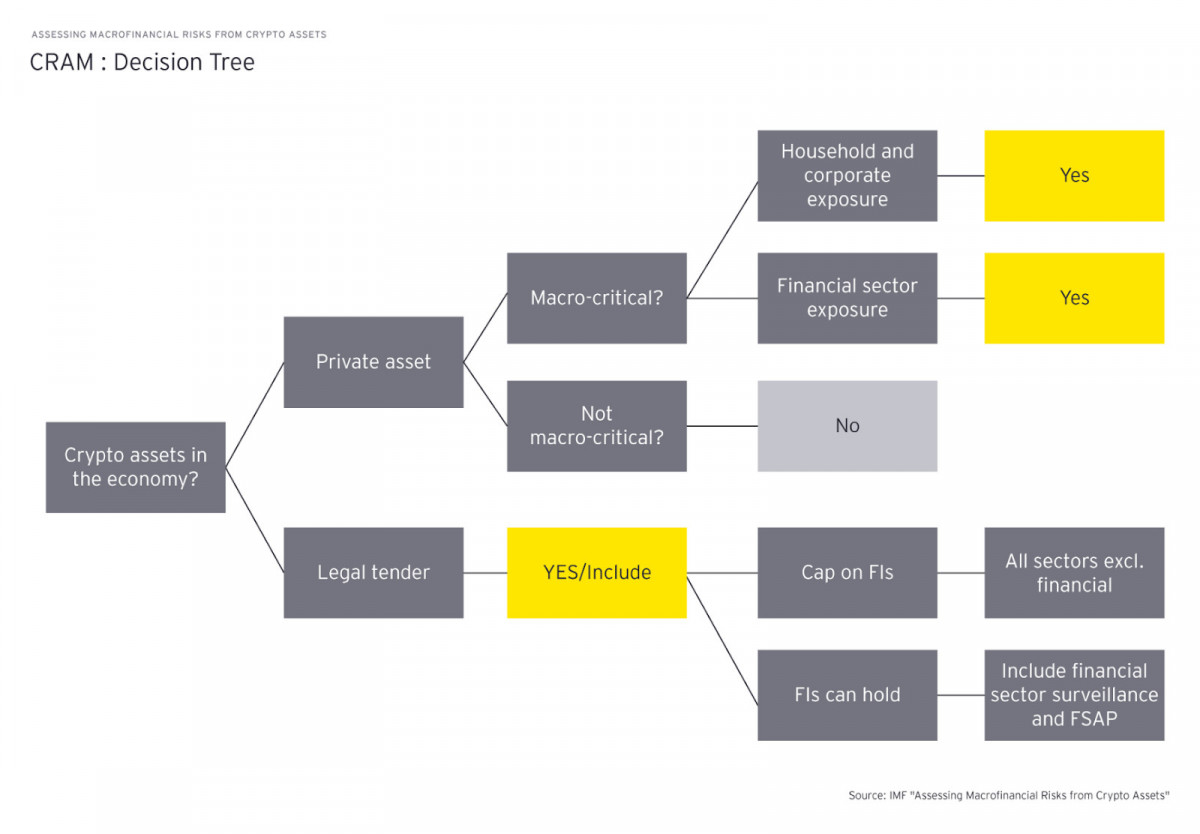

Strong options for threat evaluation and administration have gotten more and more crucial because the DeFi enterprise expands. The Crypto Threat Evaluation Matrix, or C-RAM, mannequin is one methodology that is gaining popularity. This technique affords an intensive strategy to assessing the hazards related to cryptocurrencies on a nationwide and worldwide scale.

Three phases make up the C-RAM mannequin’s operation. It evaluates the macro-criticality of cryptocurrency belongings in an financial system first. It then maps hazards explicit to every nation throughout completely different areas of susceptibility. Lastly, it assesses the hazards on the world stage associated to the broad use of cryptocurrencies. A complete consciousness of potential dangers, from operational weaknesses to systemic significance, is made potential by this methodical strategy.

Photograph: EY

Streamlining Threat Administration in Good Contracts

Within the DeFi business, good contracts have develop into a potent instrument for threat administration. These blockchain-based self-executing contracts have the flexibility to automate intricate monetary transactions and implement sure situations with out the necessity for middlemen.

Good contracts are advantageous in a number of methods in terms of threat administration. They’ll implement collateral necessities in lending platforms, routinely set off fail-safes throughout market volatility, and management asset focus to scale back dangers. Moreover, good contracts are important for preserving liquidity in decentralized exchanges, placing stop-loss orders in place to reduce potential losses, and enabling automated checks that facilitate regulatory compliance.

All through a blockchain’s lifecycle, good contracts might create and retailer on-chain knowledge, which affords essential data for threat assessments. Through the use of this knowledge to enhance compliance procedures and establish any fraud, DeFi operations could have a further diploma of safety.

Enhancing Options of Borrowing

Extra superior borrowing options are being added to DeFi protocols as they develop, giving customers extra effectivity and suppleness. Effectivity modes, or eModes, are noteworthy discoveries that present extra exact management over collateral and borrowing ways.

With the assistance of those superior borrowing capabilities, customers might apply extra subtle investing methods, get hold of larger leverage for sure asset combos, modify threat parameters primarily based on asset attributes, and maximize capital effectivity in a wide range of market situations. These options allow customers to customise their borrowing ways in line with their funding targets and threat tolerance, which can open up new use circumstances and attract a wider spectrum of gamers to the DeFi ecosystem.

The Significance of Protocol Upgrades

Updating DeFi protocols regularly is important for enhancing effectivity, safety, and usefulness. These updates often think about minimizing gasoline utilization, simplifying code bases, and bettering threat administration expertise.

Extra adaptable threat administration is now potential with the addition of options like completely different effectivity modes for a single asset due to current protocol updates. In an effort to boost system efficiency typically, they’ve additionally focused on eliminating out of date or superfluous code.

To safeguard lenders and guarantee protocol solvency, enhanced liquidation processes have been put in place, and upgraded oracle programs supply extra exact and reliable pricing feeds. These updates present how DeFi initiatives are nonetheless devoted to bettering their companies and assembly the altering calls for of shoppers and the bigger monetary ecosystem.

The enhancements in borrowing traits and threat administration are encouraging, however in addition they carry with them some new difficulties. These programs could also be more difficult for typical customers to understand and make the most of as a result of their growing complexity. If superior options will not be developed appropriately, there’s a likelihood that malicious actors will reap the benefits of them.

Moreover, with the growing interconnectivity of DeFi protocols, systemic dangers ensuing from the collapse of a single key protocol or a sequence of platform-wide liquidations have to be taken into consideration. Regulatory points are additionally fairly essential. Because the significance of DeFi will increase, regulators have gotten extra attentive to this market. To take care of long-term viability, future advances in threat administration and borrowing options might want to strike a steadiness between innovation and compliance.

Disclaimer

In keeping with the Belief Challenge tips, please be aware that the data offered on this web page isn’t supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. You will need to solely make investments what you’ll be able to afford to lose and to hunt unbiased monetary recommendation if in case you have any doubts. For additional data, we advise referring to the phrases and situations in addition to the assistance and help pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover.

About The Writer

Victoria is a author on a wide range of know-how subjects together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to write down insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on a wide range of know-how subjects together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to write down insightful articles for the broader viewers.