In a latest interview with CNBC, Gary Gensler, Chair of the US Securities and Trade Fee (SEC), addressed ongoing enforcement actions towards key gamers within the cryptocurrency business. His remarks come amid rising discontent amongst traders and members who really feel the regulatory panorama has grow to be more and more hostile.

Regulatory Oversight Important For Innovation?

Gensler started by acknowledging that the SEC operates as a legislation enforcement company overseeing the monetary markets, together with the digital asset sector. He emphasised that whereas the SEC’s enforcement actions could appear punitive, they’re supposed to foster belief in improvements.

Drawing a parallel to the auto business, he said that “innovation doesn’t thrive with out belief,” likening the necessity for regulatory oversight to the significance of visitors lights and legislation enforcement in making certain highway security.

When questioned about whether or not these enforcement actions had been aimed toward strengthening the broader market, Gensler characterised the SEC’s method as “impartial.”

Gensler famous that your complete business is a comparatively small section of the broader capital markets, however burdened that the SEC’s mission beneath his management is to instill belief and shield traders.

The dialog additionally touched on the potential influence of the upcoming US presidential election in lower than two months, which might have a big influence and sign a shift in regulation towards the digital asset business.

Each former President Trump, a notable supporter of cryptocurrency and Bitcoin use for the nation, and Vice President Kamala Harris, who not too long ago expressed her assist for cryptocurrency market members, are eager to encourage progress and innovation within the sector.

Gensler famous that insurance policies that promote investor safety are important to fostering innovation, claiming that the 2 ideas are appropriate. Nonetheless, he remained tight-lipped on the candidate’s stance on cryptocurrency progress, notably over the previous month.

Gensler Warns Of Belief Challenges In Crypto Business

Reflecting on his earlier position as an educator on the Massachusetts Institute of Expertise (MIT), Gensler talked about that he had typically instructed his college students that the cryptocurrency sector should construct investor belief to outlive.

When pressed on whether or not clearer rules would profit each the SEC and cryptocurrency companies, Gensler acknowledged that the SEC has established guidelines. Nonetheless, he identified that discontent with present rules doesn’t equate to an absence of guidelines.

The SEC Chair argued that many within the business have profited with out adhering to correct disclosures, which has led to conflicts of curiosity and damaging outcomes each inside and out of doors of the digital asset area.

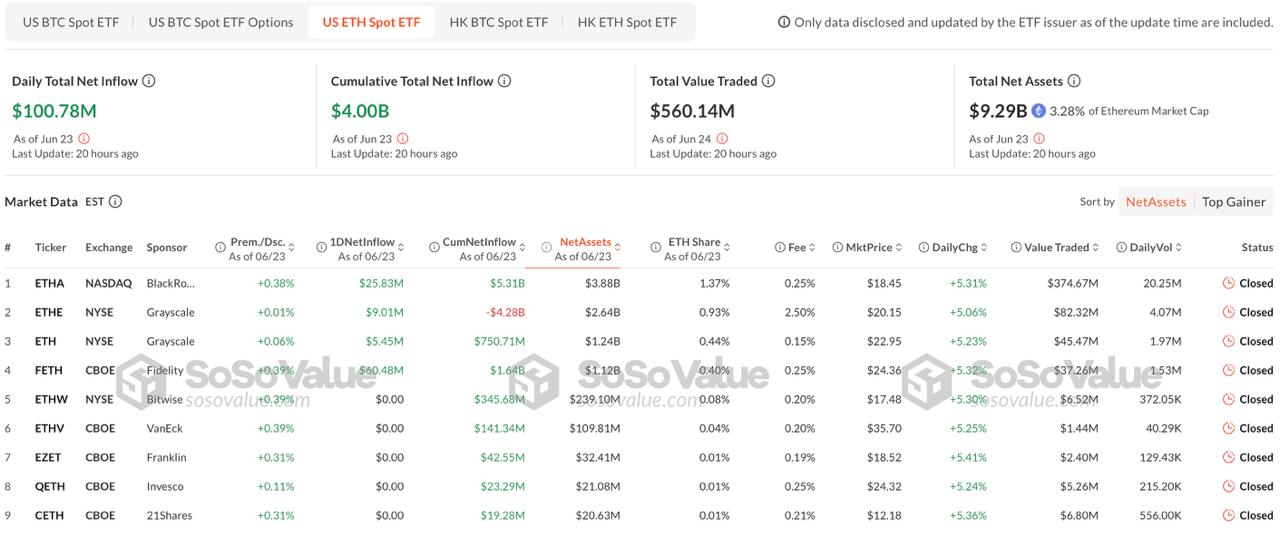

The dialogue shifted to particular cryptocurrencies, notably Bitcoin. Gensler famous that he views Bitcoin as a commodity moderately than a safety. He highlighted the approval of exchange-traded merchandise (ETPs) for Bitcoin earlier this 12 months, which may now be traded on the Nasdaq, as a big step ahead.

Seeking to the longer term, Gensler remarked that the broader cryptocurrency business will face challenges in constructing belief as a result of prevalence of fraud. When requested about the opportunity of a Bitcoin reserve fund for the US, as advised by Trump and Senator Cynthia Lummis, Gensler shunned offering a definitive reply, citing the upcoming elections however indicating he has his personal views on the matter.

Featured picture from DALL-E, chart from TradingView.com